Blue Bird Corporation BLBD, a leading school bus manufacturer, exceeded earnings expectations for the first quarter of fiscal 2025. The company has also reaffirmed its revenue and adjusted EBITDA projections for the year.

Stay informed about quarterly releases: Check the Zacks Earnings Calendar.

Understanding Blue Bird Corporation’s Financial Landscape

Blue Bird Corporation price-consensus-eps-surprise-chart | Blue Bird Corporation Quote

There is a strong demand for school buses, and analysts on Wall Street have recently raised their earnings forecasts for Blue Bird, reflecting optimism in the market.

Image Source: Zacks Investment Research

However, uncertainties in government policy continue to hover, especially regarding the Trump administration’s stance on electric vehicles (EVs). On his first day in office, Trump dismantled Biden’s EV guidance and halted funds meant for EV infrastructure. Coupled with tariff concerns related to imports from Mexico and Canada, investors are left pondering whether now is the best time to invest in Blue Bird or wait for clarity.

Rising Demand and Blue Bird’s Green Technology Leading the Way

Blue Bird stands out in the school bus sector not just for its production but for its leadership in alternative fuel and electric-powered buses. The company offers propane, gasoline, and battery-electric models, effectively positioning itself as the primary source for these options after competitors IC and Thomas ceased production of propane or gasoline buses. Given that over 90% of school buses in the U.S. currently run on diesel, Blue Bird’s offerings present a significant growth opportunity in cleaner transportation.

The company’s growth is also evident in its backlog. By the end of the first quarter of fiscal 2025, Blue Bird had a backlog of 4,400 buses, which equates to approximately six months of production. During its latest earnings call on February 5, Blue Bird reported that this backlog has grown to over 4,700 buses, representing $760 million in potential revenue. Notably, its EV backlog amounts to $250 million, with nearly 1,000 electric buses either sold or set for delivery this fiscal year. With increasing demand and stable pricing, Blue Bird is poised to lead the transition to greener transportation solutions. Their partnership with Ford F and ROUSH CleanTech lasting until 2030 further underscores their commitment to low-emission student transport.

Successful Recovery from Past Struggles

Blue Bird’s journey since the pandemic has been marked by significant operational improvements. After facing challenges in late 2021, the company implemented a robust plan to enhance operations, cut costs, and restore profitability. This turnaround reached fruition in the third quarter of fiscal 2023, and the outcomes reflect this success.

Recently, Blue Bird posted a net profit of $28.7 million, a major turnaround from an $11 million loss reported two years prior. The company has also fortified its financial stability, concluding the first quarter of fiscal 2025 with record liquidity of $280 million (including $136 million in cash). Over the past year, it has reduced its debt by $40 million, and in the last six months, Blue Bird repurchased $20 million worth of its own shares, with an additional $40 million authorized for buybacks.

Looking forward, the company forecasts fiscal 2025 revenues between $1.4 billion and $1.5 billion, an increase from $1.35 billion in 2024. They project selling 9,250 buses in fiscal 2025, an increase from the 9,000 sold last year. Of these, about 1,000 are expected to be electric, up from 700 previously. Adjusted EBITDA is anticipated to be between $185 million and $215 million, compared to $183 million last year. The company continues to target long-term revenues reaching $2 billion and a 15% adjusted EBITDA margin.

Government Policy: An Uncertain Landscape

One area of concern for investors is the government policy affecting electric vehicles. With the Trump administration’s stance causing uncertainty regarding EV incentives, Blue Bird has some exposure since approximately 25% of its EV backlog relies on delayed EPA rebate approvals.

On a positive note, a recent memo from the EPA indicated that federal funding from the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA) cannot be paused during ongoing litigation. This suggests that funding for the Clean School Bus Program may resume soon, allowing Blue Bird to fulfill its pending electric bus orders.

Additionally, Blue Bird secured an $80 million contract from the Department of Energy (DOE) to support half of its $160 million plant expansion in Fort Valley, GA. While this funding is currently on hold, the company anticipates it will resume after the policy review is complete, enabling it to expand its EV production capacity and reinforce its leadership position in the market.

Is Now the Time to Invest in BLBD Stock?

Despite the short-term uncertainties surrounding policy, Blue Bird’s core business fundamentals remain strong. The demand for school buses is on the rise with a clear movement toward cleaner alternatives. The successful turnaround has left the company in a better position to face future challenges.

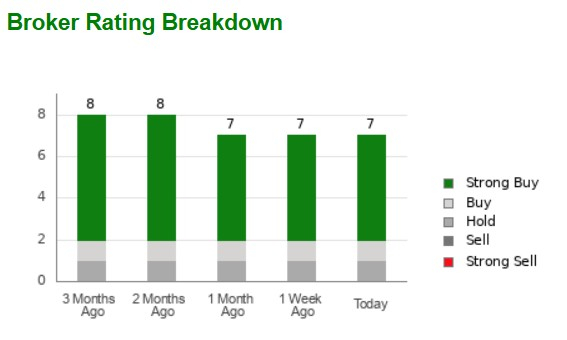

According to Wall Street analysts, there is a positive outlook. Among the seven analysts reviewing BLBD, five consider it a “Strong Buy,” one rates it as a “Buy,” and the other gives it a “Hold.” The average price target is $55.79, suggesting a potential upside of 46% from current prices.

Image Source: Zacks Investment Research

While concerns around EV financing may induce some fluctuations, Blue Bird’s foundational business remains solid. For those looking to invest in the school bus industry with a focus on green energy, BLBD stock could be a promising addition to a portfolio.

BLBD holds a Zacks Rank of #2 (Buy) and carries a VGM Score of A. Find out more about today’s Zacks #1 Rank (Strong Buy) stocks here.

Explore Zacks’ Investment Opportunities for Just $1

No gimmicks here.

A few years back, we surprised our members by offering 30-day access to our entire portfolio for only $1. No obligation to spend another cent.

Many have taken advantage of this offer while others hesitated, thinking there must be a catch. Our goal is simply to acquaint you with services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, which closed 256 positions with double- and triple-digit gains in 2024 alone.

Discover Stocks Now >>

You can get the latest recommendations from Zacks Investment Research by downloading the free report on the 7 Best Stocks for the Next 30 Days.

Ford Motor Company (F) : Free Stock Analysis Report

Blue Bird Corporation (BLBD) : Free Stock Analysis Report

For more details, read this article on Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.