Nvidia Faces Challenges Amid Rising Competition in AI Market

Nvidia (NASDAQ: NVDA) has had a rocky start in 2025, losing over 10% of its value recently. A significant factor in this downturn is the launch of a low-cost AI model by Chinese start-up DeepSeek, which threatens the semiconductor giant’s market position.

DeepSeek’s claim that it spent only $6 million to train its R1 reasoning model, which rivals OpenAI’s o1 reasoning model, sent shockwaves through the U.S. AI stock market. Nvidia’s stock took a steep dive of 17% on January 27, particularly after reports indicated that DeepSeek surpassed ChatGPT in downloads on the Apple app store in the U.S.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy now. See the 10 stocks »

The emergence of DeepSeek’s model has raised concerns about reduced demand for Nvidia’s AI chips from major cloud computing firms and governmental bodies. However, a closer examination of recent AI developments suggests that overall spending on AI chips might still trend upwards. This potential shift could enable Nvidia to recover when it shares its fiscal 2025 fourth-quarter results on February 26.

Nvidia’s Leading Position in AI Chips Could Turn the Tide

In recent years, substantial investments in AI infrastructure have been made by tech giants and governments worldwide. The announcement by former President Donald Trump last month significantly boosted AI investment prospects.

On January 21, Trump revealed at the White House that SoftBank, OpenAI, and Oracle (NYSE: ORCL) are collaborating in a joint venture to invest $100 billion in AI infrastructure. This joint project, dubbed Stargate, aims to ultimately direct up to $500 billion towards building AI infrastructure across the U.S. over the next four years.

According to Oracle chairman Larry Ellison, Stargate’s first AI data center is already under construction in Texas, with plans to develop a total of 20 data centers, potentially creating around 100,000 jobs.

In their announcement about the Stargate initiative, OpenAI noted that funding will come from SoftBank, OpenAI, Oracle, and Abu Dhabi’s MGX, an AI-focused investment firm. Notably, Nvidia is listed as one of the “initial technology partners” involved in Stargate.

Nvidia has been a key player in the AI revolution with its powerful Ampere architecture-based graphics processing units (GPUs) that underpinned the development of ChatGPT. Over the last three years, the company has consistently advanced in the AI accelerator market, releasing more powerful chips based on its Hopper and Blackwell architectures.

This consistent innovation has allowed Nvidia to maintain a commanding presence in the AI chip market, with an estimated market share of 90%. Given its technological edge over competitors, Nvidia is well-positioned to remain dominant in this space. Its GPUs serve as essential components for AI data centers, enabling companies to efficiently train and deploy AI models. The Stargate initiative’s ambitious investment strategy could further enhance Nvidia’s opportunities in this market.

For example, Oracle has been utilizing Nvidia’s GPUs to build AI infrastructure that clients can use to train AI models in the cloud. In September, Ellison noted that one of Oracle’s largest data centers would feature “800 megawatts, containing acres of NVIDIA GPU clusters capable of training the world’s largest AI models.” Following that, Oracle CEO Safra Catz mentioned during the December 2024 earnings call that the company had “delivered the world’s largest and fastest AI supercomputer, scaling up to 65,000 Nvidia H200 GPUs.”

Oracle also plans to expand its global footprint with an additional 35 cloud regions beyond the 17 it currently operates. This is likely to boost the demand for Nvidia’s GPUs. More importantly, as Nvidia collaborates with its supply chain to ramp up production of AI GPUs in 2025, it should be ready to meet the expected surge in chip demand arising from Stargate.

Companies like Meta Platforms and Microsoft are expected to maintain their investments in AI infrastructure despite DeepSeek’s new model. Both recognize the essential nature of significant AI expenditures to cater to rising application demand, especially as new efficient models emerge, as shown by DeepSeek. Semiconductor giant ASML has reported positive growth in orders, indicating strong industry confidence.

All these factors suggest that the AI investment landscape remains robust, which could lead Nvidia to announce strong results and positive guidance later this month.

Potential for Growth Ahead

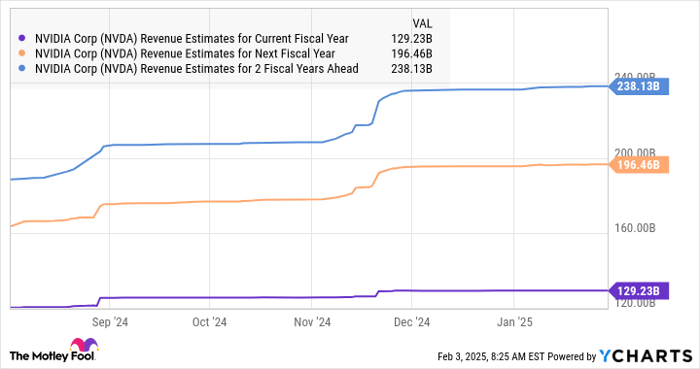

Current analyst estimates predict that Nvidia’s revenue for fiscal 2026 will increase by 52%, reaching slightly over $196 billion, followed by a 21% growth in fiscal 2027.

NVDA Revenue Estimates for Current Fiscal Year data by YCharts

However, these projections could improve in light of the ongoing discussions about AI investment, paving the way for more potential gains in Nvidia’s stock value. Currently, the 12-month price target for Nvidia is set at $175 by 66 analysts, pointing to a possible 46% increase from its current valuation.

The revenue projections for fiscal years 2026 and 2027 have recently been revised upward, a trend likely to persist amidst ongoing AI investments. As a result, Nvidia’s stock price target may also receive upward adjustments.

Investors who have held back recently considering the strong returns Nvidia has delivered over the past few years may find it prudent to invest now, as the company could be on track to recover its momentum. With a forward earnings multiple of 23, Nvidia’s valuation appears attractive compared to the tech-heavy Nasdaq-100 index with a multiple of 27. Thus, investing in Nvidia at this juncture could be a strategic decision, given the anticipated continuation of its earnings growth.

Should You Consider Investing $1,000 in Nvidia?

Before making a stock purchase in Nvidia, it’s wise to consider this:

The Motley Fool Stock Advisor analyst team recently identified their picks for the 10 best stocks to buy presently, and surprisingly, Nvidia did not make the cut. These selected stocks have shown potential for significant returns in the coming years.

Historically, if you had invested $1,000 in Nvidia based on the recommendation made on April 15, 2005, you would now have $727,150.!*

Stock Advisor offers rigorous guidelines for investors, including portfolio-building tips, regular analyst updates, and two new stock picks each month. Since 2002, the Stock Advisor service has produced returns exceeding four times that of the S&P 500.*

Learn more »

*Stock Advisor returns as of February 3, 2025

Randi Zuckerberg, a former market development director for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, serves on The Motley Fool’s board of directors. Harsh Chauhan does not hold positions in any stocks mentioned. The Motley Fool has positions in and recommends ASML, Apple, Meta Platforms, Microsoft, Nvidia, and Oracle. The Motley Fool also endorses options like long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a comprehensive disclosure policy.

The views and opinions expressed herein belong to the author and do not reflect those of Nasdaq, Inc.