Analysts See Upside Potential in First Trust Nasdaq Cybersecurity ETF

At ETF Channel, we analyzed the holdings of various ETFs to find the weighted average implied analyst target prices based on their underlying stocks. For the First Trust Nasdaq Cybersecurity ETF (Symbol: CIBR), the calculated implied analyst target price stands at $75.64 per unit.

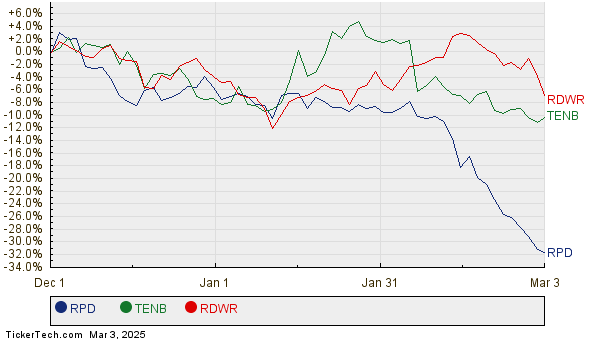

Currently, CIBR is trading at approximately $66.11 per unit, suggesting a potential upside of 14.42% based on analysts’ average targets for its underlying holdings. Three notable stocks within CIBR’s portfolio, each showing significant upside relative to their analyst targets, include Rapid7 Inc (Symbol: RPD), Tenable Holdings Inc (Symbol: TENB), and Radware Ltd (Symbol: RDWR).

Rapid7, trading at $29.09 per share, has an average target price of $39.44, indicating an upside of 35.59%. Tenable Holdings, with a recent price of $38.14, could see a rise of 30.37%, reaching its target of $49.72. Lastly, analysts expect Radware to achieve a target price of $28.00 per share, reflecting an upside of 29.39% from its current price of $21.64. Below is a twelve-month price history chart that illustrates the stock performance of RPD, TENB, and RDWR:

Here is a summary of current analyst target prices for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| First Trust Nasdaq Cybersecurity ETF | CIBR | $66.11 | $75.64 | 14.42% |

| Rapid7 Inc | RPD | $29.09 | $39.44 | 35.59% |

| Tenable Holdings Inc | TENB | $38.14 | $49.72 | 30.37% |

| Radware Ltd | RDWR | $21.64 | $28.00 | 29.39% |

Investors may question whether analysts are justified in their targets or overly optimistic about future trading prices for these stocks. It remains important to evaluate the rationale behind these targets, especially considering market dynamics and recent company developments that may influence their accuracy. An elevated target price, while generally signaling optimism, can also indicate that analysts are out of touch, potentially leading to future downgrades if they fail to adjust for changing industry conditions. Investors should conduct additional research to clarify these considerations.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

• DVR Insider Buying

• SATL market cap history

• GLPG Stock Predictions

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.