NVIDIA Reports Strong Earnings Amid AI Competition and Challenges

I recall the moment vividly.

My son was an engineering student at Stanford when one of their research groups introduced an autonomous race car named Shelley.

As a car enthusiast, I was instantly intrigued.

Modified from an Audi TTS, this remarkable vehicle boasted exceptional handling. The students had even enhanced it with ceramic brakes, known for their slower fade and easier programming.

However, it wasn’t the car design that captivated me.

It was the technology behind it.

This self-driving initiative utilized semiconductor chips from NVIDIA Corporation (NVDA).

Perhaps you’re familiar with the company.

I make that remark lightheartedly; NVIDIA has become a household name.

My initial encounter with NVIDIA could have occurred to anyone. It was merely a fortuitous moment. However, after more than 40 years in this field, I understand that staying alert to opportunities is critical for successful investing. You never know when a chance will emerge.

Similarly, NVIDIA didn’t attain its status due solely to autonomous vehicles.

Rather, the firm capitalized on another happy coincidence that revolutionized computing.

In 2012, a PhD student named Alex Krizhevsky employed NVIDIA’s graphics processing units (GPUs) to train an innovative deep neural network known as AlexNet.

This method required no conventional programming; it was capable of independently recognizing images. When it triumphed in the ImageNet challenge, the performance comparison showed GPUs significantly outperformed CPUs (central processing units) in AI tasks.

That was the pivotal moment.

Suddenly, NVIDIA’s chips turned into essential tools for artificial intelligence.

The AI Revolution had begun.

Fast forward to today; NVIDIA remains central to this ongoing revolution. Yet, following such a remarkable surge, investors faced a critical question before the latest earnings report, released yesterday: Can the company maintain its momentum?

This time, the stakes were notably higher…

- The emergence of DeepSeek, a Chinese AI company, has raised fears of increased competition for high-powered chips. (I discussed the situation and why DeepSeek isn’t a significant threat in this article.)

- Investors are becoming wary of Big Tech’s expenditures on AI.

- Production delays for NVIDIA’s Blackwell chip kept some investors on high alert.

- As major tech firms begin developing in-house AI chips, Wall Street is closely monitoring the situation.

In today’s Market 360, let’s analyze NVIDIA’s recent results. We will explore their implications for the AI Revolution and, more importantly, how to capitalize on the forthcoming phase of AI investing, even if you missed the initial wave.

Performance Overview

NVIDIA posted record earnings in its fourth quarter and for fiscal year 2025.

Fourth-quarter revenue surged 78% year-over-year to $39.3 billion, exceeding Wall Street estimates of $38.16 billion. Data center revenue for the quarter reached $35.6 billion, representing a remarkable 93% increase compared to the same quarter last year. Additionally, fourth-quarter earnings jumped 71% year-over-year to $0.89 per share, surpassing projections of $0.85.

For fiscal year 2025, NVIDIA reported total revenue of $130.5 billion, indicating an impressive 114% increase year-over-year. The company’s earnings amounted to $2.99 per share, showing a 130% annual growth. Both figures exceeded analysts’ expectations of $129.28 billion in revenue and $2.95 per share in earnings.

Notably, NVIDIA announced that the Blackwell chip contributed $11 billion in the fourth quarter, accounting for 28% of total revenue. Company leadership noted this was “the fastest product ramp in our company’s history.”

Looking ahead to the first quarter of fiscal year 2026, NVIDIA projects revenue around $43 billion, reflecting approximately 65% year-over-year growth.

Key Insights

Once again, NVIDIA’s data center division stood out as the primary growth driver, largely fueled by the Blackwell chip, which made up 50% of data center revenue. This indicates a persistent demand for advanced AI-powered computing solutions, despite recent worries surrounding DeepSeek or Big Tech’s spending on AI.

As I have mentioned before, such concerns appear largely exaggerated. Moreover, DeepSeek has faced significant reliability and data security issues. Furthermore, news frequently arises regarding Big Tech’s plans to invest billions into new data centers for AI.

During the earnings call, management discussed advancements in AI methodologies, including DeepSeek’s R1 model, which reportedly employs reasoning instead of inferencing. CEO Jensen Huang dismissed this as negligible, asserting that next-generation AI algorithms may require millions of times more computational capacity than current offerings.

