General Motors Boosts Dividends and Buybacks Amid Tariff Threats

U.S. auto giant General Motors (GM) has provided investors with a strong signal of confidence. The company announced a 25% hike in its dividend and initiated a $6 billion share buyback program. Following this announcement, GM’s stock surged 3.75% as the automaker reinforced its commitment to returning value to shareholders.

Yet, potential investors may wonder if now is the right time to buy stock in General Motors. The backdrop of looming tariff risks remains significant. U.S. President Trump plans to impose a 25% tariff on imports from Mexico and Canada, which could impact GM significantly as the automaker has the highest exposure to Mexico among U.S. firms. This situation could lead to increased costs, potentially resulting in higher vehicle prices and reduced demand. In this context, is GM ready to face these challenges, and should investors consider buying now or wait? Let’s explore further.

Key Details on GM’s Dividend and Buyback Plans

General Motors will raise its dividend to 15 cents per share, up from the previous 12 cents. This increase will take effect with the next planned announcement in April 2025, aligning GM’s payout with that of its closest competitor, Ford (F). Moreover, through the $6 billion share repurchase initiative, GM plans to execute a $2 billion accelerated share repurchase (ASR) expected to conclude by the second quarter of 2025, leaving $4.3 billion for additional buybacks.

Support for these shareholder-oriented actions stems from GM’s impressive financial performance. In the last fiscal year, GM generated $14 billion in adjusted automotive free cash flow and returned nearly $7.6 billion to shareholders through dividends and buybacks. Notably, GM accomplished its goal of reducing outstanding shares to below 1 billion, ending 2024 with 995 million shares. With a total automotive liquidity of $35.5 billion, including $21.7 billion in cash, GM’s balance sheet remains strong.

GM’s Strategies to Mitigate Tariff Impact

As the largest U.S. automaker importing vehicles from Mexico, with around 750,000 vehicles shipped from Mexico and Canada to the U.S. in 2024, GM is particularly vulnerable to the new tariffs. Many of GM’s popular models, such as the Chevy Silverado, GMC Sierra, and various mid-sized SUVs, are manufactured in Mexico. The tariffs, scheduled to begin on April 2, could pose a significant challenge.

In response, GM’s CFO, Paul Jacobson, stated the company has been preparing for this scenario since November and has developed a comprehensive game plan. A significant measure taken by GM has been the reduction of its international inventory by over 30%, which minimizes the risk of holding vehicles whose costs may suddenly increase. Jacobson emphasized, “The last thing you want is a bunch of finished inventory that just suddenly became 25% more expensive.” Additionally, the company is collaborating with logistics partners to ensure efficient supply chain management.

Unlike Ford CEO Jim Farley, who cautioned that tariffs would introduce “a lot of cost and a lot of chaos” to the industry, GM appears more proactive. Jacobson indicated that GM has numerous cost-saving strategies to adapt to the new trade environment.

With some time left before the tariffs take effect, GM has room to refine its strategies. While challenges could arise due to the policy changes, GM’s long-term outlook remains strong compared to its competitors.

Additional Factors Supporting GM

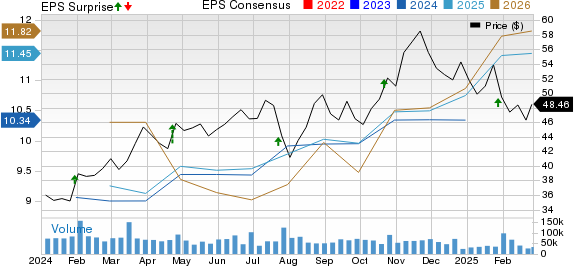

General Motors maintained its status as the top-selling automaker in the U.S. for 2024, achieving a market share increase of 30 basis points to 16.5%. The company also successfully met its $2 billion target for net fixed-cost reductions, which has bolstered its profitability. Due to strong demand and effective cost management, GM has raised its 2025 earnings outlook to a range of $11 to $12 per share, up from $10.60 in 2024.

