AMD Poised for Gains on Strong Data Center Growth Ahead of Q4 Earnings

Advanced Micro Devices (AMD) is positioned to report significant gains, particularly in Data Center revenues, when its fourth-quarter earnings are announced on February 4, 2024.

Stay updated on last-minute EPS estimates and surprises through the Zacks Earnings Calendar.

AMD has a strong product lineup and an expanding network of partners, which help it strengthen its position in the enterprise data center market. The company is leveraging its fourth-generation EPYC CPUs to achieve this growth.

The collaboration with partners such as Dell Technologies, HPE, Lenovo, and Supermicro focuses on solutions that drive data center consolidation. Key products like the Instinct MI300X Series AI accelerators and the Versal RF Series Adaptive SoCs have added to AMD’s growing portfolio.

The Zacks Consensus Estimate for Data Center revenues is set at $4.1 billion, reflecting an impressive year-over-year growth of 79.71%.

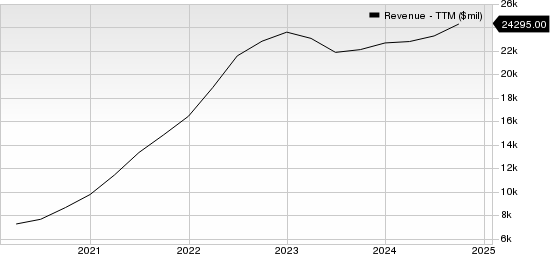

Advanced Micro Devices, Inc. Revenue (TTM)

Advanced Micro Devices, Inc. revenue-ttm | Advanced Micro Devices, Inc. Quote

Explore AMD’s overall performance expectations for the fourth quarter.

Broadened Product Line Will Support Client Revenue in Q4

AMD’s wider product range is expected to drive Client segment revenues positively.

New additions to the desktop lineup include the Ryzen 7 9800X3D, incorporating advanced “Zen 5” architecture and 2nd Gen AMD 3D V-Cache technology.

Additionally, the Ryzen AI 300 Series delivers an impressive 50 tops of AI computing power for Copilot Plus PCs, making it the industry’s fastest neural processing unit (NPU).

The consensus for fourth-quarter 2024 Client revenues is projected at $1.97 billion, signaling a year-over-year increase of 35.04%.

Gaming and Embedded Sectors Anticipate Year-over-Year Decline

In contrast, the Gaming segment is forecasted to show a decline for the fourth quarter of 2024. A drop in semi-custom sales is anticipated as major partners continue scaling back on inventory levels. In addition, AMD is transitioning to next-generation Radeon GPUs based on the RDNA architecture, which may also impact revenues negatively.

The consensus estimate for fourth-quarter Gaming revenues stands at $509 million, indicating a substantial year-over-year decline of 62.79%.

Meanwhile, AMD’s Embedded segment is also expected to face challenges due to ongoing weakness in the industrial market, with fourth-quarter Embedded revenues estimated at $922 million, reflecting a 12.77% decline year-over-year.

Our Earnings Model Insights

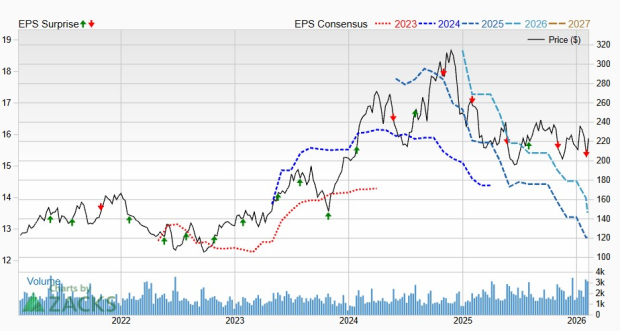

According to the Zacks model, a combination of a positive Earnings ESP and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) typically suggests an increased likelihood of earnings surprises. Currently, AMD does not fit this mold.

It holds an Earnings ESP of 0.00% and a Zacks Rank of #4 (Sell). Utilize our Earnings ESP Filter to identify stocks with favorable earnings dynamics.

Stocks Worth Considering

As investors look for potential earnings beats, here are some companies that may have favorable prospects:

Akamai Technologies (AKAM) has an Earnings ESP of +0.09% and a Zacks Rank of #2. Despite a drop of 18.2% in the last 12 months, AKAM is set to announce its fourth-quarter 2024 results on February 20.

AMETEK (AME) shows an Earnings ESP of +0.54% and currently carries a Zacks Rank of #2. AME shares have appreciated by 12.1% over the past year and will report fourth-quarter results on February 4.

DoorDash (DASH) features a promising Earnings ESP of +35.67% and a Zacks Rank of #2. With shares surging 75.8% in the past year, DASH is set to report on February 11.

Expert Predictions Highlight Top Growth Potential

Our research team has identified five stocks with promising potential for significant gains, with one standout stock singled out by Director of Research Sheraz Mian as particularly likely to outperform.

This choice has risen in the ranks of innovative financial firms. With a rapidly expanding customer base of over 50 million and a wide variety of cutting-edge solutions, this stock is expected to see substantial growth. While not every pick guarantees victory, this prospect may very well outpace previous high-flying Zacks’ stocks such as Nano-X Imaging, which soared by 129.6% in just over nine months.

Discover Our Top Stock and Four Challengers for Potential Growth

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

Akamai Technologies, Inc. (AKAM): Free Stock Analysis Report

AMETEK, Inc. (AME): Free Stock Analysis Report

DoorDash, Inc. (DASH): Free Stock Analysis Report

For more insights, click here to read the original article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.