Salesforce Reports Q4 Results and Embraces Agentic AI for Growth

On Wednesday, Salesforce (NYSE: CRM) reported solid results for its fiscal 2025 fourth quarter and provided conservative guidance, with hopes that agentic artificial intelligence (AI) will drive future growth. Agentic AI refers to software bots (the “agents”) that can autonomously complete tasks with minimal human intervention. This emerging technology is expected to represent a significant advancement in the AI evolution.

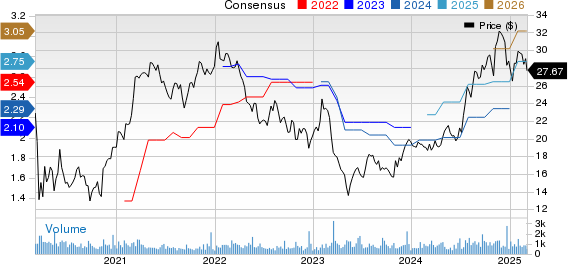

Despite its strong results, Salesforce’s stock has struggled at the start of 2025, currently down about 10% year-to-date and almost flat for the past 12 months.

Where to Invest $1,000 Right Now? Our analyst team has revealed what they believe are the 10 best stocks to buy at this moment. Learn More »

Salesforce’s Recent Performance

What do the latest results from this software-as-a-service (SaaS) company indicate about its stock potential? As of January 31, Salesforce reported a revenue increase of 8% year-over-year, totaling $10 billion, aligning with its guidance range of $9.9 billion to $10.1 billion. Subscription and support revenue also rose by 8%, reaching $9.45 billion.

During this quarter, Mulesoft revenue grew by 7%, while Slack’s revenue climbed by 11%, both reflecting an acceleration in growth compared to fiscal Q3. Tableau revenue increased modestly, by 3%. Adjusted earnings per share (EPS) rose 21% to $2.78, and the company generated $3.8 billion in free cash flow during the quarter.

Agentic AI Initiatives

Salesforce is advancing with agentic AI via its Agentforce platform, launched in October. This solution has gained traction quickly, with reported closures of 5,000 Agentforce deals, which includes 3,000 paid agreements, an increase from 1,000 deals noted in a mid-December update. Agentforce allows customers to utilize various out-of-the-box AI agents tailored for customer service, human resources, and technical support. Users can also employ low-code and no-code tools within the platform to design their own AI agents, with Salesforce stating that if a task can be described, an agent can be built to complete it.

The intention behind Agentforce is to enhance the human labor force while increasing productivity and efficiency. It operates on a consumption-based pricing model at $2 per interaction.

Salesforce has also leveraged its partner network significantly, with half of its Agentforce sales and 70% of activations stemming from its ecosystem. The company highlights its extensive training of 127,000 system-integrated employees and more than 1,000 technology partners who are creating and marketing AI agents. Agentforce can now be integrated with Alphabet‘s Gemini and deployed on Google Cloud, benefiting from collaborations with Amazon that have resulted in several major sales contracts.

Image source: Getty Images.

Looking Ahead: Fiscal 2026 Guidance

Salesforce’s current remaining performance obligations (cRPOs) grew by 10% year-over-year to $30.2 billion, a critical metric for gauging revenue outlook in SaaS companies. For fiscal 2026, Salesforce estimates revenue growth of 7% to 8%, projecting a total between $40.5 billion and $40.9 billion, with adjusted EPS ranging from $11.09 to $11.17. The company anticipates subscription and support revenue to rise by about 8.5%, with first-quarter revenue growth estimated at 6% to 7% year-over-year.

| Metric | Fiscal 2026 Q1 Guidance | Fiscal 2026 Guidance |

|---|---|---|

| Revenue | $9.71 billion to $9.76 billion | $40.5 billion to $40.9 billion |

| Revenue Growth | 6% to 7% | 7% to 8% |

| Adjusted EPS | $2.53 to $2.55 | $11.09 to $11.17 |

Data source: Salesforce.

Potential for Stock Rebound

Salesforce’s forward price-to-sales multiple is under 7, according to analysts’ estimates for fiscal 2026. Additionally, its forward price-to-earnings (P/E) ratio stands below 27, and its price/earnings-to-growth (PEG) ratio is 0.5. Generally, a PEG ratio below 1 indicates an undervalued stock, suggesting an appealing valuation for Salesforce if the Agentforce platform can effectively boost revenue growth.

CRM PS Ratio (Forward) data by YCharts.

This promising valuation may set the stage for strong stock performance throughout the year, especially as Salesforce’s guidance appears conservative. There is a robust opportunity for the company to surpass these projections, capitalizing on the growth potential of its Agentforce product.

Investing in this leading AI SaaS name seems advisable, given its valuation metrics and growth prospects.

Should You Invest $1,000 in Salesforce Now?

Before purchasing Stock in Salesforce, consider:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks to buy right now—and Salesforce is not among them. The chosen stocks are expected to generate significant returns in the forthcoming years.

For instance, consider when Nvidia appeared on this list on April 15, 2005. An investment of $1,000 at that time would now be worth $765,576!*

Stock Advisor offers an accessible guide for investors, including portfolio-building guidance, regular updates from analysts, and two new Stock picks each month. The Stock Advisor service has outperformedthe S&P 500 by over four times since 2002.

*Stock Advisor returns as of February 28, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, also sits on the board. Geoffrey Seiler has positions in Alphabet and Salesforce. The Motley Fool maintains positions in and recommends Alphabet, Amazon, and Salesforce. Further disclosure policies apply.

The views expressed herein represent those of the author and do not necessarily reflect those of Nasdaq, Inc.