Masimo Corporation Reports Strong Q4 2024 Earnings, Surpassing Expectations

Masimo Corporation (MASI) announced an impressive adjusted earnings per share (EPS) of $1.80 for the fourth quarter of 2024, reflecting a 44% increase compared to the previous year. This figure exceeded the Zacks Consensus Estimate by 20.8%.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

The adjustments accounted for acquired intangible asset amortization, alongside costs related to acquisitions and divestitures. The GAAP loss per share stood at $6.52 for the quarter, largely due to an impairment charge related to goodwill and intangibles for Sound United, which contrasts with an EPS of 63 cents reported in the same period last year.

For the full year 2024, adjusted EPS reached $4.40, marking a 16.1% rise from 2023. This also surpassed the Zacks Consensus Estimate by 7.3%.

Fourth Quarter Revenue Insights

Masimo reported fourth-quarter revenues of $600.7 million, which is a 9.4% increase year over year. This figure slightly outperformed the Zacks Consensus Estimate by 0.8%.

The revenue boost stemmed from strong performances in both Healthcare and Non-healthcare sectors. According to management, 65,000 units of non-invasive technology boards and instruments (excluding handheld and fingertip pulse oximeters) were shipped during the quarter.

Total revenues for 2024 reached $2.09 billion, reflecting a 2.3% growth from 2023. This figure aligns with the Zacks Consensus Estimate.

In after-hours trading, shares of Masimo rose nearly 6.2% following the earnings announcement.

Segment Revenue Performance

Masimo’s revenue sources are divided into two segments: Healthcare and Non-healthcare.

Healthcare revenues for Q4 reached $368.5 million, which is an 8.4% increase from the previous year. When adjusted for currency exchange rates (CER), revenues hit $369.4 million, an 8.7% rise year over year. This contrasts with previously projected revenues of $372.5 million (reported) and $371.5 million (CER).

Within the Healthcare segment, consumable and service revenues experienced notable growth, although this was somewhat balanced by a decline in capital equipment sales. Notable performances were seen across key product lines, including pulse oximetry and CO-Oximetry.

Non-healthcare revenues reached $232.2 million in Q4, indicating an 11.1% year-over-year increase. At CER, revenues were $231.5 million, a 10.7% growth compared to the same quarter last year. This surpassed previous estimates of $223.4 million and $221.4 million, respectively.

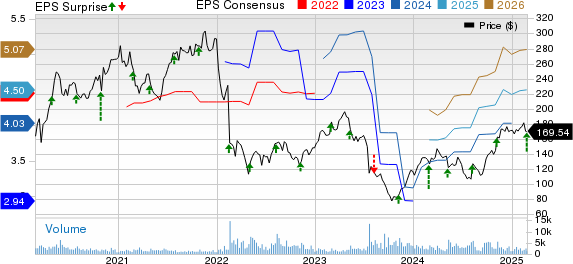

Masimo Corporation Price, Consensus and EPS Surprise

Masimo Corporation price-consensus-eps-surprise-chart | Masimo Corporation Quote

Margin Overview

In Q4, Masimo’s gross profit decreased by 6.9% year over year to $244.7 million. Consequently, the gross margin also fell by 712 basis points, landing at 40.7%.

Selling, general, and administrative expenses climbed 38.6% year over year, totaling $221.5 million. Research and development costs surged by 104.5% to $77.7 million. Overall, adjusted operating expenses rose 51.3% year over year to reach $299.2 million.

The adjusted operating loss for the reported quarter was $54.5 million, starkly contrasting with the previous year’s adjusted operating profit of $64.9 million.

Masimo’s Financial Health

As of the end of 2024, Masimo reported cash and cash equivalents of $177.6 million, a rise from $163 million at the end of 2023. Long-term debt decreased to $727.9 million, down from $871.7 million.

Cumulative net cash generated from operating activities reached $196.4 million, significantly up from $94.1 million a year prior.

Future Guidance

Masimo has updated its guidance for 2025.

For 2025, the company projects Healthcare revenues to fall between $1,500 million and $1,530 million, predicting an 8-10% increase year over year on a reported basis and a respective 8-11% increase at CER. Management also anticipates shipping between 240,000 and 260,000 technology boards and instruments in 2025.

Adjusted EPS for 2025 is now expected to be in the range of $5.10 to $5.40, reflecting a growth of 22-29% from 2024’s figures. Previous projections had pegged this estimate between $4.90 to $5.10. The current Zacks Consensus Estimate stands at $4.50.

Analysis and Outlook

Masimo’s fourth quarter results for 2024 showcased performance that exceeded expectations, highlighted by improvements in consolidated revenues across both Healthcare and Non-healthcare segments. Growth in consumables and services adds a positive touch to their performance.

Moreover, MASI has been benefiting from manufacturing high-volume sensors in Malaysia, which bolsters confidence in the company’s future prospects.

However, the ongoing decline in capital equipment revenues is concerning, as are the rising operational costs that contributed to the drop in gross margins during the quarter.

Masimo’s Market Position and Comparisons

Currently, MASI holds a Zacks Rank of #2 (Buy).

Several other well-regarded companies within the medical sector, such as Cardinal Health, Inc. (CAH), ResMed Inc. (RMD), and Boston Scientific Corporation (BSX), have also released quarterly reports recently. For instance, Cardinal Health reported a second-quarter fiscal 2025 adjusted EPS of $1.93, surpassing the Zacks Consensus Estimate by 10.3%. Their revenues reached $55.26 billion, beating expectations by 0.7%.

To see a comprehensive list of today’s Zacks #1 Rank (Strong Buy) stocks, click here.

Cardinal Health possesses a long-term estimated growth rate of…

Strong Earnings Reports Highlight Key Players in Healthcare Sector

ResMed Surpasses Expectations Again

ResMed reported its second quarter for fiscal 2025, posting an adjusted EPS of $2.43. This figure topped the Zacks Consensus Estimate by 5.7%. The company’s revenues reached $1.28 billion, exceeding estimates by 1.6%. ResMed currently holds a Zacks Rank of #2 and boasts a long-term estimated growth rate of 16%. Notably, RMD’s earnings have surpassed estimates each quarter for the past year, with an average surprise of 6.9%.

Boston Scientific Continues to Impress

Boston Scientific announced its fourth-quarter earnings for 2024, revealing an adjusted EPS of $0.70. This beat the Zacks Consensus Estimate by 7.7%. Additionally, the company reported revenues of $4.56 billion, exceeding expectations by 3.5%. With a long-term growth rate estimate of 13.3%, BSX has also shown consistent performance, surpassing earnings estimates each quarter in the past year with an average surprise of 8.3%.

Insight from Zacks’ Research Chief on Future Stock Gains

The Zacks Investment Research team has identified five stocks likely to achieve significant growth, potentially gaining +100% or more in upcoming months. Notably, Director of Research Sheraz Mian has singled out one stock, which he believes has the brightest future.

This standout pick is recognized as an innovative financial firm, already attracting over 50 million customers with its range of cutting-edge solutions. Although not every pick may succeed, this stock shows promise, drawing comparisons to previous high performers like Nano-X Imaging, which surged +129.6% in under ten months.

Free: See Our Top Stock And 4 Runners Up

Get Zacks’ latest stock recommendations. Download the 7 Best Stocks for the Next 30 Days for free.

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

Masimo Corporation (MASI) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.