Exploring Nvidia’s Dominance and AMD’s Aspirations in AI GPUs

Nvidia (NASDAQ: NVDA) has developed a remarkable business model over the past two decades. The introduction of its CUDA developer platform in 2006 marked a significant milestone. This platform included a programming interface, compiler, driver, runtime environment, and toolkit that empowered developers to improve application performance by leveraging Nvidia’s GPUs. This edge gave Nvidia’s chips a strong position over competitors.

By the late 2010s, CUDA had already become the preferred standard for GPU acceleration in deep learning. Most tools designed for deep learning were optimized for CUDA, making transitions to other GPUs challenging for users and effectively binding them to Nvidia’s offerings.

It’s this strategic positioning that has propelled Nvidia to a $3 trillion valuation. However, as history illustrates, competition in the GPU market can intensify, and another company could emerge as a more dominant player in the future.

Advanced Micro Devices: A Rising Contender

Advanced Micro Devices (NASDAQ: AMD), commonly known as AMD, currently appears to be lagging in the race for artificial intelligence (AI) GPU supremacy. Industry estimates suggest that Nvidia commands at least 80% of the AI GPU market, with some indicating figures as high as 90%. In the arena of AI components like GPUs, Nvidia is unequivocally the leader.

To understand market dynamics better, we can look back at previous chip cycles. In 2006, Intel held a significant lead in graphics chips with approximately 40% market share. AMD trailed with just over 25%, while Nvidia captured nearly 20%.

The following year, Intel maintained its lead with around 39% market share, but Nvidia had surpassed AMD, claiming nearly 30% compared to AMD’s drop below 20%.

Consider another instance from 2021 where Intel dominated the data center chip market with a 64% share; Nvidia secured 27% while AMD had only 9%. By 2023, Intel’s share plummeted to 26%, while Nvidia surged to 66%, and AMD slightly declined to 8%.

While these historical shifts may not perfectly translate to today’s AI GPU landscape, they highlight how chip market leadership can fluctuate considerably in relatively short timescales.

As for which companies could potentially rival Nvidia, the future remains unpredictable. AMD is heavily investing to enhance its AI offerings over the long haul. Recently, the company launched its MI325X AI accelerator chip to compete with Nvidia’s H200 GPUs. Moreover, AMD has announced its next-generation MI350 chips, expected to rival Nvidia’s future Blackwell chips by mid-2025.

AMD’s CEO, Lisa Su, expressed aspirations for her company to become the “end-to-end” leader in AI over the next decade, declaring, “This is the beginning, not the end, of the AI race.” The question remains: can AMD catch up to Nvidia?

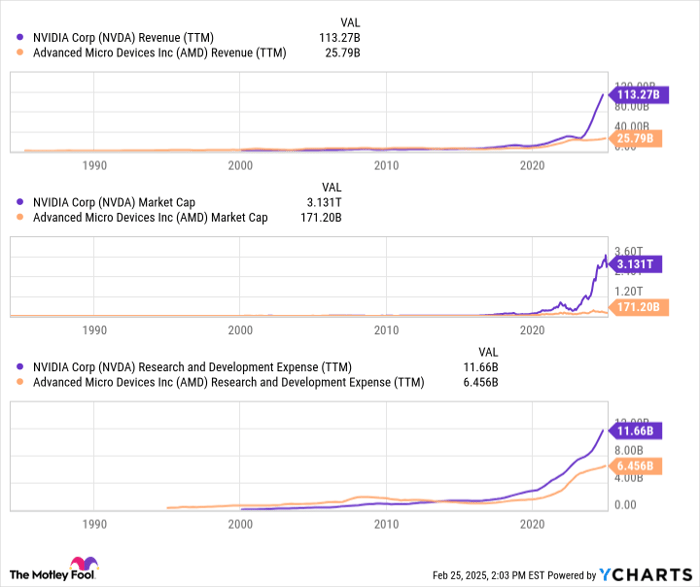

NVDA Revenue (TTM) data by YCharts

Will AMD Overtake Nvidia in AI GPUs by 2030?

Nvidia’s stronghold on the AI GPU sector is not merely due to superior chips. Currently, Nvidia’s chips are generally better than those of its competitors. However, as combined research and development expenditures of rival chipmakers grow, it is plausible that Nvidia’s lead could diminish and eventually be challenged.

A critical factor contributing to Nvidia’s success is its status as an “end-to-end” provider, overseeing both hardware and software components. This integration fosters strong loyalty among developers and businesses.

Nonetheless, AMD is making strides with its latest chip generations. Major firms like Microsoft and Meta Platforms have recently adopted AMD’s MI300 AI GPUs. AMD estimates that the addressable market for AI chips could reach $400 billion by 2027. With both AMD and Nvidia currently generating just over $30 billion in AI data center chip sales, substantial growth opportunities remain for AMD, even if Nvidia continues to lead.

While AMD faces challenges in surpassing Nvidia within the next five years, it remains a compelling option for investors looking at AI GPU trends.

Is Investing in Advanced Micro Devices Wise Right Now?

Before considering an investment in Advanced Micro Devices, it’s crucial to evaluate this:

The Motley Fool Stock Advisor analyst team has recently identified their top picks—10 best stocks for investors at this moment, with Advanced Micro Devices not among them. The selected stocks are poised to generate substantial returns in the years ahead.

Reflect on when Nvidia was featured on this list in April 2005… a $1,000 investment then would be worth $804,553!*

Stock Advisor provides an effective framework for investors, offering guidance on portfolio building, continuous updates from analysts, and two new Stock picks each month. The Stock Advisor service has historically generated returns over four times that of the S&P 500 since 2002*.

Learn more »

*Stock Advisor returns as of February 24, 2025

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, serves on The Motley Fool’s board of directors. Ryan Vanzo does not hold any positions in the mentioned stocks. The Motley Fool has investments in and recommends Advanced Micro Devices, Intel, Meta Platforms, Microsoft, and Nvidia. The Motley Fool also advocates for specific options strategies involving these companies. For further details, please consult the Motley Fool’s disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.