Synopsys Shares Fall 20.8%, Investors Weigh Recovery Options

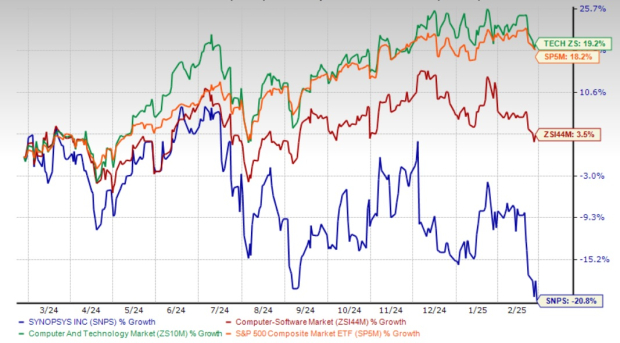

Synopsys (SNPS) shares have dropped significantly, declining by 20.8% over the past year. This underperformance contrasts sharply with the gains of the Zacks Computer – Software industry, Zacks Computer and Technology sector, and the S&P 500 index, which grew by 3.5%, 19.2%, and 18.2%, respectively. Currently trading near its 52-week low of $454.05, investors are questioning whether it’s time to buy the dip or wait for further clarity.

1-Year Price Return Performance

Image Source: Zacks Investment Research

Mixed Earnings Results Contribute to Stock Stagnation

Synopsys’ stock has stalled following the release of its first quarter of fiscal 2025 results, which showcased a mixed performance. The company reported year-over-year declines in earnings and revenues of 10.4% and 3.7%, respectively, although both metrics exceeded the Zacks Consensus Estimate.

The company’s primary segments, Electronic Design Automation (EDA) and Design IP, which account for 97.2% of total revenues, didn’t perform optimally. EDA revenues saw a slight increase of 0.8% year-over-year, reaching $978.7 million, while Design IP revenues plummeted by 17.2% to $435.1 million.

For fiscal 2025, Synopsys maintained its previous guidance, expecting revenues between $6.745 billion and $6.805 billion, with non-GAAP earnings projected in the range of $14.88 to $14.96 per share. However, these factors did not inspire confidence among investors, resulting in no recovery in the stock price following the earnings report.

Over the last four quarters, Synopsys managed to beat the Zacks Consensus Estimate three times while missing once, achieving an average surprise of 3.7%.

Find the latest EPS estimates and surprises on Zacks earnings Calendar.

Synopsys, Inc. Price, Consensus, and EPS Surprise

Synopsys, Inc. price-consensus-eps-surprise-chart | Synopsys, Inc. Quote

Key Risks Affecting Synopsys’ Performance

Several factors contribute to Synopsys’ challenges. The company’s IP and hardware revenues tend to fluctuate due to the reliance on customer product adoption schedules. Additionally, revenue recognition is complicated by capacity constraints in deploying hardware at data centers, leading to inconsistent financial performance.

A sluggish recovery in crucial markets such as mobile, PC, and automotive has hindered growth. These markets are experiencing slower-than-expected recovery as consumer demand remains low amid economic uncertainties. Particularly, the mobile and PC segments are struggling due to weak economic growth, persistent inflation, and elevated interest rates, all impacting consumer spending.

US-China Tensions Weigh on Synopsys’ Growth Prospects

Synopsys generates over 15% of its revenues from China, making the region vital for the company. While it presents opportunities, the ongoing regulatory challenges and trade tensions between the U.S. and China pose risks. Recent escalations in these tensions, including increased export controls and listings by the U.S. Department of Commerce, further complicate the landscape for Synopsys.

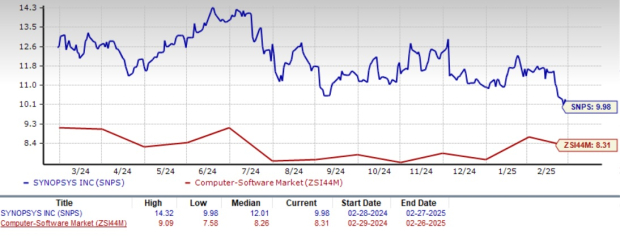

Premium Valuation of Synopsys Raises Investor Concerns

Despite the recent share price drop, Synopsys currently trades at a forward 12-month price-to-sales (P/S) ratio of 9.98x, significantly above the industry average of 8.31x. While this premium reflects the company’s leadership and growth potential, it raises concerns about limited near-term upside, particularly in a volatile market.

