Why Taiwan Semiconductor Manufacturing Could Be Your Next Smart Investment

In recent years, semiconductor stocks have surged, especially those related to artificial intelligence (AI). Notably, companies like Nvidia and Broadcom have seen impressive gains in the booming data center GPU market, outpacing the broader S&P 500 and Nasdaq Composite. However, amidst this growth, Taiwan Semiconductor Manufacturing (NYSE: TSM) has quietly established itself as a key player in the industry. Remarkably, TSMC’s stock remains undervalued. Here’s why I believe TSMC will emerge as the leading chip stock over the next decade.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

TSMC’s Bright Future in the Chip Market

Data center GPUs are crucial for powering innovative AI applications. Companies like Nvidia, Broadcom, and Advanced Micro Devices are known leaders in developing training tools for large language models and machine learning. However, what many may not realize is that these firms depend heavily on TSMC for chip manufacturing. TSMC excels in foundry services, producing chipsets for a variety of semiconductor companies across sectors like computing, mobile devices, and cloud infrastructure.

The current landscape paints a promising picture, but it’s TSMC’s future opportunities that are particularly compelling. A report by Precedence Research indicates that the total addressable market (TAM) for AI chips is projected to approach nearly $1 trillion by 2034, a significant increase from today’s estimates.

Moreover, major cloud providers like Amazon, Alphabet, and Microsoft are expected to invest over $200 billion in chips by 2025, suggesting that the market for AI chips is set to grow rapidly in the coming years.

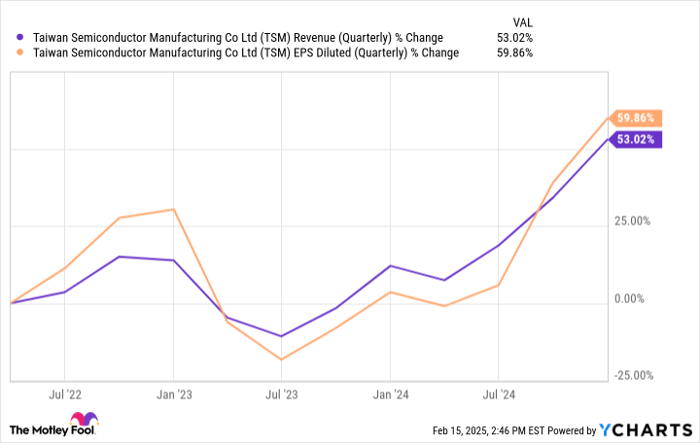

TSM Revenue (Quarterly) data by YCharts.

Importantly, the increasing demand for chips from Nvidia and others is beneficial for Taiwan Semi, which is deeply integrated within the semiconductor ecosystems. Notably, TSMC commands over 60% of the chip manufacturing market, significantly outpacing competitors like Intel and Samsung.

Image source: Getty Images.

Why TSMC May Outperform Nvidia

The chart below reveals the stock price performance of Taiwan Semi compared to Nvidia over recent years. Although TSMC has delivered market-beating returns, it has not matched Nvidia’s remarkable growth.

TSM data by YCharts.

Despite predictions of robust growth in the AI chip market, I believe that increased competition from AMD and custom silicon providers may pose challenges for Nvidia in the coming years. Conversely, Taiwan Semi stands to gain from this very competition.

Therefore, I anticipate TSMC’s revenue and earnings will continue on an upward trajectory. Currently, the stock trades at a forward price-to-earnings (P/E) multiple of 22.6, comparable to the S&P 500’s average forward P/E of 20.9.

With its advantageous position in the foundry market and the expanding chip demand, I remain optimistic that TSMC will achieve returns that surpass the S&P 500 over time.

Is Now the Right Time to Invest $1,000 in TSMC?

Before making an investment in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks to buy currently, and TSMC is not among them. The companies on this list are projected to bring in significant returns in the future.

Reflecting on Nvidia, which made this list on April 15, 2005… a $1,000 investment then would have grown to $853,275!*

Stock Advisor offers investors a straightforward strategy for success, including portfolio guidance, regular analyst updates, and two new stock picks each month. Since its inception in 2002, the Stock Advisor service has more than quadrupled the returns of the S&P 500.*

Learn more »

*Stock Advisor returns as of February 7, 2025

Decisions by key figures: John Mackey, former CEO of Whole Foods Market and an Amazon subsidiary, and Suzanne Frey, an executive at Alphabet, both sit on The Motley Fool’s board of directors. Adam Spatacco holds positions in Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool has interests in and recommends Advanced Micro Devices, Alphabet, Amazon, Intel, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool also recommends Broadcom and has specific positions concerning certain stocks. Please review The Motley Fool’s disclosure policy.

The views expressed here belong to the author and do not necessarily represent those of Nasdaq, Inc.