Meta’s Earnings and Market Outlook: Mixed Signals Ahead

Mere days before social media giant Meta Platforms Inc. META announces its fourth-quarter earnings, overall sentiment is leaning optimistic. Currently, Wall Street analysts have designated META stock as a Buy, with a consensus price target slightly above $666. Some analysts are even projecting a more optimistic target of $811 per share, supported by various fundamental factors.

Geopolitical Factors and Market Position

Geopolitical issues surrounding social media platforms may inadvertently benefit META. Recently, the U.S. Supreme Court upheld a decision to potentially ban TikTok unless its parent company, ByteDance, sells its American division. Although President Donald Trump issued a temporary executive order providing a 75-day pause on this ban, the situation remains fluid.

If complications arise, META’s stock could receive a boost. An eMarketer report highlights that TikTok generated $12.34 billion in U.S. advertising revenue last year, prompting analysts at Morgan Stanley to label Meta as the “largest fundamental winner of any TikTok ban.”

Investments in Artificial Intelligence

Additionally, Meta has committed to substantial investments in artificial intelligence (AI). Gene Munster from Deepwater Asset Management indicates that the company plans to invest as much as $65 billion this year to enhance its AI capabilities. This significant investment not only aids hardware suppliers such as Nvidia Corp. NVDA but also positions Meta prominently within the rapidly evolving AI sector.

Political Headwinds and Market Challenges

However, challenges loom for META. On the political front, Vice President J.D. Vance has raised concerns regarding the influence of major tech firms, particularly emphasizing issues of censorship—a consistent theme among conservatives. His previously stated aim of breaking up large tech corporations adds another layer of uncertainty for Meta.

Further complicating matters, the dynamics are shifting as the 2024 election draws closer. Elon Musk of social media platform X has criticized stagnant user growth and disappointing revenue, challenges that might similarly affect Meta and raise concerns about its stock valuation.

Examining Direxion ETFs

With the narrative surrounding Meta capable of shifting in various directions, traders may gravitate towards Direxion’s exchange-traded funds (ETFs) that focus on META. For optimistic investors, the Direxion Daily META Bull 2X Shares METU aims to replicate 200% of the daily investment results of META. Conversely, those who are less optimistic can consider the Direxion Daily META Bear 1X Shares METD, which reflects 100% of the inverse performance of META.

Both the METU and METD ETFs offer convenience, allowing traders to invest in a straightforward manner akin to any publicly traded stock, without the complexities often involved in options trading.

Investor Caution

It’s worth noting that leveraged or inverse ETFs come with inherent risks. Direxion cautions that exposure should generally be limited to one day to avoid the effects of daily volatility, which can lead to value decay over time.