General Motors Company Price, Consensus, and EPS Surprise

General Motors Company price-consensus-eps-surprise-chart | General Motors Company Quote

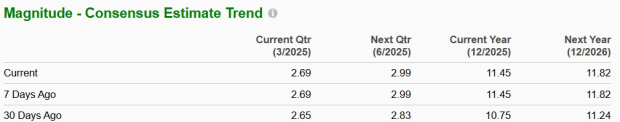

Following promising results in 2024 and an optimistic earnings per share (EPS) forecast for 2025, analysts have increased their earnings estimates over the past month.

Image Source: Zacks Investment Research

Moreover, GM’s electric vehicle (EV) sales are gaining traction, with 114,000 units sold in 2024, marking a 50% increase from 2023. In the fourth quarter of 2024, GM’s EV lineup became profitable at the variable level, aided by increased production efficiency, reduced material costs, and the introduction of new models like the Escalade IQ and Sierra EV. The company expects a $2 billion reduction in EV losses this year.

Furthermore, GM’s restructuring efforts in China are showing positive outcomes. Excluding a $5 billion restructuring charge, the company reported positive equity income for the fourth quarter of 2024 and witnessed a 40% surge in deliveries, the largest increase since mid-2022. GM aims to restore profitability in its Chinese operations this year.

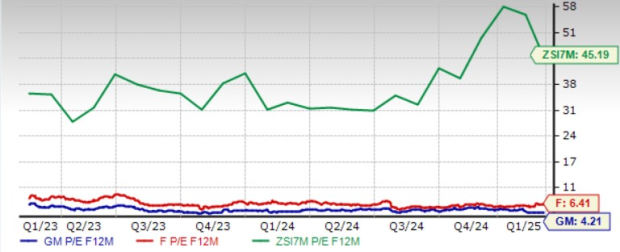

Valuation Highlights for GM

Currently, GM stock presents an attractive valuation. With a forward price-to-earnings ratio of 4.21, it trades significantly below industry averages, including competing automaker Ford.

GM’s P/E Ratio Appealing

Image Source: Zacks Investment Research

Conclusion: GM as a Strong Investment Choice

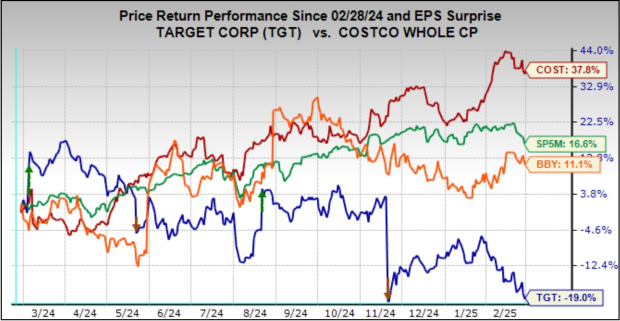

In summary, despite tariff-induced uncertainties, General Motors appears well-equipped to tackle the issues ahead. The company boasts a solid domestic presence, focuses on cost efficiency, and continues to implement shareholder-friendly initiatives. GM’s EV market share is on the rise, and the current stock price remains below its potential value. Analysts maintain a positive outlook, projecting an average price target of $58.09, indicating around 20% upside from current trading levels.

The stock holds a Zacks Rank of #2 (Buy) and bears a VGM Score of A. For those interested in additional investment opportunities, you can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Five Stocks Poised for Potential Doubling

These stocks were carefully selected by Zacks experts as top picks to potentially gain +100% or more within 2024. While not every recommendation may succeed, prior selections have yielded remarkable returns of +143.0%, +175.9%, +498.3%, and +673.0%.

Many of the stocks mentioned in this report are currently under the radar of Wall Street, presenting a great opportunity to invest early.

To discover these five potential home runs, click here.

Stay informed with the latest recommendations from Zacks Investment Research. Download our report on the 7 Best Stocks for the Next 30 Days for free here.

Ford Motor Company (F): Free Stock Analysis report

General Motors Company (GM): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.