Vanguard Mid-Cap ETF Shows Potential for Growth, Analysts Suggest

Analyzing the latest data from ETF Channel, we took a close look at the Vanguard Mid-Cap ETF (Symbol: VO) and its underlying stocks. By comparing current trading prices to analysts’ 12-month target prices, we calculated an implied target price for the ETF of $305.46 per unit.

Current Performance vs. Analyst Forecast

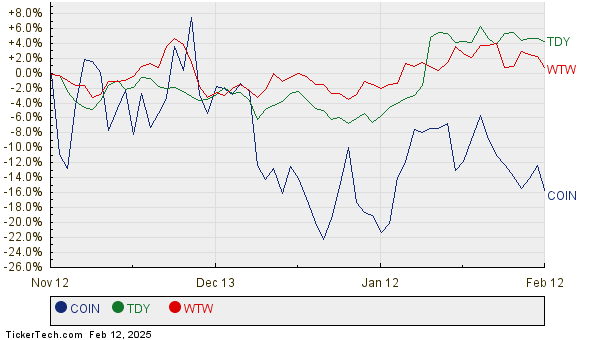

With VO recently trading at approximately $276.42 per unit, there seems to be a projected upside of 10.50%, suggesting positive expectations among analysts. Notable underlying holdings driving this outlook include Coinbase Global Inc (Symbol: COIN), Teledyne Technologies Inc (Symbol: TDY), and Willis Towers Watson Public Ltd Co (Symbol: WTW). For instance, while COIN’s recent price stands at $266.90 per share, analysts project a 10.79% increase, forecasting a target price of $295.70 per share. Likewise, TDY’s recent price of $508.54 corresponds with a 10.69% potential increase to an analyst target of $562.89. For WTW, the expected price target is $353.00 per share, marking a 10.58% upside from its current price of $319.23. Below, you can see a comparison of the stock performance for COIN, TDY, and WTW over the past twelve months:

Analyst Targets Overview

The following table summarizes the key financial data for the mentioned stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Mid-Cap ETF | VO | $276.42 | $305.46 | 10.50% |

| Coinbase Global Inc | COIN | $266.90 | $295.70 | 10.79% |

| Teledyne Technologies Inc | TDY | $508.54 | $562.89 | 10.69% |

| Willis Towers Watson Public Ltd Co | WTW | $319.23 | $353.00 | 10.58% |

Are Analysts’ Targets Justifiable?

Investors might wonder if analysts are accurate with their price predictions or overly optimistic about future performance. A high target compared to current trading prices can reflect optimism, but it may also indicate possible downgrades if expectations prove unrealistic. Taking a closer look at market trends and company performance will provide more clarity in understanding these predictions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• TMC YTD Return

• PZE Split History

• REVB Stock Predictions

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.