Synchronoss Technologies Trading at a Significant Discount

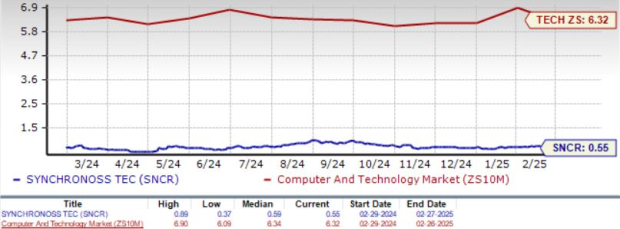

Synchronoss Technologies SNCR stock currently trades at a considerable discount, indicated by its Value Score of A. The forward 12-month Price/Sales ratio for SNCR sits at 0.55X, lower than its median of 0.59X and the Zacks Computer & Technology sector’s 6.32X.

When comparing SNCR to its competitors, it is worth noting that Microsoft MSFT and Dropbox DBX—both of which also provide personal cloud services—are trading at P/S ratios of 9.73X and 3.15X, respectively.

Year-to-Date Performance of SNCR Shares

Although SNCR shares have declined 4.7% year to date, this underperformance is relatively mild compared to the broader sector’s decline of 0.9% and the Internet Software industry’s rise of 8.2%, both influenced by challenging macroeconomic conditions. In comparison, shares of Microsoft and Dropbox have fallen 6.9% and 13.5%, respectively.

Bearish Trends in SNCR Stock

Currently, Synchronoss shares are trading below both the 50-day and 200-day moving averages, indicating a bearish trend in the stock’s performance.

Assessing Investor Action for SNCR Stock

It is essential to analyze the future potential for SNCR stock. The company’s robust portfolio coupled with a diverse partner base is expected to bolster its market prospects. In the third quarter of 2024, SNCR registered a 5.1% year-over-year growth in cloud subscribers, which contributed to an 8% increase in total revenues. Notably, 75% of Synchronoss’ revenues are contracted for a minimum of four years, promoting strong top-line visibility.

In January 2025, SNCR launched its next-generation Synchronoss Personal Cloud platform at CES 2025. This platform incorporates enhanced AI-powered photo editing tools, improved interface, and advanced backup functionalities. It is available globally through carriers such as AT&T T, Verizon, and SoftBank and currently supports over 11 million subscribers. The platform emphasizes data privacy and security while delivering a seamless, ad-free user experience.

Additionally, Synchronoss has formed significant partnerships, including a three-year contract extension with AT&T for its Personal Cloud service, which allows secure backup, management, and sharing of content across various devices. Furthermore, SNCR secured a similar contract extension with SFR, a subsidiary of Altice France, which serves over 27 million customers with its high-speed mobile and fixed networks.

Updated 2024 Guidance and Earnings Estimates

Synchronoss has raised its 2024 revenue guidance to between $172 million and $175 million, an increase from its earlier projections of $170 million to $175 million. Recurring revenues are predicted to make up 90% to 92% of total revenues, up from the 85% to 90% range previously expected. The adjusted gross margin forecast has also improved to between 77% and 78%, compared to the earlier estimate of 73% to 77%.

The Zacks Consensus Estimate for 2024 earnings remains unchanged at $0.73 per share over the last month, while the consensus for revenues is pegged at $173.03 million, indicating a 19.32% decline from 2023. Estimates for 2025 show earnings expected to be $1.46 per share, with revenues expected to reach $180.87 million, reflecting a projected growth of 4.53% over 2024.

Historically, SNCR has seen earnings surpass the Zacks Consensus Estimate in two of the last four quarters. However, the average negative surprise has been 25.76%.

Price and Consensus Overview

Synchronoss Technologies, Inc. price-consensus-chart | Synchronoss Technologies, Inc. Quote

Find the latest EPS estimates and surprises on Zacks earnings Calendar.

Investment Outlook: Buy, Sell, or Hold?

Despite a decline in professional services revenues in SNCR’s third-quarter 2024 results, recurring revenues increased. The contract extension with AT&T and SoftBank’s growing user base are positive indicators. However, growth concerns persist due to declining performance from Verizon and a heavy reliance on partners such as AT&T for growth.

The adverse foreign exchange environment, coupled with stiffening competition within the storage and backup services sector, presents additional challenges for Synchronoss. Continued efforts to reduce debt may limit investments in product development, further restricting growth potential in the near term.

Currently, Synchronoss holds a Zacks Rank #3 (Hold), suggesting that investors may benefit from waiting for a more opportune time to accumulate SNCR stock. For a complete list of today’s Zacks #1 Rank (Strong Buy) stocks, click here.

7 Stocks Poised for Growth in the Next Month

Recently released: Industry experts have identified 7 elite stocks from the current Zacks Rank #1 Strong Buys that they believe have the highest potential for early price pops.

This exclusive list has surpassed the market more than twice since 1988, achieving an average gain of +24.3% per year. It is highly advisable to give these selected stocks your immediate attention.

Want the latest recommendations from Zacks Investment Research? Download the report on the 7 Best Stocks for the Next 30 Days here.

AT&T Inc. (T): Free Stock Analysis report

Microsoft Corporation (MSFT): Free Stock Analysis report

Synchronoss Technologies, Inc. (SNCR): Free Stock Analysis report

Dropbox, Inc. (DBX): Free Stock Analysis report

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.