Ubiquiti Inc. Survives Short-Seller Attack by Andrew Left

This company must be a fraud.

Such a strong assertion aired on national television is a significant claim. This was the declaration made by Andrew Left, CEO of Citron Research, a well-known short seller, when he targeted a technology firm on CNBC in September 2017.

Accusations of fraud are not made lightly since they carry substantial implications. When serious allegations surface on television, they tend to influence public perception and investor sentiment. Consequentially, this is precisely what Ubiquiti Inc. (UI) faced when Left turned his focus towards the company.

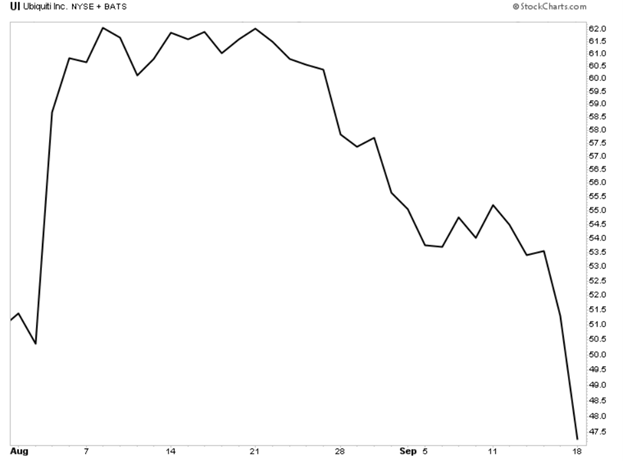

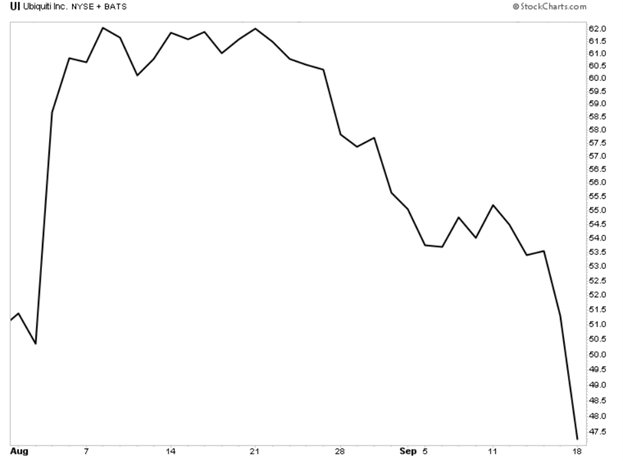

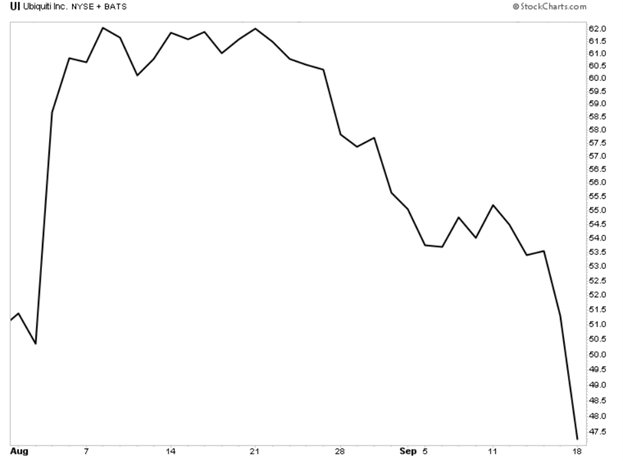

Ubiquiti is a high-growth firm renowned for designing and selling wireless communication and enterprise networking solutions for businesses and service providers globally. Left labeled the company a fraud, citing several “red flags,” including overstatements regarding its user base, potential accounting issues, and a revolving door of executive leadership. Following Left’s remarks, shares of Ubiquiti declined by 8% and continued to drop as rumors spread.

This outcome aligns with Left’s intentions. Short selling is a strategy where investors borrow shares of a stock and sell them at current market prices, hoping to repurchase them later at a lower price to profit from a decline in the stock’s value. Essentially, short sellers thrive when a stock’s price falls.

Companies like Citron, Hindenburg, and Muddy Waters frequently take short positions in other businesses, issuing research reports filled with critical assessments. While some of these criticisms may bear merit, others may be exaggerated or unfounded, aimed solely at driving down stock prices.

The reaction from Ubiquiti’s CEO, Robert Para, illustrates the seriousness of the claims:

This leads to an important question: Were Left’s allegations justified?

