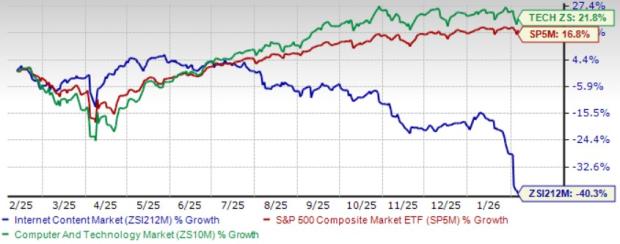

Market Declines Amidst Tariff Concerns and Mixed Economic Signals

The S&P 500 Index ($SPX) (SPY) closed down -1.59% on Thursday, while the Dow Jones Industrials Index ($DOWI) (DIA) declined by -0.45%. The Nasdaq 100 Index ($IUXX) (QQQ) saw a notable drop of -2.75%. In futures trading, March E-mini S&P futures (ESH25) decreased by -1.56%, and March E-mini Nasdaq futures (NQH25) fell by -2.70%.

Market Overview

Stock indexes experienced a sell-off on Thursday, with the S&P 500, Dow Jones, and Nasdaq 100 reaching six-week lows. Despite Nvidia’s better-than-expected Q4 earnings report, the stock plummeted over -8%, dragging down other chip stocks amid worries regarding gross profit margins and impending US tariffs. The wider market also faced pressure following President Trump’s announcement that 25% tariffs on Canada and Mexico are set to take effect on March 4, alongside an additional 10% tariff on China. Furthermore, inflationary pressures persisted as the Q4 core PCE price index adjustments indicated higher figures. Additionally, US weekly jobless claims increased more than anticipated to a 2-1/2 month peak, and January pending home sales recorded their largest decline in nine months.

Economic Indicators and Fed Comments

Stocks extended their losses on Thursday afternoon following hawkish comments from the Federal Reserve. Cleveland Fed President Hammack remarked that US interest rates are not “meaningfully restrictive” and should remain steady while waiting for inflation to return to a 2% target. Similarly, Philadelphia Fed President Harker noted that the current policy rate continues to exert downward pressure on inflation without adversely affecting economic performance.

Earlier in the day, stocks showed early resilience due to positive US economic data. Q4 GDP estimates remained steady at +2.3% (q/q annualized). Additionally, January’s non-defense capital goods orders ex-aircraft and parts, which serve as a proxy for capital expenditures, rose by +0.8% month-over-month, exceeding the expected +0.3% increase.

Labor Market and Real Estate Trends

Initial unemployment claims climbed by +22,000 to a 2-1/2 month high of 242,000, indicating a weaker labor market than the predicted 221,000. Moreover, January pending home sales declined by -4.6% m/m, significantly worse than expectations of -0.9% and representing the steepest fall in nine months. Kansas City Fed President Schmid pointed out the need for the Fed to weigh inflation risks against potential growth concerns, highlighting heightened uncertainty in economic recovery.

This week’s economic calendar remains busy, with the January PCE price index report, the Fed’s preferred inflation measure, expected to moderate slightly to +2.5% year-over-year (from December’s +2.6%), and the core index projected to ease to +2.6% from +2.8%. If these estimates hold true, they remain substantially above the Fed’s +2% inflation target.

Global Market Reactions

Globally, stock markets posted varied results on Thursday, with the Euro Stoxx 50 declining by -1.00%. In contrast, China’s Shanghai Composite Index increased to an eight-week high, closing up +0.23%. Japan’s Nikkei 225 ended slightly higher, up +0.30%.

Interest Rates and Bonds

Interest rates faced downward pressure as March 10-year T-notes (ZNH25) closed down -7.5 ticks, resulting in a yield increase of +2.3 basis points to 4.279%. U.S. T-notes struggled amid President Trump’s tariff announcement, which could elevate inflation and deter potential rate cuts. Furthermore, the upward revision to the Q4 core PCE price index signaled persistent inflation, impacting T-notes negatively. Hawkish remarks from both Cleveland and Philadelphia Fed Presidents further supported the case for maintaining current monetary policy.

