Warren Buffett’s Caution: A Closer Look at Current Market Valuations

When Berkshire Hathaway‘s (NYSE: BRK.A)(NYSE: BRK.B) eminent CEO speaks, Wall Street listens closely. Warren Buffett’s track record in his 60 years at the helm has seen his company outperform the S&P 500 (SNPINDEX: ^GSPC) significantly. His leadership has led to a staggering cumulative gain in Berkshire’s Class A shares (BRK.A) of 6,076,172% as of February 24.

Investors often seek insights from Buffett through various methods. Quarterly filings known as Form 13Fs reveal the stocks Buffett and his top advisors, Todd Combs and Ted Weschler, are buying and selling. Additionally, Berkshire’s quarterly operating results indicate whether the team is acting as net buyers or sellers in the market.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to consider. Learn More »

Berkshire Hathaway CEO Warren Buffett. Image source: The Motley Fool.

The annual shareholder letter from the Oracle of Omaha provides profound insights. These letters outline Berkshire Hathaway’s performance and delve into the qualities Buffett seeks in investments.

Buffett’s Candid Market Outlook

Warren Buffett is primarily known for his optimistic outlook on investing. He often advises against betting against the U.S. economy, advocating that owning an S&P 500 index fund is one of the best approaches to gain exposure to leading American businesses.

Berkshire’s CEO embraces this perspective because he understands the cyclical nature of the economy and stock market. Economic downturns and market corrections are part of the cycle, and instead of trying to predict their timing, Buffett opts for a long-term investment strategy.

Historically, recessions and bear markets tend to be brief while economic expansions and bull markets extend over more prolonged periods. Thus, remaining optimistic about the long-term prospects is statistically more sensible.

Despite this optimism, Buffett is a discerning investor who seeks perceived value when acquiring stakes in public companies. In the “Where Your Money Is” section of his shareholder letter, he expressed his concern by stating, “Often, nothing looks compelling.” These four straightforward words reveal Buffett’s difficulty in finding value in a market that is historically high-priced.

A Shift in Investor Sentiment

Buffett’s sentiments are echoed by his actions. Over the past nine quarters, from October 1, 2022, to December 31, 2024, he has sold $173 billion in stocks. This includes a staggering $134 billion in sales during 2024, resulting in Berkshire’s cash holdings exceeding $334 billion, bolstered by U.S. Treasuries.

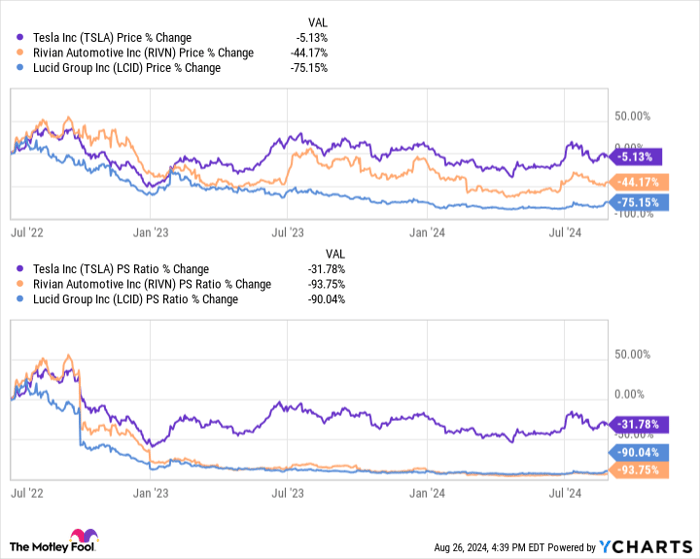

The current stock market exhibits some of the highest valuations in its history. The “Buffett Indicator,” which compares the market capitalization of U.S. companies to the nation’s GDP, reached a record high of 207.46% on February 18. Historically, the average reading for this indicator has been about 85% since 1970, indicating that the market is significantly overvalued.

S&P 500 Shiller CAPE Ratio data by YCharts.

Furthermore, the Shiller price-to-earnings (P/E) Ratio of the S&P 500, a metric based on ten years of average inflation-adjusted earnings, also indicates high valuations. As of February 24, the Shiller P/E Ratio stood at 37.73, marking its third-highest level in the history of continuous bull markets, with readings above 30 historically linked to substantial market pullbacks.

In addition to high market valuations, some of Berkshire Hathaway’s primary holdings have also underperformed in terms of perceived value. For instance, Apple (NASDAQ: AAPL) was initially added to Berkshire’s portfolio in 2016 when its P/E multiple was in the low teens. As of February 24, it trades at over 39 times its trailing twelve-month earnings, prompting Buffett to divest approximately 615.6 million shares over the past year.

Image source: Getty Images.

Patience Leads to Rewarding Outcomes

Given the high valuations of major stock indexes and Buffett’s ongoing status as a net seller, it seems unlikely that significant investments will be made from Berkshire Hathaway’s substantial cash reserves in the near future. Nonetheless, Buffett’s latest letter also conveyed assurances for long-term investors, emphasizing the foundational principles instilled by him and his late partner, Charlie Munger. He reassured shareholders by stating:

“Berkshire shareholders can rest assured that we will forever deploy a substantial majority of their money in equities—mostly American equities although …

Warren Buffett’s Investment Strategy: A Cautious Approach to Value

Warren Buffett is on the lookout for attractive investment opportunities and is eager to put his company’s capital to work, but he remains disciplined in his approach. As a value investor, he won’t pursue multinational firms unless their valuations align with his criteria.

Historically, Buffett, also known as the Oracle of Omaha, has embraced patience. His strategy of waiting for valuations to return to sensible levels has paid off significantly. Over the past sixty years, Berkshire Hathaway’s Class A Stock has seen a remarkable cumulative gain exceeding 6,000,000%. However, during periods when “nothing seems compelling,” it is reasonable for investors to expect that sales will surpass new purchases.

Is Investing $1,000 in Berkshire Hathaway a Smart Move Now?

Before making an investment in Berkshire Hathaway, it is essential to consider recent analyses:

The team at Motley Fool Stock Advisor has identified what they believe are the 10 best stocks to buy currently, and Berkshire Hathaway did not make the list. The selected stocks are viewed as having potential for substantial returns in the forthcoming years.

For example, back on April 15, 2005, when Nvidia was highlighted, an investment of $1,000 at that time would now be valued at around $776,055!*

In addition, the Stock Advisor service offers investors a straightforward roadmap for success. This includes portfolio-building guidance, regular analyst updates, and two new Stock recommendations each month. Since 2002, the Stock Advisor has delivered returns more than four times greater than the S&P 500.

Learn more »

*Stock Advisor returns as of February 24, 2025

Sean Williams has no investment in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Berkshire Hathaway. Please see their disclosure policy for more details.

The opinions expressed in this article are those of the author and do not necessarily reflect the views of Nasdaq, Inc.