S&P 500 Rises in 2025: What Investors Need to Know About Toast

After a successful year in 2024, the S&P 500 is on the rise, climbing by 3% in 2025. Major players like Apple and Amazon have recently released fourth-quarter earnings, but attention now shifts to Nvidia and Microsoft, who will announce their earnings on February 26 and February 28, respectively. Their results could have a significant impact on market direction.

Long-term investors understand the importance of looking beyond immediate trends. Staying focused on the potential market landscape in five, ten, or twenty years is key. Despite today’s fluctuations, the market tends to reward those who are patient and forward-thinking.

Stay Informed Every Morning! Subscribe to Breakfast news for daily market updates in your inbox. Sign Up For Free »

Toast (NYSE: TOST) is a growing company that has caught the attention of investors. Its stock rose by 83% over the past year, and analysts see strong long-term growth potential. Here are three reasons why it might be a smart investment today.

1. Significant Market Opportunity

Toast is a cloud-based company powered by artificial intelligence. It specializes in providing solutions to the restaurant industry, making operations easier and promoting rapid growth.

The company is expanding quickly, having added 7,000 new locations in the third quarter of 2024, escalating its total to 127,000. This growth reflects a flywheel effect; as more restaurants adopt Toast’s platform, it becomes increasingly popular. Currently, 20% of new locations are referred by existing customers, further propelling this momentum.

Toast continues to enhance its platform with new features tailored for various dining styles, including fine dining and bakeries.

Toast perceives over a $1 trillion opportunity in U.S. restaurants, claiming about 13% of the market by location. Although it faces competition from other companies focused on the restaurant industry, such as Aloha, it also competes with firms like Block, which caters to the broader small business sector.

Additionally, Toast is venturing into international markets, currently serving 2,000 locations and viewing an opportunity to reach 280,000 sites in the near future. The potential is far more extensive, with 15 million global locations on the horizon.

Lastly, a new product aimed at the grocery segment is in its early stages, targeting 220,000 locations, with 1,000 already operational.

2. Path to Profitability

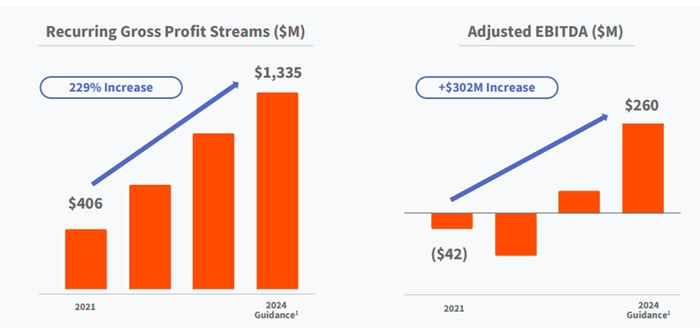

Toast measures its progress using annualized recurring run rate (ARR), which rose by 27% year over year in the third quarter. The subscription model ensures dependable monthly revenues and fosters customer loyalty. Although ARR growth has slowed somewhat recently, the overall trend indicates Toast’s path to profitability.

Image source: Toast.

In the third quarter of 2024, Toast reported net income of $56 million, improving from a $31 million loss the previous year. Management has raised its forecasts for gross profit and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) for the fourth quarter and the year, with Wall Street predicting $0.17 in earnings per share (EPS) in Q4.

3. Attractive Valuation

Toast has a strong growth trajectory and is shifting toward profitability, yet its stock remains reasonably priced at 33 times forward earnings and under 5 times trailing twelve-month sales.

With numerous growth prospects and increasing profits, Toast appears poised for expansion, making now a favorable time to consider investing.

Should You Invest $1,000 in Toast Now?

Before committing any money to Toast, keep this in mind:

The Motley Fool Stock Advisor team has recently identified their list of the 10 best stocks to buy currently, and Toast is not among them. The selected stocks could yield substantial returns in the coming years.

For instance, if you had invested $1,000 in Nvidia when it made the list on April 15, 2005, you’d now have $850,946*

Stock Advisor offers a clear strategy for investors, including guidance on portfolio building, regular analyst updates, and two new stock picks every month. The Stock Advisor service has more than quadrupled the returns of the S&P 500 since 2002*.

Learn more »

*Stock Advisor returns as of February 7, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jennifer Saibil has positions in Apple. The Motley Fool has positions in and recommends Amazon, Apple, Block, Microsoft, Nvidia, and Toast. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.