Despite the onslaught from short sellers, Ubiquiti demonstrated strong earnings following the Citron report. In the first quarter after the allegations, Ubiquiti reported revenues of $245.9 million—up 20.1% year-over-year. The company achieved a gross profit of $111.7 million, making up 45.4% of its revenues, with a net income of $74.9 million and earnings per share of $0.92.

Additionally, Ubiquiti repeatedly surpassed analyst expectations in subsequent quarters, reflecting its resilience in both revenue growth and profitability. The company’s solid fundamentals, such as expanding margins and strong cash flow, ultimately revealed that the allegations made lacked factual support.

In my own investment strategy, I was confident enough to include Ubiquiti in my Growth Investor service in May 2021, resulting in a notable 90% gain by December 2021.

Crucially, Ubiquiti is still a viable company today. In retrospect, the Citron report of 2017 appears as a mere hiccup in the broader narrative of the firm.

The accompanying chart highlights the sharp decline in Ubiquiti’s stock price when the Citron report was published, indicated by the red arrow. However, the stock has since rebounded strongly and recorded impressive gains.

How Historic Stock Declines Affect Investor Confidence

The situation soon unfolded as claims subsided, with the company’s fundamentals ultimately speaking volumes about its true potential.

In the aftermath, Para emerged vindicated.

Nonetheless, it’s crucial to consider the broader implications.

The steep decline initiated by Citron affected many hardworking investors. Many might have abandoned this Stock, missing out on the substantial 500%-plus increase that followed.

This outcome raises concern.

Investors may have had dreams, from preparing for retirement to planning vacations or weddings for their loved ones.

Meanwhile, Left faces civil charges from the Securities and Exchange Commission (SEC) and criminal charges from the Department of Justice (DOJ).

In essence, this scenario has led me to regard short sellers with disdain.

This situation mirrors what transpired with Super Micro Computer, Inc. (SMCI) back in August. If you haven’t been following, let me break it down in today’s Market 360. I will also discuss the latest developments and why I believe it remains a viable investment today. Additionally, I will highlight where you can seek out stocks with strong fundamentals that present good buying opportunities right now.

Analysis of Super Micro’s Situation

Super Micro stands out as a leading provider of high-performance servers, particularly known for its energy-efficient, liquid-cooled hardware aimed at data centers focused on artificial intelligence. This specialization positioned the company as a vital contributor during the AI Boom, leading to significant demand for its products.

On August 26 of last year, Super Micro faced a damaging report from Hindenburg Research, a well-known short-seller. An ex-employee also alleged that the company engaged in accounting violations, filing a whistleblower report that caught the attention of the DOJ.

In light of these allegations, the DOJ initiated an investigation, forcing Super Micro to delay submission of its annual 10-K report to the SEC.

On October 30, Super Micro experienced a dramatic fall of over 30% when its auditor, Ernst & Young, resigned due to concerns about the company’s internal controls. The stock took another 12% hit the following day after CNBC’s Jim Cramer speculated on the possibility of delisting from the NASDAQ, prompting the company to receive a deficiency notice with a deadline of November 16 for compliance.

After appointing a new auditor, Super Micro received an extension to submit its 10-K and 10-Q reports to the SEC following a thorough three-month investigation by an independent Special Committee. This investigation found no evidence of fraud or misconduct involving the management or board of directors.

The new deadline was set for February 25. Anticipating compliance, shares of SMCI surged by approximately 49% leading up to the deadline, which the company successfully met.

