Market Uncertainty Persists: Staying Invested Despite Tariffs

Tariffs and trade wars have been creating ripples in the market recently. Since the presidential election three months ago, the S&P 500 has gained only about 1%. President Trump has threatened tariffs on several countries, leaving investors anxious about future implications.

Despite this uncertainty, it’s crucial for investors not to abandon the market. The potential fallout from tariffs has caused some stock prices to dip, but panicking and selling can lead to significant financial loss in the long run. Here’s why patience is essential.

Where should you invest $1,000 right now? Our analysts have identified the 10 best stocks to consider. Learn More »

Government Policies: Uncontrollable and Short-Term

For long-term investors, it’s essential to look at the broader trends instead of worrying about short-term issues like tariffs and policy changes.

Predicting governmental actions is challenging. Laws take time to pass and can vary dramatically from one administration to the next.

If a company is so vulnerable to tariffs that it threatens their competitiveness and future survival, it may not be the right investment choice.

The renowned investor Warren Buffett remains unconcerned about economic forecasts. He focuses on long-term economic growth and encourages others to do the same.

In his annual letters, Buffett noted, “despite some severe interruptions, our country’s economic progress has been breathtaking.” He advocates for belief in America’s long-term potential, a mindset long-term investors should adopt.

Consider Choosing an ETF for Your Investments

If you’re still unsure about which stocks to hold, consider investing in an exchange-traded fund (ETF).

ETFs simplify investing by giving you exposure to a multitude of stocks—sometimes hundreds or thousands—through a single purchase. This diversifies your risks and allows you to benefit from overall market performance.

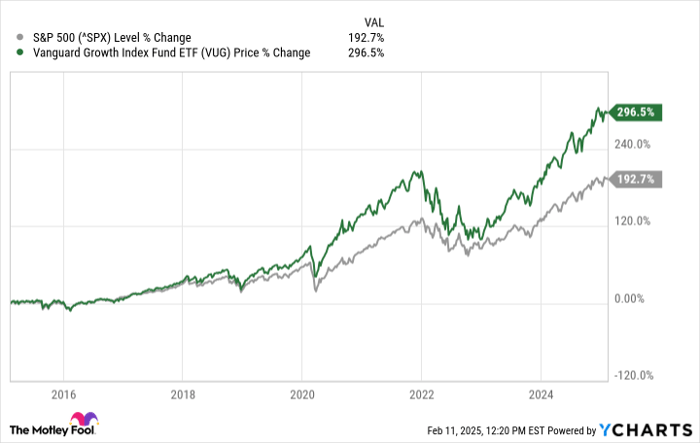

A good option is the Vanguard Growth ETF (NYSEMKT: VUG). With a low expense ratio of 0.04%, its fees won’t significantly dent your returns.

This ETF includes top growth stocks like Tesla, Meta Platforms, and Nvidia. It boasts around 180 stocks, with 59% in the tech sector.

While tech stocks can be volatile, this fund has outperformed the S&P 500, achieving returns nearly 300% over the past five years, compared to about 190% for the broader index.

^SPX data by YCharts.

Stay Calm and Invest

Investing amid economic or political uncertainty can be daunting. However, trying to time the market is often a fruitless endeavor.

If you’re uncertain about individual stocks, opting for an ETF like Vanguard Growth Index is a safer choice. Short-term fluctuations might happen, but historically, such investments tend to appreciate over time.

Discover a Second Chance for Lucrative Investments

Felt like you missed out on today’s top-performing stocks? Now could be your opportunity.

Occasionally, our expert team issues a “Double Down” stock recommendation on companies poised for growth. If you think you’ve missed your chance, consider acting before it’s too late. The data is compelling:

- Nvidia: A $1,000 investment since our “Double Down” in 2009 would be worth $360,040!*

- Apple: A $1,000 investment since our “Double Down” in 2008 would be worth $46,374!*

- Netflix: A $1,000 investment after our “Double Down” in 2004 would be valued at $570,894!*

Currently, we are issuing “Double Down” alerts for three exceptional companies, and opportunities like this may not last long.

Learn more »

*Stock Advisor returns as of February 3, 2025

Randi Zuckerberg, a former director of market development at Facebook and sister to Meta Platforms CEO Mark Zuckerberg, serves on The Motley Fool’s board. David Jagielski holds no position in any mentioned stocks. The Motley Fool has positions in and recommends Meta Platforms, Nvidia, Tesla, and Vanguard Index Funds – Vanguard Growth ETF. A disclosure policy is in place.

The views expressed herein are those of the author, not necessarily reflecting the opinions of Nasdaq, Inc.