Deciding on Berkshire Hathaway A Shares: Buy, Hold, Sell, or Convert?

Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) has become synonymous with investment wisdom, largely due to Warren Buffett’s guidance. For investors eager to join Buffett, there are two share classes to consider. While many will lean toward the B shares, what should owners of A shares do regarding buy, sell, hold, or conversion decisions?

Should You Buy Berkshire Hathaway A Shares?

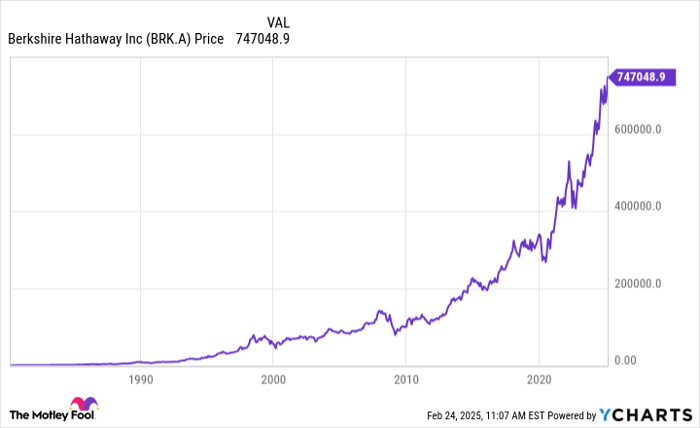

Berkshire Hathaway A shares command a hefty price tag of over $748,000 each. This significant investment often phases out the average investor, as purchasing 10 shares requires nearly $8 million. With an average daily trading volume of around 1,500 shares, it’s clear that very few can afford to own multiple A shares.

However, possessing A shares can offer status. Holding these shares for years might indicate that you recognized Buffett’s investment skills early on, potentially leading to substantial capital gains. Nevertheless, given the high entry cost, only a limited number of investors can realistically consider acquiring A shares.

Is It Time to Hold Berkshire Hathaway A Shares?

If you’re already an A share holder, you have little reason to sell. Buffett and his skilled team have a long history of successful investments. Plus, Berkshire Hathaway’s extensive cash reserves provide a safety net, allowing for strategic investments during market dips.

As long as you are satisfied with the company’s management and long-term outlook, maintaining your investment makes sense.

BRK.A data by YCharts.

Reasons to Sell Berkshire Hathaway A Shares

Sometimes, liquidity needs force investors to sell stocks. Selling just one A share provides a significant cash inflow. However, some investors might feel Berkshire’s valuation is too steep as it trades near its historic highs. Concerns about the company’s cash management could also spur a decision to sell.

As Buffett approaches retirement from day-to-day operations, concerns about future leadership—especially following the recent passing of Charlie Munger—may also influence your choice to sell. Despite the training of incoming leaders, uncertainty exists around how the company will evolve post-Buffett.

Can You Convert Berkshire Hathaway A Shares?

Berkshire Hathaway offers a unique advantage with its A/B share structure. A share shareholders can convert their shares into 1,500 B shares. This conversion maintains the price correlation between the two classes while enhancing liquidity.

When needing cash, converting to B shares first could be a strategic move, allowing you to sell as many B shares as needed while minimizing your exposure. With B shares averaging 3.9 million in daily trading volume, this route often results in easier transactions.

Understanding the Right Time to Buy Berkshire Hathaway

Berkshire Hathaway functions more like a mutual fund than a conventional corporation, reflecting the investment acumen of Buffett and his team. While it’s difficult to suggest a wrong time to invest with a proven manager, current market conditions show that stock prices are near all-time highs, prompting some to reconsider their positions.

The unique pricing structure and conversion process of A shares make decision-making more complex. If you own A shares, you should weigh the option to convert them into B shares before deciding on a sale, as this may offer a better strategy for liquidity while holding onto an investment with growth potential.

Explore New Investment Opportunities

If you ever felt you missed out on prime investments, now is your chance to learn about potential lucrative opportunities. On rare occasions, our analyst team identifies “Double Down” stock recommendations for companies poised for growth.

- Nvidia: $1,000 invested in 2009 would now be worth $323,920!

- Apple: $1,000 invested in 2008 would now be valued at $45,851!

- Netflix: $1,000 invested in 2004 is now worth $528,808!

Currently, we’re issuing “Double Down” alerts for three exceptional companies worth your attention.

Continue »

*Stock Advisor returns as of February 28, 2025

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.