Performance of METU and METD

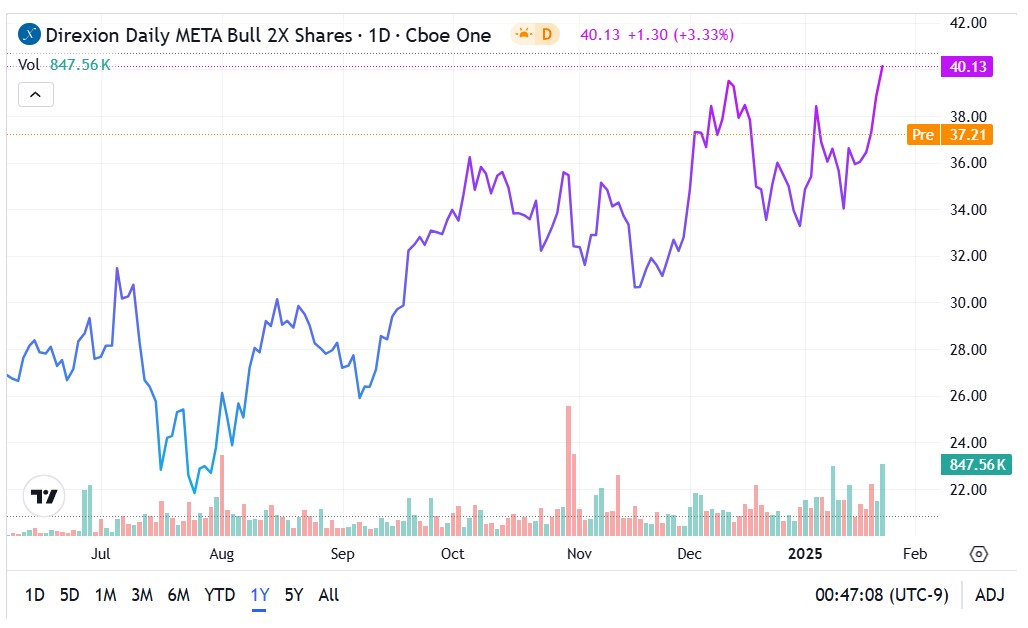

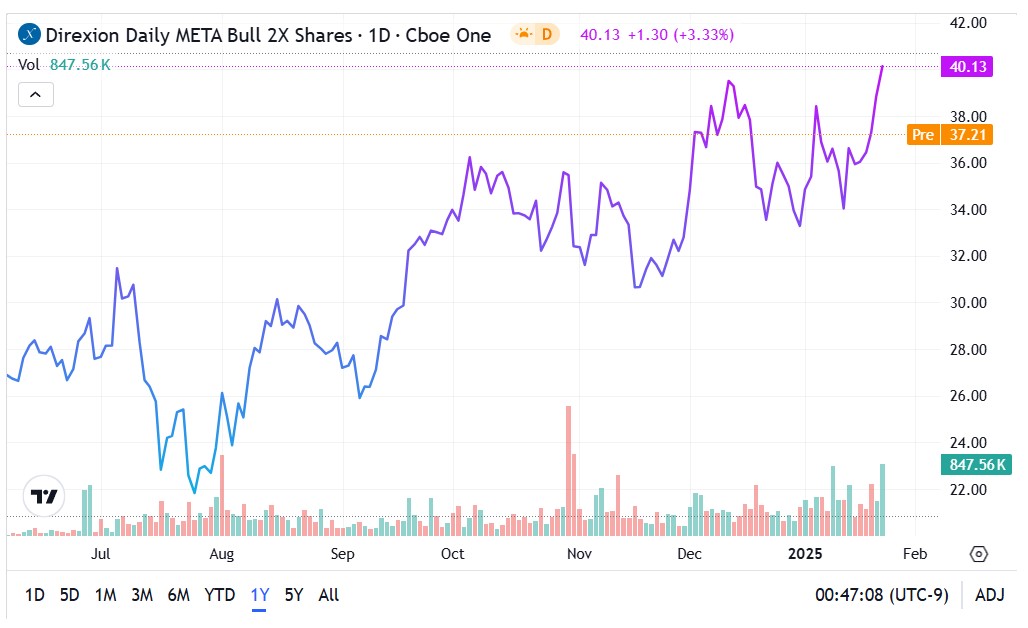

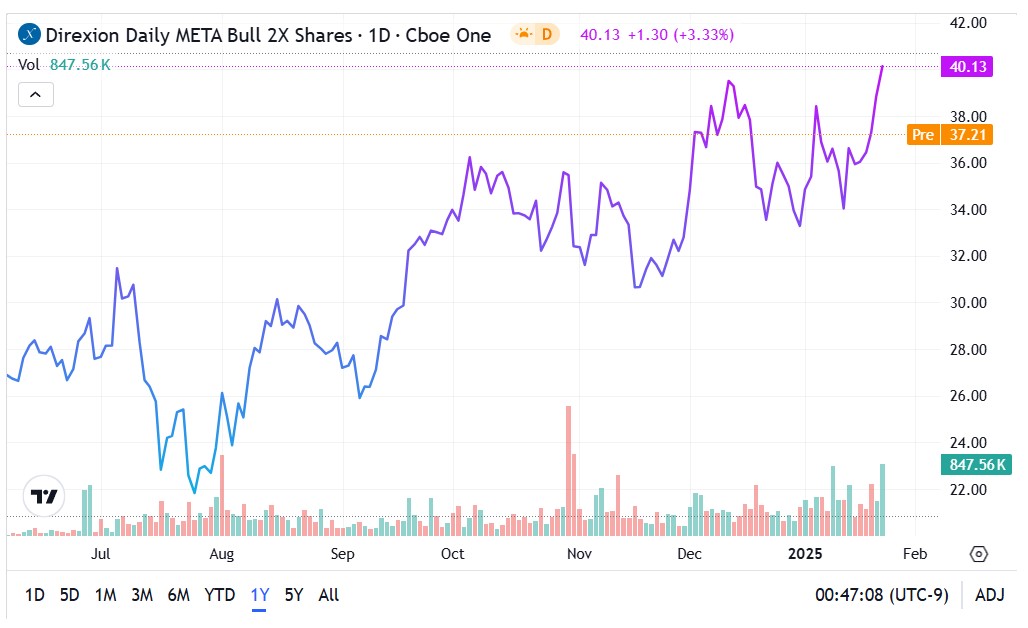

The METU ETF: Since its inception in June, Direxion’s META Bull fund has thrived amid a surge in tech enthusiasm, notably gaining over 49%.

- Currently, METU is riding a “step-up” formation, gradually advancing higher after brief periods of consolidation.

- Despite some skepticism ahead of Q4 results, META’s stock could continue to climb if it stays above the 50-day moving average of $35.17.

The METD ETF: In contrast, the Direxion META Bear fund has encountered difficulties since its June launch, with a decline of almost 26% in market value.

- Sadly for META bears, the METD ETF is trapped in a negative trajectory, with the 50-day moving average limiting upward movement.

- The recent drop below the $18 mark has been detrimental. Still, bears could gain momentum if prices break through the $18.50 resistance level.

Featured photo by Thomas Ulrich on Pixabay.

Market News and Data brought to you by Benzinga APIs