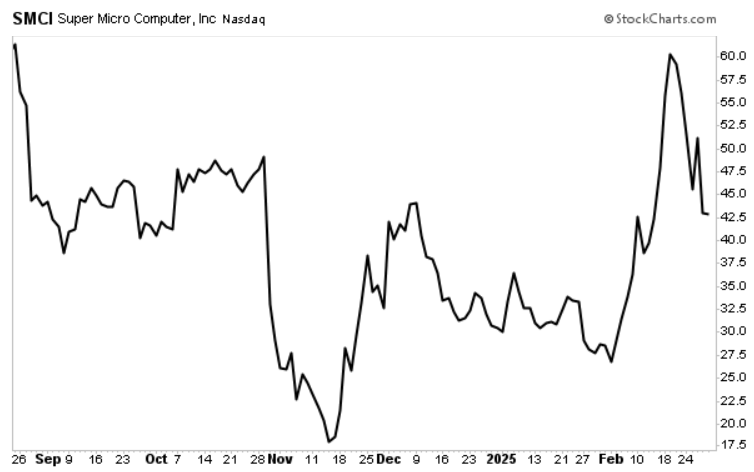

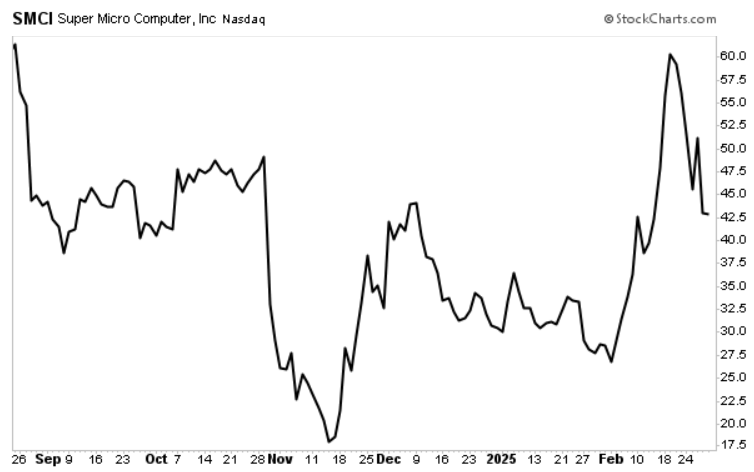

However, the damage inflicted on investor confidence was considerable, as highlighted in the graph below.

This rollercoaster ride highlights the volatility investors often face.

The Importance of Fundamentals

After the initial news broke and SMCI began to decline, the stock received a D-rating in the Stock Grader (subscription required). Typically, this warrants an automatic sell recommendation. However, I advised my Growth Investor subscribers to hold their positions. While some may have deemed this advice unwise, the volatility observed during that period was substantial, leading many to feel hesitant about holding onto the stock.

Super Micro’s Strong Fundamentals Amid Market Challenges

Investors often feel uneasy when their hard-earned money is at risk. However, the volatility of the market can sometimes be exacerbated by manipulative actions from short sellers looking to profit at others’ expense.

Super Micro’s Remarkable Performance

Super Micro has showcased superior fundamentals that are hard to argue against. The latest update indicates that for the second quarter of fiscal 2025, sales will range between $5.6 billion and $5.7 billion, marking a significant 54% year-over-year growth. Analysts had projected sales between $5.0 billion and $6.0 billion.

As we look ahead to the third quarter, Super Micro expects total sales to fall between $5.0 billion and $6.0 billion, slightly below the analyst forecast of $6.09 billion. Additionally, the company has revised its full-year fiscal 2025 revenue estimate, now projecting $23.5 billion to $25 billion, down from an earlier estimate of $26 billion to $30 billion. Even so, this forecast still signals nearly 60% growth on the lower end.

Order Backlog Confidence

Crucially, Super Micro has a substantial order backlog, potentially stretching four to five years. From my experience in accounting, I understand that misrepresenting an order backlog is exceedingly difficult.

The Stakes Against Short Sellers

Ultimately, fundamentals are paramount for any investment. Short sellers often have ulterior motives and seek to disrupt the market landscape. My disdain for these manipulative traders was evident when I expressed my frustrations during a CNBC International interview in February 2024. I rebutted claims that NVIDIA Corporation (NVDA) was engaging in round-tripping, pointing out that their actual fourth-quarter 2024 earnings results validated substantial growth, resulting in a stock rally of approximately 16%.

In a noteworthy turn, Hindenburg Research has officially closed its operations, as founder Nate Anderson announced the shutdown on January 15, 2025.

Future Implications for Super Micro

Despite the positive indicators, Super Micro is not entirely in the clear. After filing its 10-K and 10-Q reports, the stock surged by as much as 23.4%, only to lose momentum amid a broader tech sell-off following NVIDIA’s earnings announcement. Nevertheless, I view this as a temporary setback—similar to historical fluctuations faced by Ubiquiti.

Strategies for Future Investments

Considering these developments, you may be interested in identifying more stocks with superior fundamentals akin to Super Micro. My Growth Investor service offers recommendations with an average sales growth of 26% and a remarkable 556.1% growth in earnings per year. This earnings season, the average surprise has reached 43.3%.

Now is a prime time to join, as I have just published the March Monthly Issue for subscribers of Growth Investor, featuring four new stock recommendations. Each of these stocks has recently received positive analyst revisions, which often precede unexpected earning surprises and subsequent stock price increases.

Click here to join now and gain immediate access to my March Monthly Issue. Subscribers will also have full access to Special Market Podcasts, Weekly Updates, and more!

(If you are already a Growth Investor subscriber, click here to log in to the members-only website.)

Sincerely,

Louis Navellier

Editor, Market 360

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

NVIDIA Corporation (NVDA) and Super Micro Computer, Inc. (SMCI)