Investors are paying close attention to quantum computing, which is currently experiencing significant advancements. Simultaneously, artificial intelligence (AI) continues to be a dominant theme in the market, as its development progresses. Many investors are eager to explore opportunities in both fields, but options remain limited.

One company that stands out in the quantum computing and AI sectors is Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL). Alphabet offers a compelling way to tap into both trends effectively.

Stay Informed Every Market Morning! Subscribe to Breakfast news for free daily updates. Sign Up Now »

A Quantum Leap: Google Sparks Investment Interest

Alphabet played a pivotal role in boosting interest in quantum computing. In December, Google, which is part of Alphabet, declared that its Willow quantum computing chip accomplished a task that the fastest supercomputers would take 10 septillion years (10 followed by 25 zeros) to finish. While that number is astonishing, the real takeaway is the technological breakthrough behind it.

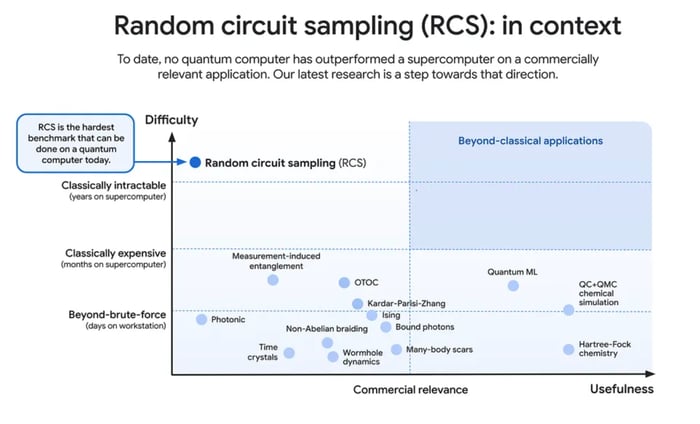

Unlike classical computing, which relies on bits (0s and 1s) that can directly transmit information, quantum computing uses qubits. Qubits represent probabilities of being a 1 or a 0, which enables much greater data storage and processing capabilities. However, due to the nature of qubits, errors can occur during calculations. Google has devised a method to mitigate these errors, which allowed it to achieve this impressive benchmark accurately. Nevertheless, Google does not claim that this test has immediate commercial value, as it primarily demonstrated the potential power of quantum computing rather than practical applications. The following chart illustrates Google’s perspective on the test’s usefulness:

Image source: Alphabet.

Though we’re still years away from commercially applicable quantum computing, some companies in the sector are already applying their technology in research settings. Investing in a company like Alphabet, which stands to gain from quantum developments while also participating in the booming AI industry, seems like a smart strategy.

Alphabet Positioned to Benefit from AI Spending Surge

As Alphabet competes with its Gemini AI model, it is also reaping rewards from businesses investing heavily in AI computing resources.

The primary channel for this benefit comes through Google Cloud, which is Alphabet’s cloud computing division. Businesses that find it impractical to acquire dedicated AI servers often turn to cloud computing services for their needs. This flexibility allows them to adjust computing power based on fluctuating demands. Given Google Cloud’s extensive client base, the computing resources become utilized efficiently across various companies.

Thanks to this mutually beneficial model, the cloud computing market is projected to exceed $2 trillion by 2030.

Google Cloud has been at the forefront of providing top-tier computing resources, being among the first to implement Nvidia‘s Blackwell GPUs. Cloud revenue surged by 30% year over year to $12 billion in Q4, indicating remarkable growth for Alphabet in this sector.

While Google Cloud is a significant contributor to Alphabet’s AI aspirations, the company is also embedding AI capabilities into its existing search framework and advertising tools. Despite not leading the generative AI race, Alphabet appears well-positioned to benefit from the evolving AI landscape. Coupled with its quantum computing prospects, the outlook for Alphabet’s stock remains positive.

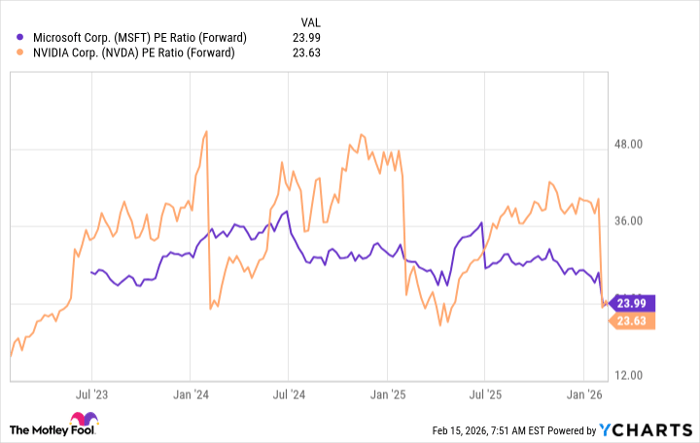

GOOGL PE Ratio (Forward) data by YCharts

Interestingly, Alphabet’s stock is currently valued at 21 times forward earnings, a relatively reasonable price considering its growth potential in various sectors. This makes it an attractive option for long-term investors as trends in AI and quantum computing develop.

Seize This Opportunity Before It’s Too Late

Do you ever feel like you missed the opportunity to invest in exceptional stocks? If so, now is the time to pay attention.

Occasionally, our expert analysts issue a “Double Down” stock recommendation for companies poised for significant growth. If you’re worried about having missed your chance, now presents a perfect moment to invest before the window closes. The data speaks volumes:

- Nvidia: if you invested $1,000 when we recommended it in 2009, you’d have $350,809!*

- Apple: if you invested $1,000 when we recommended it in 2008, you’d have $45,792!*

- Netflix: if you invested $1,000 when we advised it in 2004, you’d have $562,853!*

Currently, we are issuing “Double Down” alerts for three outstanding companies, and this may be one of your last chances to take advantage of such opportunities.

Learn more »

*Stock Advisor returns as of February 3, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet and Nvidia. The Motley Fool has positions in and recommends Alphabet and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.