Citigroup Adjusts NIKE’s Outlook: Analysts Predict Significant Growth

Fintel reports that on February 7, 2025, Citigroup downgraded their outlook for NIKE (XTRA:NKE) from Buy to Neutral.

Analyst Forecast Indicates 22.30% Upside Potential

As of January 29, 2025, the average one-year price target for NIKE stands at 85,05 €/share. Projections vary from a low of 47,99 € to a high of 119,73 €. This average target suggests a possible increase of 22.30% from its most recent closing price of 69,54 € / share.

Explore our leaderboard showcasing companies with the largest price target upside.

NIKE’s Revenue and EPS Projections

The expected annual revenue for NIKE is 59,373MM, reflecting a growth of 21.22%. The projected non-GAAP EPS is 4.78.

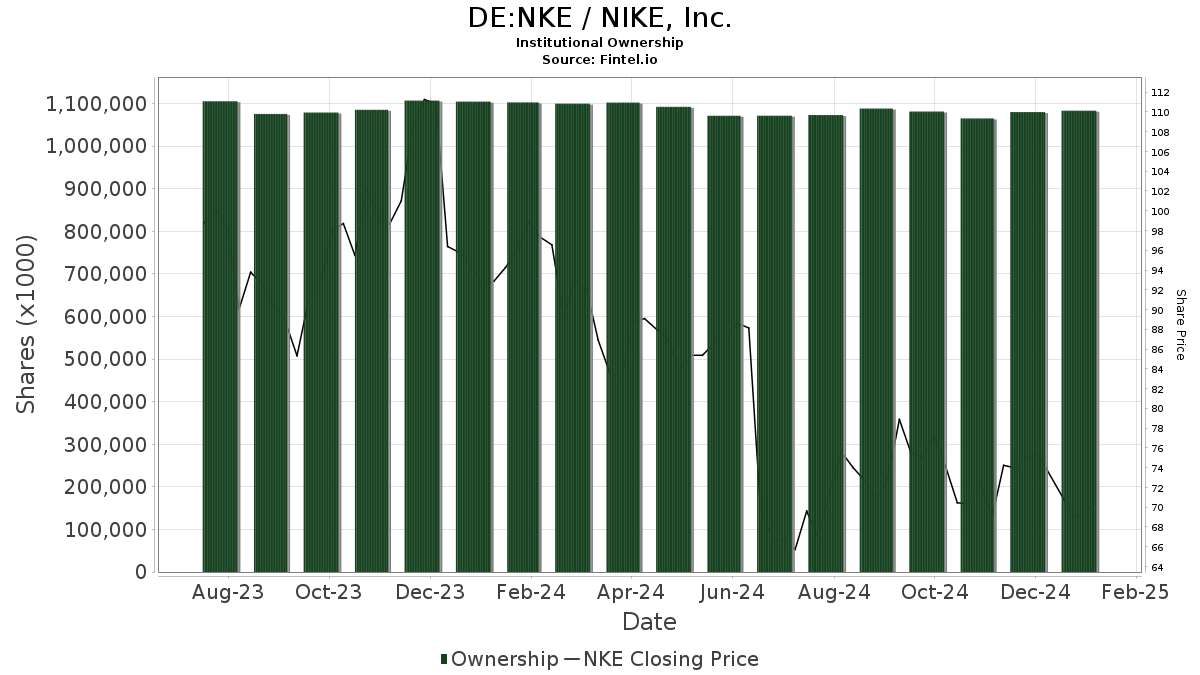

Fund Sentiment Overview

Currently, 3,223 funds and institutions report holdings in NIKE, marking a decrease of 101 owners or 3.04% from the previous quarter. The average portfolio weight of all funds in NKE is 0.35%, which has increased by 3.37%. Over the last three months, total shares owned by institutions rose slightly by 0.10% to 1,088,636K shares.

Institutional Shareholder Activity

The Vanguard Total Stock Market Index Fund Investor Shares holds 38,088K shares, which equates to 3.22% ownership. In a previous filing, they reported ownership of 38,267K shares, indicating a decrease of 0.47%. However, their portfolio allocation in NKE increased by 9.65% over the last quarter.

Meanwhile, the Vanguard 500 Index Fund Investor Shares owns 31,468K shares, representing 2.66% ownership. Their prior filing showed 31,092K shares, reflecting an increase of 1.19% and a 9.24% boost in portfolio allocation in NKE over the last quarter.

Wellington Management Group LLP holds 27,442K shares, or 2.32% ownership. Their last report indicated ownership of 26,099K shares, a notable increase of 4.89%. Their portfolio allocation in NKE rose by 20.99% in the last quarter.

Geode Capital Management possesses 25,029K shares, translating to 2.12% ownership. Previously, they reported owning 24,778K shares, an increase of 1.00%, signaling a 9.23% rise in their portfolio allocation in NKE last quarter.

Furthermore, Capital World Investors has 22,257K shares, representing 1.88% ownership. Their previous filing indicated ownership of 5,729K shares, marking a substantial increase of 74.26%. They have also raised their portfolio allocation in NKE by an impressive 333.25% over the last quarter.

Fintel serves as a comprehensive investing research platform for individual investors, traders, financial advisors, and small hedge funds, offering extensive data on fundamentals, analyst reports, ownership structures, fund sentiment, and more.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.