Analysts See Upside Potential in iShares Core Dividend Growth ETF (DGRO)

ETF Channel has analyzed the iShares Core Dividend Growth ETF (Symbol: DGRO) to determine its growth potential by comparing its underlying holdings with analyst target prices. The average analyst target price for DGRO is currently set at $70.91 per unit.

Current Trading and Upside Analysis

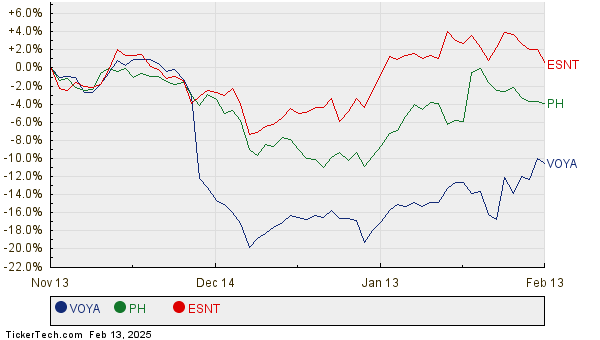

DGRO is trading at approximately $63.59 per unit, indicating that analysts foresee an 11.52% upside for this ETF based on the target prices of its underlying stocks. Notably, three of these holdings demonstrate significant growth potential compared to their analyst targets: Voya Financial Inc (Symbol: VOYA), Parker Hannifin Corp (Symbol: PH), and Essent Group Ltd (Symbol: ESNT).

Notable Holdings with Upside

Currently, VOYA shares are priced at $73.41, with an average analyst target of $83.50, suggesting a potential upside of 13.74%. Parker Hannifin Corp, priced at $678.42, has a target of $765.78, translating to an expected upside of 12.88%. For Essent Group Ltd, trading at $57.11, analysts anticipate a rise to a target of $63.88, indicating an 11.85% upside. The chart below shows the twelve-month price history for these stocks:

Summary of Analyst Targets

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Core Dividend Growth ETF | DGRO | $63.59 | $70.91 | 11.52% |

| Voya Financial Inc | VOYA | $73.41 | $83.50 | 13.74% |

| Parker Hannifin Corp | PH | $678.42 | $765.78 | 12.88% |

| Essent Group Ltd | ESNT | $57.11 | $63.88 | 11.85% |

Evaluating Analyst Projections

The question arises: Are analysts’ targets based on solid reasoning, or do they reflect an overly optimistic outlook on these stocks’ future performances? High price targets might suggest optimism, yet they could also lead to revising downward if market conditions change. Investors should assess whether the targets are aligned with current company and market trends for a more informed investment decision.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• CYTX Historical Stock Prices

• EOG Dividend Growth Rate

• Top Ten Hedge Funds Holding JMEE

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.