Moderna Struggles Amid Mixed Financial Results and Market Pressures

Valued at $13.1 billion by market cap, Cambridge, Massachusetts-based Moderna, Inc. (MRNA) operates as a clinical-stage pharmaceutical company. It focuses on discovering and developing messenger RNA (mRNA) based therapies and vaccines for the treatment of autoimmune conditions, infectious diseases, immuno-oncology, rare diseases, and cardiovascular diseases.

Stock Performance Falls Short of Market Expectations

Over the past year, Moderna has significantly underperformed compared to the broader market. MRNA stock has declined by 63.4% over the last 52 weeks, and 15.9% year-to-date (YTD). In contrast, the S&P 500 Index ($SPX) has surged 22.6% over the past year and gained 3.1% in 2025.

When comparing MRNA’s performance to the SPDR S&P Biotech ETF (XBI), Moderna also lags behind, with XBI showing gains of 7.1% over the past year and 5.2% YTD.

A Tumultuous Decline from Previous Heights

Back in August 2021, Moderna’s stock reached an all-time high of $497.49, propelled by high demand for its COVID-19 vaccines. However, the company’s stock has since eroded, diminishing investors’ wealth significantly.

Latest Financial Results Spark Concerns

On November 7, Moderna’s stock dipped nearly 3% following the release of its mixed Q3 results. The company reported a modest 3.6% increase in total revenues, amounting to $1.9 billion, which exceeded Wall Street’s expectations. Moderna also posted a net income of $13 million, a notable improvement from the $3.6 billion net loss in the same quarter last year. Its earnings per share (EPS) of $0.03 convincingly surpassed analyst estimates. Nonetheless, concerns about a slowdown in vaccine demand continue to overshadow these positive developments.

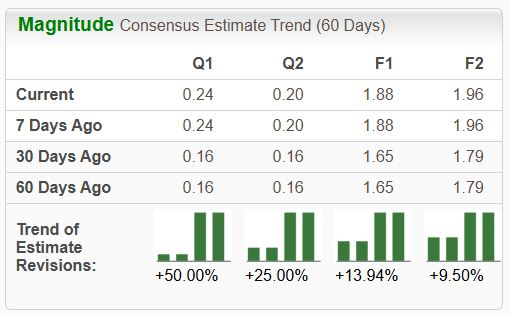

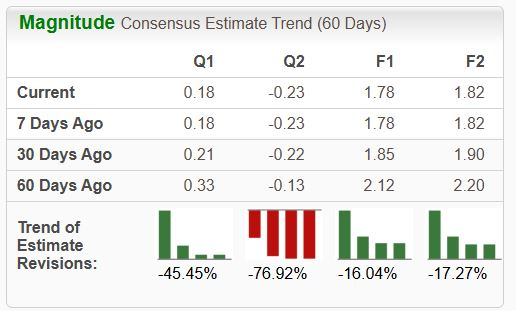

Analysts anticipate a decline in losses for fiscal 2024, predicting a decrease of 25.6% year-over-year to $9.18 per share. Importantly, Moderna has demonstrated a solid earnings surprise history, beating the Street’s estimates in each of the past four quarters.

Analyst Recommendations Show Cautious Sentiment

Among the 25 analysts covering MRNA stock, the consensus rating is a “Hold.” This encompasses four “Strong Buy,” 17 “Hold,” one “Moderate Sell,” and three “Strong Sell” ratings.

This outlook is slightly bearish compared to three months ago when six analysts recommended “Strong Buy,” and only two analysts issued “Strong Sell” ratings. On January 27, Evercore ISI Group analyst Cory Kasimov maintained an “In-Line” rating on MRNA, while lowering the price target to $50, indicating a 42.9% premium over current price levels.

Meanwhile, Moderna’s mean price target of $70.32 indicates a remarkable potential upside of 101% based on current valuation.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are solely for informational purposes. For more details, please view the Barchart Disclosure Policy here.

More news from Barchart

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.