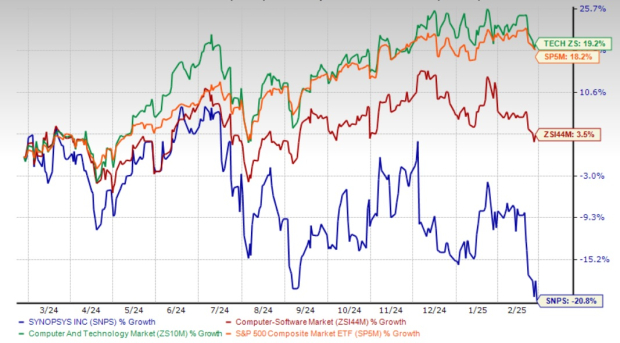

Market Review: Technology Weakness Weighs on U.S. Indices

The S&P 500 Index ($SPX) (SPY) closed down -0.47% on Tuesday, while the Dow Jones Industrials Index ($DOWI) (DIA) increased by +0.37%. The Nasdaq 100 Index ($IUXX) (QQQ) fell by -1.24%. Additionally, March E-mini S&P futures (ESH25) dropped -0.42%, and March E-mini Nasdaq futures (NQH25) fell -1.20%.

Tech Sector Drives Market Declines

On Tuesday, tech stocks underperformed again, dragging down the rest of the stock market. The Nasdaq 100 index saw a decline of -1.24%, compounding losses of -2.06% last Friday and -1.11% on Monday. A concerning drop in U.S. consumer confidence, coupled with tariff risks, contributed to a risk-off atmosphere in the markets.

Chip Stocks Affected by Potential Sales Restrictions

Some semiconductor stocks faced downward pressure following reports that the Trump administration may impose new restrictions on chip sales to China. However, the overall U.S. stock market found some support amidst a sharp -11 basis point drop in the 10-year T-note yield.

Consumer Confidence Takes a Hit

The February Conference Board U.S. consumer confidence index fell sharply by -7.0 points to an eight-month low of 98.3, far below expectations of a decrease to 102.5. This was the largest drop in 2.5 years and marked the third straight month of decline.

Cryptocurrency Market Sees Significant Losses

The cryptocurrency market also suffered, with Bitcoin (^BTCUSD) falling more than -6% and Ether (^ETHUSD) down over -5%, following a -6% drop on Monday. Factors contributing to this decline included a massive $1.5 billion Ether hack of the Bybit crypto exchange and a memecoin scandal involving Argentina’s President Milei.

Trade Tensions with China Intensify

Reports from Bloomberg suggest that the Trump administration is tightening chip controls on China while encouraging European and Asian nations to impose similar restrictions on chip sales. The administration is also contemplating sanctions on specific Chinese companies to hinder its domestic chip industry development, especially in AI and military sectors.

Tariffs and Trade Policy Updates

During a press conference with French President Macron, President Trump confirmed that U.S. tariffs on imports from Mexico and Canada will proceed “on time, on schedule.” The tariffs, initially delayed until March 4, could have significant implications as Trump also aims to enforce “reciprocal tariffs” set to be ready by April 1.

Mixed Signals in U.S. Housing Market

U.S. home prices showed significant gains in December. The S&P Corelogic U.S. home price index rose +0.52% month-over-month and +4.48% year-over-year, exceeding expectations. Meanwhile, the FHFA U.S. house price index increased by +0.4% month-over-month and +1.4% year-over-year, consistent with previous readings.

Upcoming Economic Indicators

Investors are keenly awaiting Nvidia’s earnings report due after Wednesday’s market close. The remainder of this week’s economic calendar is quite busy. On Thursday, the U.S. Q4 GDP report is anticipated to indicate a +2.3% quarterly increase, and personal consumption is expected to rise by +4.1%. Additionally, the January PCE price index report, the Federal Reserve’s preferred inflation measure, is projected to ease slightly to +2.5% year-over-year.

International Market Trends

Overseas markets also closed lower, with the Euro Stoxx 50 falling -0.11%. China’s Shanghai Composite Index decreased by -0.80%, while Japan’s Nikkei Stock 225 experienced a -1.39% drop.

Interest Rates Overview

March 10-year T-notes (ZNH25) rose +22 ticks as the 10-year T-note yield fell by -10.8 basis points to 4.293%. Weak U.S. consumer confidence data and increased safe-haven demand linked to tech and cryptocurrency declines pressured T-note prices. The market is currently pricing in a 3% chance of a -25 basis point rate cut at the next FOMC meeting scheduled for March 18-19.

Stock Movers in Focus

All of the “Magnificent Seven” tech stocks closed lower, with Tesla (TSLA) seeing the steepest decline of over -8% after revealing a -45% year-on-year drop in European sales. Some chip stocks traded down amid news of potential chip restrictions, with Nvidia (NVDA) down more than -3% ahead of earnings, while Marvell Technology (MRVL) and Intel (INTC) fell by over -5%.

Cryptocurrency-related stocks also fell sharply with the broader crypto market. MicroStrategy (MSTR) dropped over -11%, while Coinbase (COIN) and Riot Platforms (RIOT) each fell more than -6%.

In the restaurant sector, shares rebounded after the National Restaurant Association’s appeal to President Trump to exempt food and drink from tariffs. Darden Restaurants (DRI), Texas Roadhouse (TXRH), and Wingstop (WING) each rose over +1%, while the Cheesecake Factory (CAKE) fell -1.2%. Home Depot (HD) gained more than +2% following positive management expectations for fiscal growth.

Zoom Communications (ZM) fell over -8% after receiving negative guidance from its management. Krispy Kreme (DNUT) plunged -22% due to underwhelming revenue projections.

Earnings Reports Coming Soon

Upcoming earnings reports include Verisk Analytics Inc (VRSK), NRG Energy Inc (NRG), Lowe’s Cos Inc (LOW), and NVIDIA Corp (NVDA), among others.

On the date of publication, Rich Asplund did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.