Zebra Technologies Surpasses Earnings Expectations in Q4 2024

Zebra Technologies Corporation (ZBRA) posted adjusted earnings of $4.00 per share for the fourth quarter of 2024, beating the Zacks Consensus Estimate of $3.95. This marks a significant rise from the $1.71 per share reported in the same quarter last year.

Stay informed about quarterly releases: Check the Zacks Earnings Calendar.

Total revenues reached $1.33 billion, exceeding the consensus estimate of $1.31 billion. This represents a 32.2% increase compared to the previous year, driven by strong performances in the Enterprise Visibility & Mobility and Asset Intelligence & Tracking segments. Additionally, organic net sales grew by 31.6%, while foreign currency translation contributed positively by 0.6% to overall revenues.

Financial Performance Overview

In 2024, Zebra reported net revenues of $4.98 billion, up 8.7% from last year. Adjusted earnings increased by 37.7% to $13.52 per share.

Segment Performance Highlights

The Asset Intelligence & Tracking segment saw revenues rise by 29.5% year over year to $448 million, exceeding the Zacks Consensus Estimate of $441 million, with organic net sales up 28.8%. Currency translation positively impacted total revenues by 0.7%.

Revenues for the Enterprise Visibility & Mobility segment also performed well at $886 million, a 33.6% increase from last year. This figure surpassed the consensus estimate of $871 million, and organic net sales rose by 33.1%, while foreign currency translation improved revenues by 0.5%.

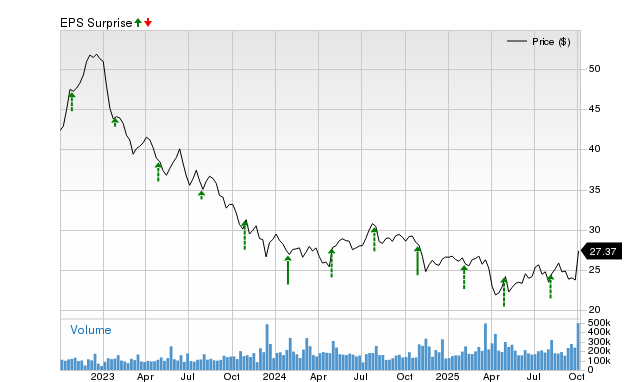

Stock Performance Insights

Zebra Technologies Corporation price-consensus-eps-surprise-chart | Zebra Technologies Corporation Quote

Cost Analysis and Profitability

In the fourth quarter, Zebra Technologies faced a cost of sales totaling $686 million, an increase of 22.3% year over year. Operating expenses rose 13.1% to $423 million, leading to a net income of $163 million, a significant increase from $17 million in the same period last year.

Financial Position and Cash Flow

At the close of the fourth quarter, Zebra Technologies’ cash and cash equivalents totaled $901 million, a jump from $137 million at the end of December 2023. The company’s long-term debt stood at $2.09 billion, slightly up from $2.05 billion previously.

For 2024, Zebra generated significant cash flow, with $1.01 billion from operating activities, a major rise from the previous year’s $4 million outflow. Their capital expenditures were $59 million, resulting in a free cash inflow of $954 million, compared to a $91 million outflow last year.

Future Projections

Looking ahead, Zebra Technologies anticipates a net sales increase of 8-11% year over year for the first quarter of 2025, although they expect a 1% negative effect from foreign currency translation. The adjusted EBITDA margin is projected at approximately 21%, with earnings per share expected between $3.50 and $3.70. For 2025, the company estimates net sales growth of 3-7% and adjusted earnings of $14.75-$15.25 per share, while maintaining a free cash flow target of at least $750 million.

Current Market Position

Zebra Technologies currently carries a Zacks Rank #4 (Sell).

Explore the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance Highlights of Industry Peers

Tetra Tech, Inc. (TTEK) reported earnings of $0.35 per share for the first quarter of fiscal 2025 (ended December 2024), exceeding the Zacks Consensus Estimate of $0.34 and up from $0.28 per share a year earlier.

Tetra’s revenues for the quarter reached $1.2 billion, surpassing estimates by 8.85%, compared to $1.02 billion in the previous year. The company has topped revenue estimates in each of the last four quarters.

Waste Management, Inc. (WM) reported fourth-quarter earnings of $1.70 per share, missing the Zacks Consensus Estimate of $1.79, but slightly better than $1.74 per share a year prior.

WM generated revenues of $5.89 billion for the quarter, narrowly beating the consensus estimate by 0.18%, up from $5.22 billion of the previous year. The company has met revenue estimates two times in the last four quarters.

Packaging Corporation of America (PKG) reported adjusted earnings of $2.47 in the fourth quarter, falling short of the Zacks Consensus Estimate of $2.51, but matching the company’s guidance and rising by 16% year over year.

Sales for the fourth quarter climbed 10.7% year over year to $2.15 billion, driven by increased volumes and favorable pricing/mix, exceeding the consensus estimate of $2.13 billion.

Zacks Research Team Insights

The Zacks Research team has identified the top 5 stocks likely to gain over 100% in the near future. Among these, Director of Research Sheraz Mian highlights one stock that stands out for its high growth potential.

This significant pick comes from a rapidly growing financial firm with over 50 million customers and a broad range of innovative solutions, indicating a promising future. While not all selections have guaranteed success, this one may surpass previous winners like Nano-X Imaging, which surged by 129.6% within nine months.

Free: Discover Our Top Stock and 4 Additional Selections

Get a Free Stock Analysis Report for Tetra Tech, Inc. (TTEK)

Get a Free Stock Analysis Report for Waste Management, Inc. (WM)

Get a Free Stock Analysis Report for Packaging Corporation of America (PKG)

Get a Free Stock Analysis Report for Zebra Technologies Corporation (ZBRA)

Read the original article on Zacks.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.