American Express: A Strong Investment Backed by Warren Buffett

It’s encouraging when one of the world’s most renowned investors, Warren Buffett, has a significant stake in a stock we’re considering for our portfolio. Recently, American Express posted its fourth consecutive earnings surprise. Currently holding a Zacks Rank #2 (Buy), American Express continues to impress its critics.

American Express provides credit card payment products and travel-related services, organized into four segments: US Consumer Services, Commercial Services, International Card Services, and Global Merchant and Network Services. Their offerings encompass various products such as payment and financing solutions, accounts payable management, and lifestyle services. The company also operates airport lounges under the Centurion Lounge brand, catering to a diverse clientele that includes consumers, small businesses, and large corporations through online platforms and direct sales teams.

Market Performance Insights

Over the past year, American Express (AXP) shares have significantly outperformed the market. This positive trend looks set to continue into 2025. The company is a member of the Zacks Financial – Miscellaneous Services industry group, which ranks among the top 27% of over 250 Zacks Ranked Industries. High rankings for this group suggest a strong potential for outperformance in the coming months.

This industry is part of the Zacks Finance Sector, currently the strongest sector overall. Historical studies show that a stock’s price rise is significantly linked to its sector and industry ranking. The top 50% of Zacks Ranked Industries often outperform the bottom 50% by over two to one.

AMEX stock recently hit new 52-week highs on increasing trading volume. Options trading can be an effective way to capitalize on this upward momentum, providing flexibility to match strategies with market dynamics.

Understanding Options Trading

Before diving into today’s options trade, let’s revisit some key concepts of options trading. It’s not necessary to get bogged down by intricate formulas. In my experience, simpler strategies tend to perform better over time.

Options are contracts that offer the buyer the choice (not the obligation) to buy or sell a stock at a predetermined price, known as the strike price. A call option permits the buyer to purchase the stock, while a put option allows for selling. The buyer of the option pays a premium, and the seller—or writer—of the option receives that premium. Options typically have an expiration date that can range from one week to over a year.

Options consist of two values: time value and intrinsic value. In-the-money options have both values, while at-the-money and out-of-the-money options possess only time value. All options expire worthless if they remain at or below strike price at expiration.

Strategies for Maximizing Returns on American Express

Given its upward trajectory, American Express stock is well-suited for a call option purchase:

Image Source: StockCharts

When executed properly, trading options can yield significant profits with limited risk.

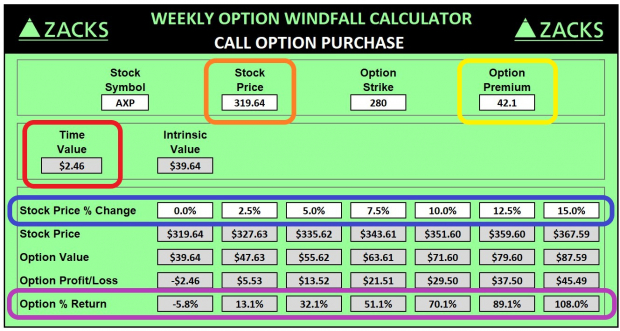

In this trade, we’ll aim for the March 21st expiration with a 280-strike price. Buying this option offers the right to purchase 100 shares of AXP stock at $280 before March 21st, a little over a month away.

The table below illustrates the potential risk/reward for this trade. American Express shares currently trade at $319.64. The March 21 call we are considering costs 42.1 points, resulting in a total investment of $4,210 based on trading 100 shares.

Image Source: Zacks Investment Research

The first row shows potential performance scenarios at expiration, while the second row indicates corresponding percentage returns for our call option trade. If AXP remains unchanged, we face a modest loss of 5.8%. Should the stock rise 5%, we could see a 32.1% profit, and a 15% increase would yield a substantial 108% profit.

This example highlights the leverage of options. Stock investors buying 100 shares of AXP would need to invest $31,964. A 15% increase would generate a $4,794 profit. Conversely, the option trader only invests $4,210 for the same 100 shares, potentially earning a nearly identical $4,549 profit with much less capital at risk.

It is worth noting that the example call option has low time value, just 2.46 points, equating to only 0.8% of the stock’s price. Minimizing time value while maximizing intrinsic value is a prudent risk management strategy, particularly as expiration approaches.

Final Thoughts

With American Express demonstrating strong potential for outperformance, AXP stock seems poised for continued gains. Support from the financial sector adds to this bullish outlook. Using low-risk call options can optimize potential returns on American Express shares. Investors should closely monitor AXP stock as we move further into the year.

7 Must-Watch Stocks for the Month Ahead

Recently released: Experts have compiled a list of 7 exceptional stocks from the current lineup of 220 Zacks Rank #1 Strong Buys. These stocks are expected to experience significant price increases soon.

Since 1988, this exclusive collection has consistently beaten the market, achieving an average annual gain of +24.3%. Make sure to pay attention to these handpicked selections.

See them now >>

For the latest insights from Zacks Investment Research, you can download the report on “7 Best Stocks for the Next 30 Days” for free.

American Express Company (AXP): Free Stock Analysis Report

To view this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.