Quantum Computing Stocks: A Closer Look at Rigetti’s Rollercoaster Journey

Quantum computing stocks have skyrocketed recently, driven by a significant milestone from Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL). The company’s Willow quantum chip completed a standard benchmark computation in less than five minutes—an achievement that would take a supercomputer 10 septillion years (a 1 followed by 25 zeros).

The Willow chip also showcased its ability to dramatically reduce errors as it scales, tackling a problem researchers have faced for almost three decades.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Following this news, stocks of quantum computing companies, including Rigetti Computing (NASDAQ: RGTI), surged. However, volatility continues as experts like Nvidia CEO Jensen Huang caution that “very useful” quantum computing may be further off than many investors expect.

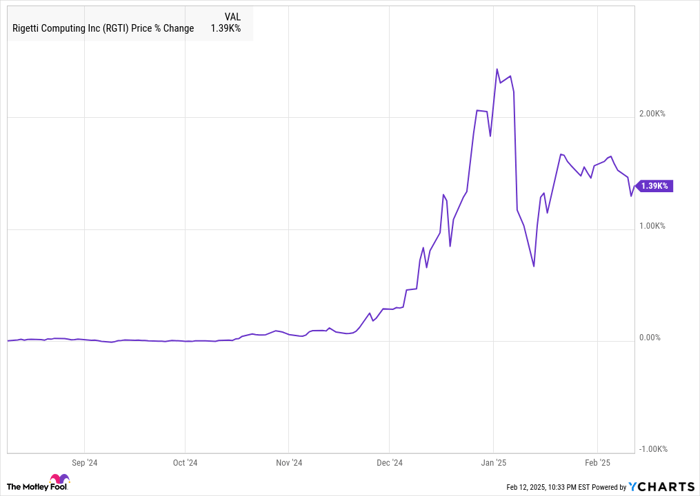

The chart below illustrates Rigetti’s stock performance over the past six months:

RGTI data by YCharts.

Rigetti’s stock was gaining traction before Google’s announcement, but following Huang’s remarks, shares experienced a notable dip in January. As it stands, the stock is in a waiting pattern as investors seek more insight into the future of quantum computing and Rigetti’s role in it. So, is now a good time to invest in Rigetti? Let’s examine the company more closely.

Image source; Getty Images.

Understanding Rigetti Computing

Rigetti aims to create the world’s most powerful computers through quantum technology. It has pioneered the development of the first multiple-chip quantum processor and began selling quantum computers to customers in 2023.

The company positions itself against high-performance computing (HPC), which uses powerful Nvidia chips. Unlike classical HPC, quantum computers could solve complex problems more rapidly and cost-effectively.

Moreover, Rigetti is distinctively vertically integrated, managing its own laboratory and manufacturing facility. This strategy allows for greater control over production, although it generally requires more upfront financial investment. Currently, Rigetti is generating minimal revenue, reporting just $2.4 million in Q3, with an operating loss of $17.3 million. The company is working toward a goal of releasing a 100-qubit system by the end of 2025, with a qubit being the fundamental unit of quantum information.

Management has not provided long-term projections, leaving uncertainty regarding when Rigetti will generate significant revenue. However, forecasts suggest revenue may rise from $11 million in 2024 to $15.6 million in 2025—modest growth for a company still in its developmental stage.

Should You Consider Rigetti Computing as an Investment?

After an impressive rise, Rigetti’s stock now trades at a very high price-to-sales ratio, approximately 300, based on a market cap of $3 billion. This inflated market cap could spell opportunities for significant gains, but it also poses risks of steep declines if investor sentiment shifts or if the company’s anticipated growth falters. The drop following Huang’s comments underscores how swiftly perceptions can change within this nascent field.

While quantum computing boasts great potential, success isn’t guaranteed. Competing startups and tech giants like Alphabet also aim to carve out a segment within this competitive landscape.

Though Rigetti possesses innovative technology, more evidence of its business viability is needed before it can be definitively labeled a worthwhile investment. Its current valuation appears speculative, and while there’s potential for big rewards, disappointment in the near to medium term seems more plausible. Making long-term predictions remains challenging at this point.

Is Now a Good Time to Invest $1,000 in Rigetti Computing?

Before purchasing shares in Rigetti Computing, think about the following:

The Motley Fool Stock Advisor analysts recently ranked what they consider the 10 best stocks for investment now, and Rigetti Computing was not among them. The selected stocks are expected to provide impressive returns in the coming years.

Take, for example, Nvidia, which was featured in our recommendations on April 15, 2005… a $1,000 investment at that time would be worth $850,946!*

Stock Advisor offers a straightforward strategy for investors, complete with portfolio-building guidance, ongoing updates from analysts, and two new stock picks each month. Since its inception, Stock Advisor has more than quadrupled the S&P 500’s performance since 2002*.

Learn more »

*Stock Advisor returns as of February 7, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Jeremy Bowman has positions in Nvidia. The Motley Fool has positions in and recommends Alphabet and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.