Vanguard Growth ETF Sees Significant Inflows This Week

Nearly $1 Billion Added to VUG’s Outstanding Units

Today, data from ETF Channel shows noteworthy changes in the shares outstanding for various ETFs. The Vanguard Growth ETF (Symbol: VUG) is a highlight, reporting an approximate inflow of $994.1 million. This represents a 0.6% week-over-week increase in outstanding units, rising from 379,896,079 to 382,261,054. Notable stocks within VUG include Netflix Inc (Symbol: NFLX), which is down about 0.2%, Equinix Inc (Symbol: EQIX), gaining about 0.2%, and American Tower Corp (Symbol: AMT), decreasing by about 0.1%. For details on VUG’s holdings, check the VUG Holdings page.

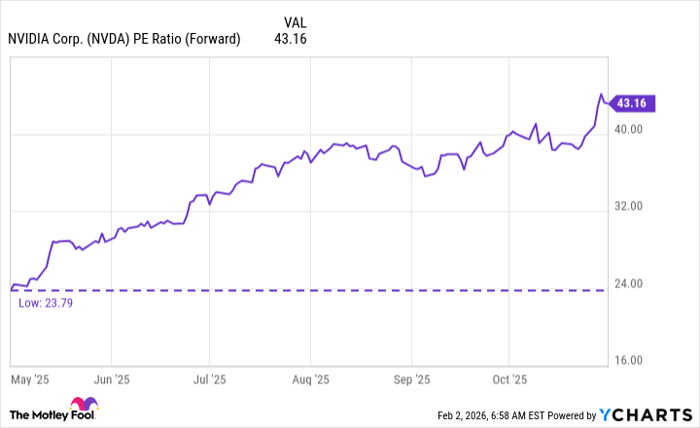

The following chart illustrates VUG’s one-year price performance compared to its 200-day moving average:

Examining the chart, VUG reached a low of $321.2923 per share over the past year, with a high of $428.69. The last trade was noted at $421.46. Analysts often compare current share prices to the 200-day moving average, offering valuable insights into market trends.

Exchange traded funds (ETFs) function similarly to stocks; however, investors buy and sell “units” instead of “shares.” Units can be traded like stocks and may also be created or destroyed based on market demand. Each week, we monitor the week-over-week changes in shares outstanding to identify ETFs experiencing significant inflows (indicating new units created) or outflows (resulting in old units being retired). The creation of new units necessitates purchasing the ETF’s underlying holdings, whereas the destruction involves selling these assets, which can influence the individual stocks held within the ETFs.

![]() Explore which 9 other ETFs experienced notable inflows »

Explore which 9 other ETFs experienced notable inflows »

Also see:

- Blue Chip Dividend Stocks Hedge Funds Are Buying

- ETFs Holding THR

- Funds Holding CONY

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.