Cisco Systems Reports Strong Earnings, Shares Rise After Market

Cisco Systems Inc. (CSCO) exceeded earnings expectations for the second quarter of fiscal 2025, leading to a notable 6.6% increase in its stock price during after-market trading on February 12.

Earnings Outperform Expectations

For the latest quarter, Cisco announced adjusted earnings of $0.94 per share, surpassing the Zacks Consensus Estimate of $0.91. This is an improvement from $0.87 in the same quarter last year.

The company reported quarterly revenues of $13.99 billion, which exceeded the Zacks Consensus Estimate by 0.91% and marked an increase from last year’s $12.79 billion. This growth is notable as it follows four consecutive quarters of revenue decline.

Although Cisco has faced challenges in networking sales due to reduced demand from telecommunications and cable service providers, the recent quarter saw networking revenues beat the expectations.

In contrast, revenues from observability, services, security, and collaboration experienced year-over-year growth and also exceeded forecasts. Additionally, the non-GAAP margin for both product and services exceeded expectations.

Looking Ahead: Growth Opportunities

Cisco’s acquisition of Splunk in March 2024 has positively impacted its adjusted earnings per share sooner than anticipated, contributing to a stronger recurring revenue stream. The partnership with Splunk was notably enhanced through its deployment on Microsoft Corp.’s Azure platform.

The new AI-powered Hypershield, which fuses security and networking, was launched and has bolstered Cisco’s security offerings. During a recent conference call, Cisco management highlighted that orders for AI infrastructure with webscalers reached over $350 million in the second quarter alone, with total AI infrastructure orders nearing $700 million. They expect this to exceed $1 billion in fiscal 2025.

Cisco outlined its strategy to grow its AI presence through three key areas: developing AI training infrastructure for webscale customers, enhancing AI inference and enterprise cloud capabilities using products like Nexus switches, NVIDIA Corp. (NVDA)-based AI servers, and optimizing AI network connectivity.

Optimistic Projections for Fiscal 2025

Cisco has raised its earnings per share (EPS) guidance for fiscal 2025 (ending July 2025) to a range of $3.68-$3.74, up from the previous estimate of $3.60-$3.66. The midpoint of this new range, $3.71, is significantly above the current Zacks Consensus Estimate of $3.65.

The revenue forecast for fiscal 2025 was also elevated to $56-$56.5 billion, compared to the prior estimate of $55.3-$56.3 billion. The midpoint of this revised revenue range, $56.25 billion, is well above the current Zacks Consensus Estimate of $55.93 billion.

The chart below illustrates Cisco Systems’ stock performance over the past year.

Image Source: Zacks Investment Research

Positive Trends in Earnings Estimates

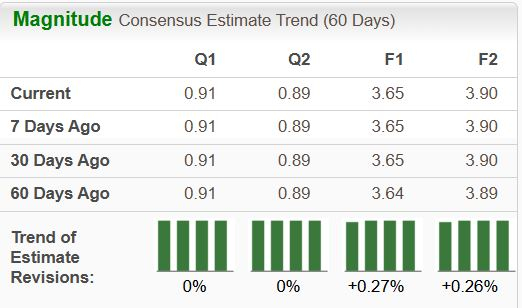

The current Zacks Consensus Estimate for fiscal 2025 earnings has risen by 0.3% over the last 60 days. Presently, the Zacks estimate suggests a 3.9% increase in revenues and a 6.9% increase in EPS for fiscal 2026. The earnings estimate for fiscal 2026 has also gone up by 0.3% in the last month.

Analysts are likely to revise their EPS and revenue estimates for fiscal 2025 and 2026 upward after Cisco’s impressive second-quarter results.

Image Source: Zacks Investment Research

Investment Opportunity: Buy CSCO Shares

Over the past year, Cisco has achieved a return of 25.9%, slightly outpacing the S& P 500’s return of 23.4%. Currently, the stock holds a Zacks Rank #2 (Buy). A positive ranking combined with the earnings beat is expected to push CSCO’s stock price higher.

With a forward P/E ratio of 17.09X for the current year, Cisco compares favorably to the industry average of 17.32X and the S&P 500’s 18.62X. Additionally, Cisco’s return on equity stands at 25.7%, significantly better than the industry average of -5.53% and the S&P 500’s 16.84%.

The average short-term price target from brokerages indicates an increase of 3.6% from Cisco’s last closing price of $62.53, with target prices ranging between $56 and $78. This suggests a potential upside of up to 24.7% and a downside of 10.4%.

Image Source: Zacks Investment Research

Zacks Research Identifies Potential Stock for Gain

Recently, Zacks experts identified five stocks with a high probability of gaining +100% in the coming months. From these, Director of Research Sheraz Mian picked a single stock poised for the most substantial growth.

This top choice belongs to one of the most innovative financial companies, boasting over 50 million customers and a variety of advanced solutions expected to drive significant gains. While not all recommendations succeed, this stock could exceed earlier Zacks investments like Nano-X Imaging, which surged +129.6% in just over nine months.

To explore our top stock and four other strong picks, please view our latest report.

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.