Chewy on the Comeback: A Bright Future for Investors

After years of declines, it may be time for investors to again pay attention to Chewy(NYSE: CHWY) stock. Indeed, investor interest in the pet supply e-retailer appeared to fade amid the post-pandemic downturn that never seemed to end for this company.

Finally, its outlook may be changing. Even though it is down 68% from its 2021 peak, the stock has made significant strides amid rising sales growth and increased profits. As customers spend more on the platform, rising popularity and new revenue sources could eventually take Chewy stock back to its long-term highs and beyond.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Chewy Shifts Gears After a Tough Stretch

Chewy started gaining traction with pet owners in the last decade. While it faced fierce competition from Amazon and physical retailers, Chewy set itself apart with outstanding customer service and personalized experiences. Sending handwritten cards to pet owners or flowers for grieving customers created a loyal base.

This customer-friendly approach led to Chewy’s IPO in 2019, a strategic move as the pandemic saw more people adopting pets and turning to online shopping.

However, just as fortunes changed, the stock began to fall in early 2021 as the pandemic-driven trends reversed. By mid-2022, the bear market had erased all pandemic-related gains, pushing shares down to all-time lows.

Today, things are looking up after the stock bottomed in 2024. Chewy attributes this shift to increased spending by current customers and rising pet adoption rates. Its membership program, Chewy+, draws comparisons to Amazon Prime, offering perks like free shipping to encourage more frequent shopping.

Additionally, Chewy has begun international sales in Toronto and nearby areas since 2023. While results from Canada are not detailed yet, the company plans to expand into other markets outside the U.S.

This international move offers growth potential but raises concerns, particularly as retail cultures can differ greatly. U.S. companies have found success in Canada, yet failures abound when trying to tap into vastly different retail environments abroad. Investors should remain cautious about Chewy’s potential challenges beyond North America.

Financials Pick Up Steam

Chewy’s financial situation has markedly improved. In the first 39 weeks of fiscal 2024 (ending October 27, 2024), net sales reached $8.6 billion, marking a 4% yearly increase. The 5% revenue growth reported for fiscal Q3 lends further optimism for the company’s financial recovery.

Coupled with controlled expense growth, operating income saw a significant rise. The company benefitted from a $216 million income tax credit, leading to a net income of $370 million during this period, compared to just $8 million the previous year.

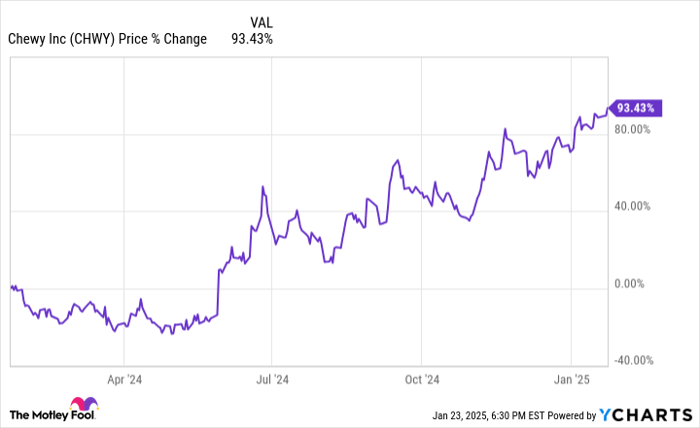

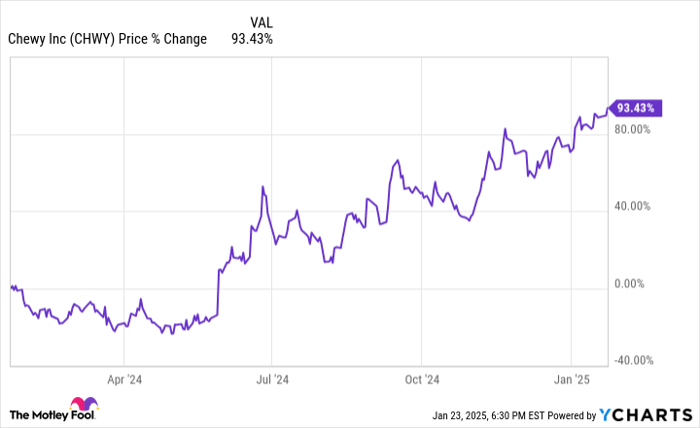

Looking ahead, Chewy expects nearly $12 billion in total net sales for the entire fiscal 2024, representing a projected 6% growth for the year. In light of these advancements, the stock has surged over 90% within the last year.

CHWY data by YCharts

From a valuation perspective, this rise has driven the P/E ratio to around 42. While that might appear elevated, a forward P/E of 31 suggests robust future profit growth, potentially benefiting Chewy’s stock performance as the company continues to bounce back.

Should You Buy Chewy Stock? Considerations Ahead

After enduring a significant downturn, Chewy seems poised for a return to growth. The stock has rebounded due to increased spending by current customers and the revenue boost from Chewy+. However, revenue growth remains in single digits, and it’s too soon to evaluate the success of international efforts. Still, the company has found a potential path to sustainable growth, which could be positive for shareholders.

Is Chewy Worth Your Investment?

Before investing $1,000 in Chewy, take this into account:

The Motley Fool Stock Advisor analyst team recently identified what they believe to be the 10 best stocks to purchase right now—and Chewy isn’t one of them. The selected companies hold promise for significant returns in the upcoming years.

For perspective, when Nvidia made this list on April 15, 2005, investing $1,000 at the time would have resulted in a portfolio worth $874,051!*

Stock Advisor provides an accessible plan for success, complete with portfolio-building tips, regular analyst updates, and two new stock picks each month. The Stock Advisor service has consistently outperformed the S&P 500 since 2002*.

Learn more »

*Stock Advisor returns as of January 21, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Chewy. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.