Just because the chip is designed doesn’t mean it gets deployed. And you’ve seen this over and over again. Many chips get developed, but when the time comes, businesses have difficult decisions to make…

NVIDIA Reports Strong Earnings Amid Market Volatility

Our technology is not only more advanced and higher performing, but it also boasts significantly improved software capabilities. Importantly, our deployment speed is lightning-fast.

NVIDIA’s automotive sales for the quarter reached $570 million, reflecting the growing demand for chips in self-driving cars and robots. This figure, while a small portion of the overall market, marks a striking 103% increase compared to the previous year.

Market Response to Earnings Report

The immediate market reaction to NVIDIA’s earnings report was mixed. Shares initially climbed by approximately 3.5% on Wednesday, ahead of the announcement. However, on Thursday, the stock experienced a setback, plummeting more than 5% during trading.

What fueled this decline? A slight dip in NVIDIA’s margins was a primary concern. The company’s margins fell to 73% from 76% year-over-year and are projected to decrease further to 71% in the current quarter. Considering that the Blackwell chips are more complex and costly to manufacture, this margin contraction is understandable. Nevertheless, Wall Street’s focus on these numbers led to a selloff despite NVIDIA’s continued market dominance.

It’s noteworthy that the company addressed several market concerns during the earnings call, including issues related to DeepSeek, AI spending, delays with Blackwell chips, and rising competition. Yet, the market fixated on the minor margin decline and guidance.

Investors should not be overly concerned by this initial reaction. Historically, NVIDIA’s immediate post-earnings performance does not necessarily dictate long-term trends.

Preparing for the Future of AI

The long-term outlook for NVIDIA remains positive. The company stands at the forefront of what many believe is the most significant technological revolution of this generation: the AI Revolution.

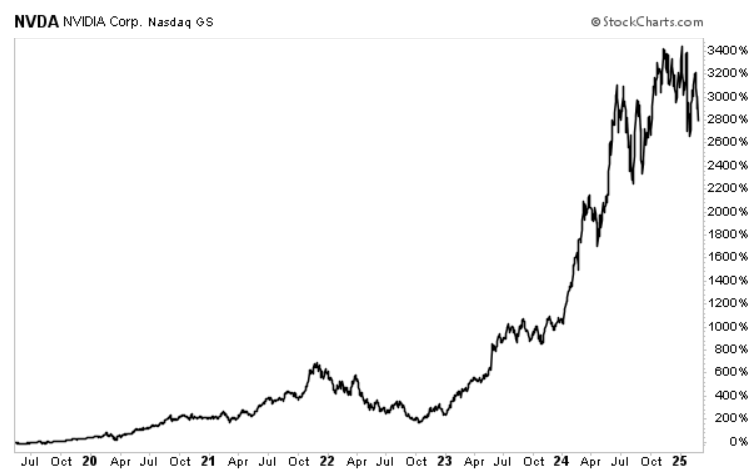

NVIDIA has established itself as a leader in this space. With nearly a 3,000% increase since being recommended in the Growth Investor service in 2019, NVIDIA is considered a monopolistic force in its field. As I continue to endorse this stock, I have no plans to sell.

Looking ahead, it is crucial to consider the next wave of innovation. NVIDIA is already taking steps to prepare for what follows this technological shift. I recently filmed a presentation outlining the upcoming revolution poised to reshape the industry.

If you feel you may have missed out on investing in NVIDIA, this upcoming shift is highly important. The most significant gains in technology tend to come from smaller, innovative firms, which may soon emerge as the next significant players in the AI realm.

To learn more about this potential, click here.

As advancements continue, early investors will find their rewards in the future market landscape.

Best regards,

Louis Navellier

Disclosure: By the date of this email, I own shares of:

NVIDIA Corporation (NVDA)

P.S. Don’t forget…

At 8 PM ET tonight, TradeSmith CEO Keith Kaplan will hold a crucial market briefing titled: The Last Melt-Up.

This session is particularly timely given the recent pullback of the S&P 500, political challenges facing Trump’s agenda, persistent inflation concerns, and the Fed’s uncertain stance.

Is a significant market correction imminent? Should investors consider liquidating their holdings?

Join Keith tonight at 8 PM ET to find the answers here.