Analyst Insights: Invesco MSCI USA ETF Offers Promising Potential

When examining the Invesco MSCI USA ETF (Symbol: PBUS) and its underlying holdings, analysts project an encouraging future. With our analysis at ETF Channel, we discovered an implied analyst target price of $68.49 per unit for PBUS.

Current Performance and Potential Upside

At a recent trading price of $60.52 per unit, this indicates a potential upside of 13.17% based on analysts’ average expectations. Among PBUS’s underlying assets, three stand out for their significant upside against analyst target prices: Charter Communications Inc (Symbol: CHTR), Allstate Corp (Symbol: ALL), and Chevron Corporation (Symbol: CVX).

Highlighted Stocks with Upside Potential

Charter Communications, currently trading at $347.84 per share, has an average target of $415.73—representing a 19.52% increase. Allstate Corp’s recent price of $190.24 suggests a 17.44% upside potential to its target of $223.41. Lastly, Chevron Corporation, trading at $152.62, has a target of $176.95, which reflects a possible increase of 15.94%.

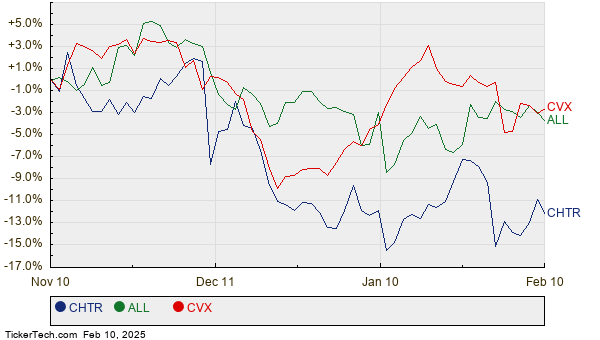

Below is a twelve-month price history chart comparing the stock performance of CHTR, ALL, and CVX:

Analyst Target Prices Summary

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco MSCI USA ETF | PBUS | $60.52 | $68.49 | 13.17% |

| Charter Communications Inc | CHTR | $347.84 | $415.73 | 19.52% |

| Allstate Corp | ALL | $190.24 | $223.41 | 17.44% |

| Chevron Corporation | CVX | $152.62 | $176.95 | 15.94% |

Evaluating Analyst Optimism

Investors may ponder whether analysts are being realistic with these price targets. A target that is much higher than a stock’s current trading price could indicate optimism but also risk of future downgrades if economic conditions shift. It is important for investors to conduct thorough research on recent developments within these companies and their industries.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Additional Reading:

· Consumer Services Dividend Stocks

· CHBH Insider Buying

· IXG shares outstanding history

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.