Understanding Wall Street Analysts’ Recommendations for Nvidia

Investors often seek insights from Wall Street analysts when deciding whether to Buy, Sell, or Hold a Stock. Although media coverage of rating changes can influence a Stock‘s price, it raises the question: how much do these recommendations truly matter?

To explore this, let’s examine the current outlook from the brokerage community for Nvidia (NVDA) and the reliability of these recommendations for making informed investment choices.

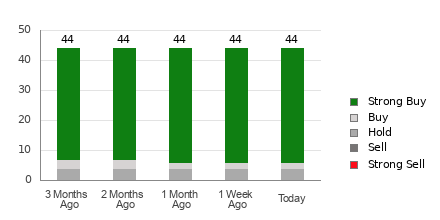

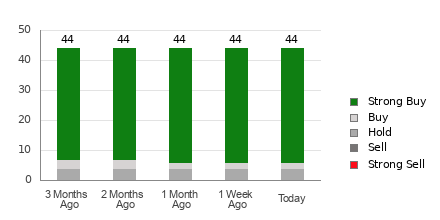

Nvidia’s Current Analyst Rating

Nvidia has an average brokerage recommendation (ABR) of 1.23 on a scale from 1 to 5, with 1 being Strong Buy and 5 being Strong Sell. This ABR is based on insights from 44 brokerage firms. An ABR of 1.23 indicates a consensus leaning towards Strong Buy, with 38 ratings classified as Strong Buy and two as Buy. Collectively, these categories represent 86.4% and 4.6% of all recommendations, respectively.

Trends in Brokerage Recommendations for NVDA

While the ABR indicates a favorable outlook for Nvidia, relying solely on this metric may not lead to optimal investment decisions. Research suggests that brokerage recommendations often fail to effectively guide investors toward stocks with the potential for significant price increases.

The Bias in Brokerage Recommendations

Why is this the case? Brokerage firms typically have vested interests in the stocks they cover, which can lead to an optimistic bias among their analysts. Studies show that for every “Strong Sell” recommendation, firms tend to issue five “Strong Buy” ratings.

This discrepancy highlights a misalignment between the interests of brokerage firms and those of retail investors, which can obscure the genuine direction of a Stock‘s future performance. Therefore, treating these recommendations as supplementary to your personal analysis or a proven predictive tool may be more beneficial.

Leveraging Zacks Rank for Better Analysis

Zacks Rank is a proprietary rating tool that classifies stocks into five categories—from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell)—and boasts an impressively validated track record for predicting near-term stock performance. Using the ABR to validate the Zacks Rank might enhance your investment decision process.

Differences Between ABR and Zacks Rank

Even though both Zacks Rank and ABR are measured on a scale from 1 to 5, they serve different functions. The ABR reflects brokerage recommendations and may include decimals (e.g., 1.28), whereas the Zacks Rank operates on a whole number system.

Brokerage analyst ratings tend to be overly optimistic, guided more by their employer’s interests than independent research, potentially misleading investors. In contrast, Zacks Rank focuses on earnings estimate revisions, which demonstrate a strong correlation with near-term stock price shifts.

It is vital to note that Zacks Rank assesses stocks uniformly, ensuring proportional representation across all stocks covered by brokerage analysts’ earnings estimates. This balanced approach differentiates it from the ABR, which may lag in terms of timeliness.

Current Outlook for Nvidia

Regarding earnings estimates for Nvidia, the Zacks Consensus Estimate for the current year has risen by 0.2% over the past month to $2.94. This increase reflects growing analyst optimism regarding the company’s earnings outlook, supported by a consensus on higher EPS estimates, which may drive the Stock price upward in the near future.

The combination of the increased consensus estimate and other related factors has assigned Nvidia a Zacks Rank #2 (Buy). For further insights, you can view the complete listings of today’s Zacks Rank #1 (Strong Buy) stocks here.

Thus, Nvidia’s Buy-equivalent ABR can guide investors, but it should be complemented by more reliable measures like the Zacks Rank.

Zacks’ Top Stock Recommendations

Our experts have identified five stocks with substantial potential for growth of 100% or more in the coming months. Among these, the Director of Research, Sheraz Mian, has flagged one stock positioned to achieve the highest gains. This stock represents a leading financial firm with over 50 million customers and a suite of innovative solutions, indicating strong growth potential. While not every selection will succeed, this particular stock may outperform previous Zacks picks, such as Nano-X Imaging, which rose by 129.6% in just nine months.

For additional insights, discover our top stock and four promising runners-up here.

For the latest stock recommendations from Zacks Investment Research, download our report on the 7 Best Stocks for the Next 30 Days for free.

NVIDIA Corporation (NVDA): Access your free Stock analysis report here.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.