Disney and Qualcomm Report Strong Q1 Earnings, Beating Expectations

On Wednesday, Disney DIS and Qualcomm QCOM both delivered impressive earnings, exceeding expectations in both earnings and revenue for their fiscal first quarter.

As major players in their industries, these companies are worth watching closely in the upcoming weeks.

Disney’s Impressive Q1 Performance

Disney’s strategic cost-cutting measures have paid off, resulting in a net income of $3.7 billion and adjusted earnings of $1.76 per share. This represents a remarkable 44% increase from the EPS of $1.22 in the same quarter last year. Disney has surpassed earnings estimates for nine consecutive quarters, beating Q1 estimates of $1.44 by an impressive 22%.

With three major box office hits in 2024, Disney’s sales rose 5% year-over-year to $24.69 billion, slightly above analysts’ expectations of $24.65 billion.

Image Source: Zacks Investment Research

Qualcomm’s Strong Q1 Results

Qualcomm, a leader in the chip industry, reported a net income of $3.18 billion, marking a 24% increase in adjusted earnings to $3.41 per share compared to $2.75 in the last quarter. The company has beaten EPS estimates for seven consecutive quarters, outperforming Q1 estimates of $2.93 by 16%.

Qualcomm’s chipset business achieved a record $10 billion in sales, showcasing significant gains in the handset and automotive markets. Overall, Q1 sales reached $11.66 billion, up 17% from $9.93 billion a year earlier, easily surpassing estimates of $10.91 billion.

Image Source: Zacks Investment Research

Future Earnings Projections for Disney and Qualcomm

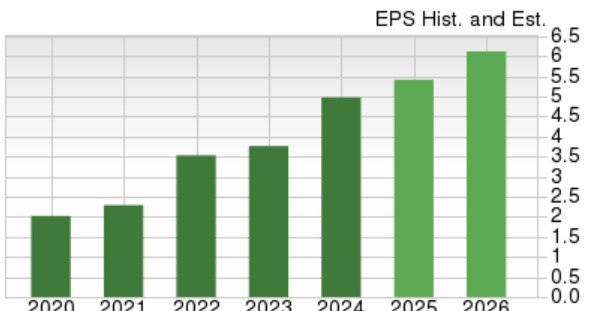

Disney maintains its full-year earnings guidance, anticipating a high-single-digit EPS growth for fiscal 2025. Analysts project the Zacks Consensus to be $5.43 per share, indicating a 9% growth. Additionally, EPS is expected to climb another 13% in FY26 to reach $6.16. Disney also estimates its cash from operations will be around $15 billion this year.

Image Source: Zacks Investment Research

For Q2, Qualcomm anticipates an EPS in the range of $2.70-$2.90, exceeding the current Zacks Consensus of $2.68, which forecasts 10% growth. Qualcomm also expects Q2 revenues of $10.2 billion-$11 billion, compared to Zacks’ estimate of $10.35 billion, projecting 10% growth.

Zacks estimates predict Qualcomm’s earnings to grow 10% this year and another 10% in FY26, reaching $12.32 per share.

Image Source: Zacks Investment Research

Conclusion

Both Disney and Qualcomm are positioned for potential growth, with Zacks assigning them a rank of #2 (Buy). Notably, earnings estimates for FY25 and FY26 have increased in the past month. The trend of positive revisions may continue, supported by strong Q1 results and optimistic guidance.

Seize the Opportunity: The Future of Nuclear Energy

The demand for electricity is rising dramatically as society aims to cut reliance on fossil fuels. Nuclear power presents a strong alternative.

Recently, leaders from the US alongside 21 nations pledged to triple the world’s nuclear energy capacity. This bold shift could lead to significant profits for nuclear-related stocks for those who invest early.

Our report, Atomic Opportunity: Nuclear Energy’s Comeback, details key participants and technologies driving this transformation, highlighting three standout stocks likely to thrive.

Download Atomic Opportunity: Nuclear Energy’s Comeback free today.

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

The Walt Disney Company (DIS): Free Stock Analysis Report

Read the full article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.