Top Dividend Stocks to Secure Your Financial Future Today

Flying cars and vacations in space may capture our imagination, but investing fundamentals remain unchanged. Just as blockbuster films once dominated the box office, the option to reward shareholders with dividends remains a critical component of investment strategy. For those keen on securing consistent passive income, acquiring shares in established dividend stocks like Coca-Cola (NYSE: KO), ExxonMobil (NYSE: XOM), and York Water (NASDAQ: YORW) is a prudent approach.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to buy at this moment. Learn More »

Invest in Coca-Cola: A Timeless Choice

The Coca-Cola Company has built an impressive legacy since it served its first glass nearly 140 years ago. While consumer preferences have diversified away from sugary beverages, the company’s proactive approach to expanding its product lineup signals adaptability. This readiness to evolve suggests that Coca-Cola will continue to respond effectively to market demands in the future.

As a recognized Dividend King, Coca-Cola boasts a remarkable history of increasing its dividend for over six decades. This, coupled with a notable stake in Berkshire Hathaway, positions Coca-Cola Stock as a sound consideration for investors with a long-term perspective, especially with its current forward dividend yield of 2.9%.

ExxonMobil: Powering Your Investment Strategy

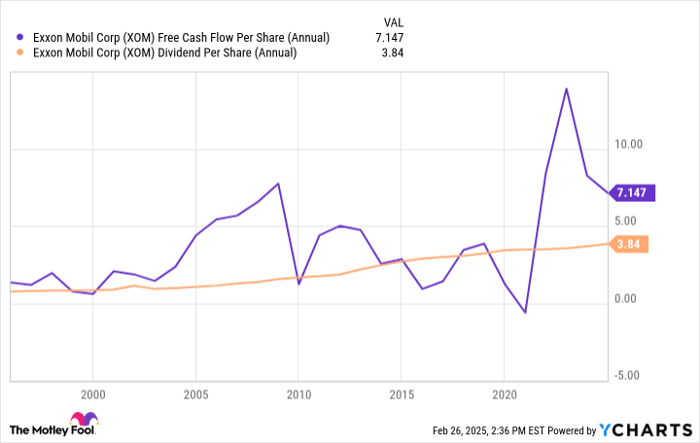

While trends like solar energy and electric vehicles grow, fossil fuels remain integral to the global energy landscape. As such, investors seeking passive income through dividends should look at ExxonMobil Stock, which offers a solid forward yield of 3.6%.

ExxonMobil has a consistent track record of 42 consecutive years of dividend increases, underscoring its commitment to shareholder returns. The company’s extensive operations across the energy value chain yield significant free cash flow, allowing it to sustain dividend payments even during market volatility.

XOM Free Cash Flow Per Share (Annual) data by YCharts.

ExxonMobil is projected to have $165 billion in excess cash after dividend payments from 2025 to 2030, enabling the company to explore growth opportunities that will likely ensure its capacity to maintain dividend distributions in the future.

York Water: Reliable Earnings Within Reach

Investors often find high-yield dividend stocks appealing, but those that maintain consistent business models—like York Water—draw attention for their ability to offer stable dividends regardless of economic conditions. Operating since 1816, York Water has reliably provided water services to Pennsylvania residents while also distributing dividends to investors.

For risk-averse investors, utility stocks such as York Water, with their 2.6% forward-yielding dividend, provide a predictable income stream. Although regulated markets limit rate adjustments, interventions by the Pennsylvania Public Utility Commission help ensure a steady rate of return, allowing the company to effectively plan for expenses and dividends.

YORW EPS Diluted (Annual) data by YCharts.

York Water has adopted a cautious approach to dividend distributions since 2010, as its diluted earnings per share have increased faster than its dividend. A conservative payout ratio averaging 58.3% from 2015 to 2023 further enhances its attractiveness for dividend-focused investors.

Choosing the Right Dividend Stock for You

For those seeking a well-established dividend opportunity, Coca-Cola stands out as a solid investment. Conversely, ExxonMobil provides a strong option for energy sector enthusiasts. For maximum security and stability, York Water is a prime candidate.

No matter which of these investments you consider, Coca-Cola, ExxonMobil, and York Water remain promising options for long-term shareholders.

Don’t Miss Out on a Second Chance at Potential Gains

Have you ever worried you missed investment opportunities with top-performing stocks? Here’s another update.

Occasionally, our team of experts issues a “Double Down” Stock recommendation for companies they believe are poised for growth. If you feel you’ve missed your window, now is the optimal time to act.

- Nvidia: A $1,000 investment when we doubled down in 2009 would now be worth $323,920!*

- Apple: A $1,000 investment back in 2008 would have grown to $45,851!*

- Netflix: A $1,000 investment from 2004 would have increased to $528,808!*

We’re currently issuing “Double Down” alerts for three remarkable companies, and this may be the last opportunity of its kind.

Continue »

*Stock Advisor returns as of February 28, 2025

Scott Levine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.