Apple’s Q1 Results Show Promise Amidst AI Push

Apple (NASDAQ: AAPL) experienced a rocky start to 2025, with shares declining throughout January. However, the first-quarter earnings report released on January 30 may pave the way for a brighter future.

Positive Fiscal Trends Amidst Setbacks

In the first quarter, which ended December 28, 2024, Apple’s revenue grew by 4% compared to the previous year. Notably, earnings exceeded analysts’ expectations, rising by 10%. Despite a slight 1% dip in iPhone sales, the tech company’s outlook remains optimistic. Management highlighted the growing adoption of artificially intelligent devices as a key driver for future growth.

Wondering where to invest $1,000 today? Our analysts have identified the 10 best stocks for investment right now. See the 10 stocks »

Let’s examine the significant insights from Apple’s latest report and evaluate whether its growth factors can boost the stock price over the next few years.

Apple Intelligence: A Catalyst for Growth

Apple introduced Apple Intelligence—a set of AI features for iPhones, iPads, and MacBooks—in June 2024. The rollout has been gradual and is available only on newer models, including the iPhone 15 Pro and the latest iPad and MacBook lines.

The company plans to expand Apple Intelligence features throughout the year in multiple languages. Additionally, Apple is enhancing Siri’s capabilities using advanced language models, which is a positive development for investors. During the latest earnings call, CEO Tim Cook stated:

We did see that in markets where we rolled out Apple Intelligence, the iPhone 16 family performed better year over year compared to areas without it.

Revenue from iPads and MacBooks saw a 15% year-over-year increase, likely due to the wider adoption of AI features. A similar trend is expected as Apple extends these features to its iPhone line.

Analyst Dan Ives from Wedbush Securities predicts a multiyear upgrade cycle for iPhones due to AI. He estimates around 300 million iPhones over four years old that could prompt users to upgrade as Apple Intelligence becomes available. This anticipation aligns with the company’s revenue forecast, which suggests growth in the “low- to mid-single digits year over year” for the current quarter.

Importantly, the company remains positioned as a leader in the smartphone and PC markets, both of which could benefit from advancements in generative AI. Apple led the global smartphone market in 2024 with an 18.7% share, and it ranked fourth in PCs with an 8.7% market share. Estimates suggest shipments of generative AI smartphones may quadruple by 2027, while generative AI-capable PCs could see sales triple over the same period.

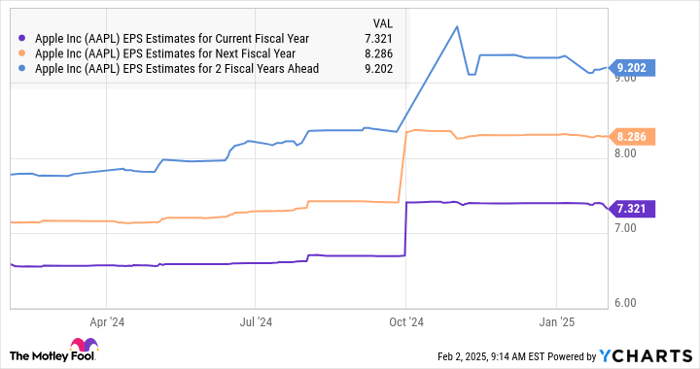

Earnings Growth Potential and Stock Outlook

Analysts expect Apple’s earnings to rise by 9% this fiscal year, with growth projected to accelerate in the following years. If earnings reach $9.17 per share by fiscal 2027, and if the stock trades at 33.5 times earnings—similar to the current Nasdaq-100 ratio—the stock price could jump to $307, representing a 30% increase from present levels. Currently, Apple trades at about 37 times earnings.

If the growth accelerates due to AI, Apple could maintain a premium valuation and potentially monetize its AI services, driving further earnings growth and benefits for shareholders.

Is Apple a Smart Investment Right Now?

Before purchasing Apple stock, here’s a crucial point to consider:

The Motley Fool Stock Advisor team has highlighted 10 best stocks to buy now, and curiously, Apple is not included in this selection. Those stocks are positioned for strong returns in the coming years.

For example, consider Nvidia’s performance. When it made the list on April 15, 2005, a $1,000 investment would have grown to $714,954 today!

Stock Advisor offers easy-to-follow investment guidance, portfolio building strategies, and regular stock updates. Since 2002, the service has significantly outperformed the S&P 500.

Learn more »

*Stock Advisor returns as of February 3, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.