“`html

Ceragon Networks Set to Release Q4 2024 Earnings: What Investors Should Know

Ceragon Networks Ltd. CRNT is scheduled to announce its fourth-quarter 2024 results on February 11, before the market opens.

Check the latest EPS estimates on Zacks Earnings Calendar.

The Zacks Consensus Estimate for the upcoming quarter predicts earnings of 10 cents, which would signify an impressive 150% increase compared to the same period last year. Total revenues are estimated at $104 million, representing a 15% rise year-over-year.

In its last quarterly report, CRNT surpassed the Zacks Consensus Estimate for earnings by 77.8%.

Examining CRNT’s Earnings Forecast

According to our model, Ceragon’s chances of surpassing earnings expectations this quarter are uncertain. Typically, a combination of a positive Earnings ESP and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) would suggest a favorable outlook. However, CRNT does not fit this criterion. Currently, it has an Earnings ESP of -5.26% and a Zacks Rank of #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Analyzing Key Drivers Before CRNT’s Q4 Earnings

Ceragon is likely benefiting from strong demand for its solutions, particularly in the private networks segment within North America, which contributed $24.5 million to overall revenues in Q3 2024. The company is actively diversifying its operations towards private networks.

A robust presence in India also supports growth, with the country accounting for nearly half of Ceragon’s overall revenues in the previous quarter at $50.5 million. As India continues to upgrade its telecommunications infrastructure with 4G and 5G technologies, demand for high-capacity wireless products, particularly microwave and E-Band solutions, is expected to grow. Management indicated a promising start to Q4 in terms of bookings during the last earnings call.

The recent acquisition of Siklu is likely helping Ceragon expand its market share in the North American Enterprise Security domain. By utilizing Siklu’s PtMP technology, the company aims to appeal to service providers focusing on fixed subscriber growth through the deployment of 5G wireless technologies.

Looking ahead to 2024, CRNT anticipates revenues, including those from Siklu, between $390 million and $400 million, marking a growth of 12% to 15% year-over-year.

Management expects the non-GAAP operating margins to hit a minimum of 10% at the midpoint of the revenue guidance, suggesting an improving bottom line.

Despite these positive factors, some concerns linger. A slowdown in certain public network areas outside India, caused by a weak global economy and fluctuating 5G demand, raises caution. Furthermore, increased competition from Chinese firms in regions like Latin America, Africa, and parts of Asia-Pacific poses significant challenges for CRNT.

The company reported a slowdown in orders from Tier 1 customers during Q3 2024, attributed to the timing of network builds. As Tier 1 customers represent major revenue sources for telecommunications equipment providers, any delays could strain revenue visibility.

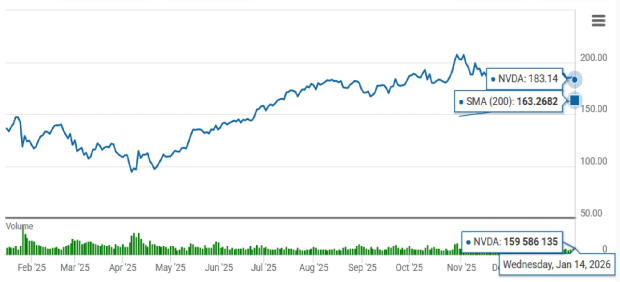

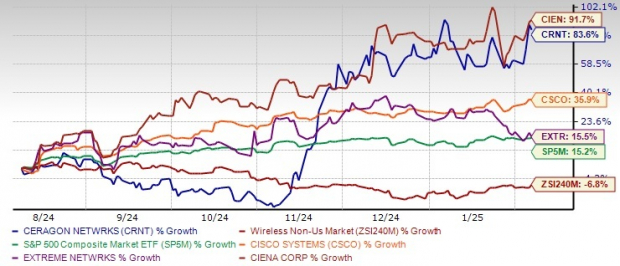

CRNT Stock Performance Surges

In the past six months, CRNT shares have surged by 83.6%, significantly outperforming the 6.8% decline in the Wireless Non-U.S. industry and the 15.2% gain of the Zacks S&P 500 index.

CRNT Stock Price Performance

Image Source: Zacks Investment Research

This stock performance outstrips several competitors in the industry. For instance, Cisco Systems (CSCO) and Extreme Networks (EXTR) saw increases of 35.9% and 15.5%, respectively, while Ciena Corporation (CIEN) experienced an impressive 91.7% jump during the same period.

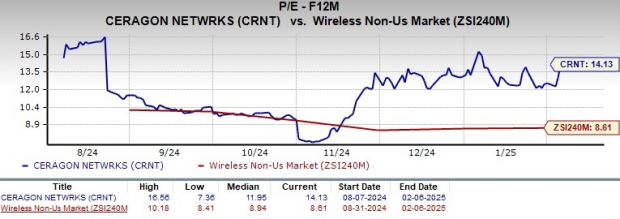

CRNT Valuation Insights

Currently, CRNT stock is trading at a higher valuation, with a forward 12-month Price/Earnings ratio of 14.13X, compared to the industry average of 8.61X.

Image Source: Zacks Investment Research

Ceragon’s Strategic Focus for Growth

CRNT is prioritizing growth initiatives, including mmWave products, Private Networks, and Managed Services, to harness the rising demand for advanced wireless technologies. This strategy is likely to strengthen the company’s competitive position in the market. Additionally, Ceragon is making substantial progress on its product roadmap, having secured orders for its new IP50EX solution.

The company’s strategic acquisitions also contribute to its growth by fostering synergies that enhance business capabilities.

“““html

Ceragon Networks Takes Strategic Steps in Operational Efficiency

Ceragon Networks Ltd. (CRNT) is focused on cost reduction and improving operational efficiency by integrating resources. Recently, the company completed its buyout of End 2 End Technologies, LLC, an influential systems integration and software development firm in the U.S. This acquisition is valued at around $8.5 million, with an extra potential payment of up to $4.3 million if certain financial targets are met by 2025, to be disbursed mainly in 2026.

While acquisitions can enhance growth, they also introduce integration risks. High levels of goodwill and intangible assets on the balance sheet represent the challenges that accompany frequent buyouts.

Consider Holding CRNT Stock This Earnings Season

Although markets in India and North America present opportunities, several challenges could pressure CRNT’s stock price. Issues such as a slowdown in public network sectors outside India, sluggish ordering from communication service providers (CSP), a premium valuation, and the risks associated with acquisitions must be navigated carefully.

Investors may find it wise to hold CRNT stock for now. This strategy allows them to potentially benefit from growth while addressing external risks.

Exploring the Promising Future of Nuclear Energy

The demand for electricity is rising rapidly as the world aims to lessen reliance on fossil fuels such as oil and natural gas. Nuclear energy stands out as a viable alternative.

Recently, leaders from the United States and 21 other nations pledged to triple global nuclear energy capacities. This ambitious initiative could translate into substantial profits for nuclear-related stocks, particularly for investors who enter the market early.

Our timely report, Atomic Opportunity: Nuclear Energy’s Comeback, delves into key players and technologies driving this trend, spotlighting three standout stocks positioned for potential gains.

Download Atomic Opportunity: Nuclear Energy’s Comeback free today.

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Ciena Corporation (CIEN) : Free Stock Analysis Report

Extreme Networks, Inc. (EXTR) : Free Stock Analysis Report

Ceragon Networks Ltd. (CRNT) : Free Stock Analysis Report

Read this article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.

“`