Forward 12-Month P/S Valuation

Image Source: Zacks Investment Research

Nevertheless, there are positive developments for Synopsys amidst these challenges.

Strategic Partnerships Support Synopsys’ Growth

Synopsys benefits from robust strategic partnerships and its technological edge. Collaborations with leaders like Taiwan Semiconductor Manufacturing (TSM), NVIDIA (NVDA), Intel, and Arm Holdings (ARM) enable the company to remain at the forefront of chip design innovation.

These partnerships extend beyond technology sharing and involve co-development of solutions vital for advancing AI, high-performance computing (HPC), and next-generation semiconductor designs. For example, Synopsys and TSM’s joint efforts in Multi-Die test chip tape-outs are helping streamline processes and reduce time-to-market for complex semiconductor designs. Additionally, NVIDIA leverages Synopsys software for GPU design, while Synopsys and Arm have collaborated to create integrated solutions for next-generation chiplets, SoCs, and systems across various sectors.

Strengthening AI Capabilities to Drive Future Growth

The company continues to enhance its portfolio with AI-powered design automation tools, positioning itself well in rapidly changing industries. Throughout 2024, Synopsys achieved significant milestones in AI technology. To strengthen its automotive segment, SNPS partnered with SiMa.ai to create solutions that aid automotive firms in developing silicon and software for AI-enhanced features in future vehicles.

In 2024, Synopsys secured certification for its AI-driven digital and analog design flows on Samsung Foundry’s SF2 process, further advancing its initiatives with TSM in EDA and semiconductor technology.

Synopsys Expands AI Offerings Amidst Short-Term Stock Challenges

Synopsys, a leader in electronic design automation, announced a series of innovative solutions to enhance its advanced process and 3DFabric technologies alongside tools designed specifically for the demands of artificial intelligence (AI). Key product launches include its inaugural complete PCIe 7.0 IP solution, the Polaris Software Integrity Platform, and upgrades to its Synopsys ZeBu EP2 and HAPS-100 12 systems.

New Hardware for AI Verification

At the start of 2025, Synopsys revealed an expansion to its hardware-assisted verification (HAV) portfolio, introducing both the HAPS-200 prototyping and ZeBu-200 emulation systems. These advancements are aimed at efficiently managing extensive AI computational data sets, positioning Synopsys strongly in a rapidly growing market.

Financial Outlook for Synopsys

The company’s expansion into the AI sector opens new avenues for growth, with the Zacks Consensus Estimate indicating a promising trajectory for Synopsys. For fiscal years 2025 and 2026, revenue projections suggest an 8% increase and a subsequent 12.4% increase, respectively. Earnings per share (EPS) estimates point to growth rates of 12.7% and 15.9% during the same periods.

Investment Positioning: Hold Synopsys Stock

Despite a 20.8% decline in Synopsys’ stock price over the past year, which reflects valuation pressures and macroeconomic uncertainties, the company’s robust fundamentals and innovation leadership indicate potential for long-term success. Current investors are advised to maintain a hold position, allowing for participation in future growth while navigating any short-term market volatility. For prospective investors, waiting for a favorable market pullback may present an advantageous entry point into this industry leader.

Synopsys currently holds a Zacks Rank #3 (Hold). To review a detailed list of Zacks #1 Rank (Strong Buy) stocks, click here.

Discover Potential Top Picks for 30 Days Ahead

Experts have identified seven elite stocks recommended from the current selection of 220 Zacks Rank #1 Strong Buys, which they predict are “Most Likely for Early Price Pops.”

Since 1988, this curated list has outperformed the market by more than double, averaging a gain of +24.3% per year. Pay immediate attention to these top seven stocks.

Interested in the latest recommendations from Zacks Investment Research? Download the report featuring the 7 Best Stocks for the Next 30 Days today. Click here to access this free report.

NVIDIA Corporation (NVDA): Free Stock Analysis report

ARM Holdings PLC Sponsored ADR (ARM): Free Stock Analysis report

Synopsys, Inc. (SNPS): Free Stock Analysis report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.