Losses in T-notes were somewhat mitigated by gains in German bunds, which reached a two-week high. Even as US jobless claims rose to a significant high and home sales dropped, these factors presented a dovish outlook for Fed policy. European bond yields exhibited mixed results; the yield on the 10-year German bund fell to a two-week low at 2.410%, while the 10-year UK gilt yield increased by +0.9 basis points to 4.512%. Eurozone economic confidence for February improved by +1.0 to a five-month high of 96.3, outperforming forecasts of 95.9.

US Stock Movers

Teleflex (TFX) led the S&P 500 losers, closing down more than -21% after lowering its 2025 adjusted EPS guidance well below analyst expectations. Chip stocks faltered, with Nvidia (NVDA) leading the decline, closing down more than -8% despite its earnings report. Other semiconductor companies like Marvell Technology (MRVL), Applied Materials (AMAT), and Broadcom (AVGO) also dropped by more than -7%, while ON Semiconductor (ON), Lam Research (LRCX), and Micron Technology (MU) fell over -6%, along with NXP Semiconductors NV (NXPI), Advanced Micro Devices (AMD), and GlobalFoundries (GFS) which faced declines of more than -5%.

Additionally, Viatris Inc (VTRS) slid more than -15% after reporting a larger-than-expected Q1 loss. Axon Enterprise (AXON) decreased by over -8% following a price target cut by Argus Research. eBay (EBAY) also fell more than -8% after presenting Q1 revenue guidance below consensus. Pure Storage (PSTG) decreased over -14%, while Moderna (MRNA) closed down over -7% amid reevaluated contracts for flu vaccine shots. However, Salesforce (CRM) fell by more than -4% after reporting Q4 revenues that missed estimates, along with a forecast for 2026 revenue below consensus.

Teladoc Health (TDOC) was another significant loser, closing down more than -12% after its 2025 revenue forecast fell short of expectations.

Strong Earnings Reports Boost Key Stocks in S&P 500 and Nasdaq 100

Invitation Homes (INVH) saw its shares rise by over +5% after announcing Q4 revenue of $659.1 million, surpassing the consensus estimate of $651.1 million. This performance led the stock to be a top gainer in the S&P 500.

In the Nasdaq 100, Warner Bros Discovery (WBD) shares closed up more than +4%, propelled by its Q4 total subscriber count reaching 116.90 million, which exceeded the consensus forecast of 115.75 million.

Healthcare Sector Gains Momentum

Universal Health Services (UHS) experienced a more than +3% increase in share price, contributing to a rally in healthcare stocks after reporting Q4 adjusted EPS of $4.92. This figure was significantly above the expected $4.15. Additionally, firms including Molina Healthcare (MOH), Centene (CNC), and Humana (HUM) closed up more than +2%. UnitedHealth Group (UNH) and Elevance Health (ELV) also saw gains of over +1%.

Nutanix Raises Revenue Forecast Amid Strong Q2 Performance

Nutanix (NTNX) shares skyrocketed by over +11% after reporting Q2 revenue of $654.7 million, exceeding the consensus estimate of $641.7 million. Following this strong performance, the company raised its full-year revenue outlook to a range of $2.50 billion to $2.52 billion, surpassing the previous estimate of $2.44 billion to $2.47 billion, and strengthening expectations beyond the consensus of $2.46 billion.

Snowflake and Allstate Record Positive Earnings

Snowflake (SNOW) recorded a more than +5% rise after its Q4 revenue reached $986.8 million, beating the consensus figure of $958 million. The company also projected 2026 product revenue of $4.28 billion, above the consensus of $4.23 billion.

Allstate (ALL) shares closed up more than +3% following the announcement of an increase in its quarterly dividend to $1.00 per share from the previous 92 cents, also surpassing expectations of 95 cents. The company furthermore authorized a $1.5 billion stock buyback program.

Additional Stock Movements

Papa John’s International (PZZA) saw a gain of more than +1% after posting a Q4 adjusted EPS of 63 cents, which was stronger than the consensus of 50 cents. In another noteworthy development, Walgreens Boots Alliance (WBA) closed up more than +1% amidst news that a potential buyout deal from Sycamore Partners could result in the separation of Walgreens’s US and UK pharmacy businesses along with its specialty pharmacy unit.

Earnings Reports (2/28/2025)

Upcoming earnings reports include Apellis Pharmaceuticals Inc (APLS) and New Fortress Energy Inc (NFE).

On the date of publication, Rich Asplund did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy

here.

More news from Barchart

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.