Smart Investment Choices to Fund Your Early Retirement

Why do you invest? For many, the primary aim is to secure a comfortable retirement as soon as possible. The Motley Fool’s research indicates that the average American retires at a fairly young age: 62 years old.

This age might seem early considering the full retirement age (FRA) for Social Security benefits is set between 66 and 67 years, depending on your birth year. Many people aim to retire around the FRA, as it represents a time when they hopefully have sufficient savings to transition smoothly into retirement.

Where to invest $1,000 right now? Our analysts have identified the 10 best stocks to consider for investment. See the 10 stocks »

The good news is that it is indeed possible to retire at 62 without sacrificing your lifestyle. The secret lies in selecting stocks that generate strong growth with manageable risk. Let’s explore three stocks that may lead you toward a comfortable retirement.

1. PepsiCo

At first glance, PepsiCo (NASDAQ: PEP) might not seem like a top investment choice. The beverage sector is not typically a high-growth area and is quite competitive. However, a deeper examination reveals advantages in this stock.

Unlike Coca-Cola (NYSE: KO), which focuses on marketing and utilizes third-party bottlers, PepsiCo owns many of its bottling and production facilities. This ownership structure helps reduce operating costs and maintain consistent earnings growth.

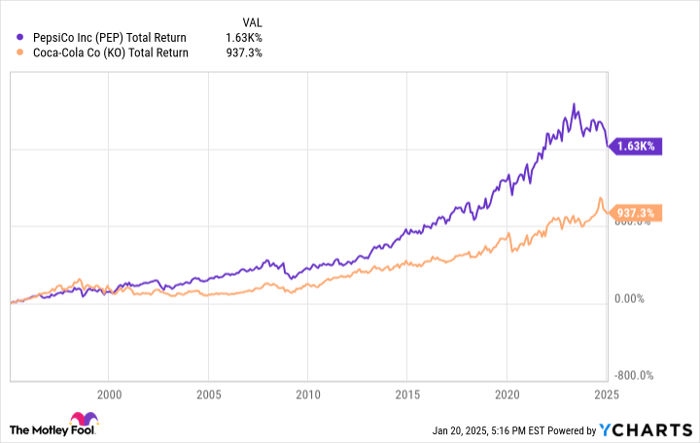

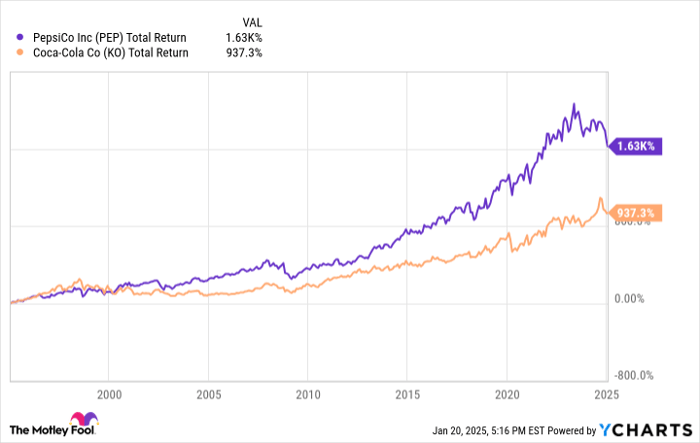

Over the past 30 years, if you had reinvested dividends from both companies, PepsiCo would have outperformed Coca-Cola, providing more value to its shareholders.

PEP Total Return Level data by YCharts.

The company’s consistent stock-buyback program has also accelerated earnings and dividend growth. PepsiCo has raised its dividend annually for over 52 years, showcasing the strength of its brand.

2. Amazon

Amazon (NASDAQ: AMZN) has become a well-known favorite among investors, and for good reason. With a market cap nearing $2.4 trillion, many see value in holding this stock.

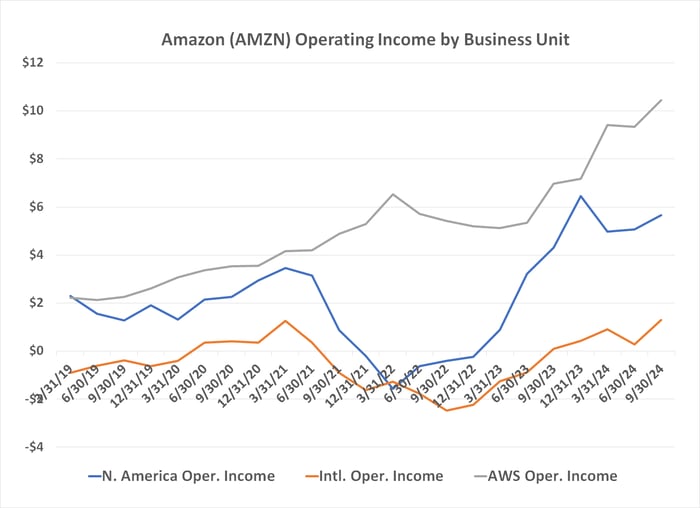

Its cloud computing segment is crucial, as Amazon Web Services (AWS) contributes around 17% of sales but accounts for 60% of operating income. The cloud industry is projected by Goldman Sachs to grow at an average of 22% annually through 2030.

Meanwhile, Amazon is finally seeing profit growth in its e-commerce sector. Both its domestic and international online sales have become more profitable.

Data source: Amazon Inc. Chart by author. Figures are in billions.

However, there’s still significant growth potential in e-commerce. Only 16% of U.S. retail sales are currently online, and global online shopping is expected to grow at 10% yearly until 2032.

3. Wolfspeed

Finally, consider adding Wolfspeed (NYSE: WOLF) to your investment list as it may help you retire comfortably.

Wolfspeed specializes in next-generation energy technology that utilizes silicon carbide. Though not a common household name, its technology is poised for increasing demand.

This material, silicon carbide, improves the reliability and performance of electronics in various applications, including data centers, solar systems, and electric vehicles (EVs).

While not new, the widespread acknowledgment of silicon carbide’s potential is recent. Analysts predict Wolfspeed’s revenue could surge, with estimates of over 42% growth next year, followed by 57% the year after as the industry expands at an average annual rate of 30% through 2032.

Is Amazon a Smart Investment Choice?

Before diving into an investment in Amazon, remember that the Motley Fool Stock Advisor team recently pinpointed 10 stocks they believe are top options, and Amazon was not among them. These selected stocks may offer impressive returns moving forward.

Reflect on Nvidia’s journey: if you had invested $1,000 when it made this list on April 15, 2005, you’d have $902,242 today.

Stock Advisor provides investors with a straightforward approach, including portfolio strategies and two new stock picks each month. Since 2002, this service has outperformed the S&P 500 by over four times.

Learn more »

*Stock Advisor returns as of January 21, 2025

John Mackey, former CEO of Whole Foods Market and an Amazon subsidiary, is on The Motley Fool’s board of directors. James Brumley holds positions in Coca-Cola. The Motley Fool holds positions in and recommends Amazon, Goldman Sachs Group, and Wolfspeed. The Motley Fool follows a disclosure policy.

The views and opinions expressed herein belong to the author and do not necessarily reflect those of Nasdaq, Inc.