Comparing AI Leaders: IonQ vs. Nvidia for Your Investment

Two prominent artificial intelligence (AI) stocks on many investors’ minds are IonQ (NYSE: IONQ) and Nvidia (NASDAQ: NVDA). Nvidia, a semiconductor giant, has surged 53% over the past year as demand for its processors increased amid the AI boom. In contrast, IonQ, a quantum computing firm, has seen its stock price jump around 125%, driven by optimism about its technology’s potential to enhance AI capabilities.

According to PwC, the AI sector could be valued at $15.7 trillion by 2030. With both these companies at the leading edge of this trend, investors might wonder which represents a better investment. Here’s the case for each.

Where to invest $1,000 right now? Our analyst team has disclosed what they believe are the 10 best stocks to buy right now. Learn More »

Image source: Getty Images.

Nvidia’s Leading Position in AI

Nvidia does not require much introduction among technology investors. If you’re questioning why this company is leading the AI conversation, consider some key facts:

- Nvidia holds an estimated 70% to 95% of the AI chip market.

- Data center revenue surged 93% to $35.6 billion in the fourth quarter of fiscal year 2025, ending January 26.

- Projected data center spending could escalate to $2 trillion within the next five years.

These statistics underscore Nvidia’s significant advantage in the AI landscape and show its potential for continued growth. For instance, Nvidia’s commanding market share poses a considerable challenge for competitors like Advanced Micro Devices in the chip sector.

Additionally, major tech firms are investing hundreds of billions in data center infrastructure, further positioning Nvidia as a significant beneficiary. Companies such as Meta Platforms, Alphabet, and Microsoft plan substantial investments this year to enhance their data centers to meet AI demands.

While some analysts express concerns that firms like DeepSeek could develop AI models using fewer and less powerful processors, it may not signal downfall for Nvidia. This assertion reflects a learning process from advanced AI models, indicating that larger tech players must continue data center investments to stay competitive.

Despite rumors to the contrary, the demand for AI data infrastructure will likely continue driving investments towards Nvidia. The company’s recent launch of the Blackwell AI processor meets this demand, and its fourth-quarter sales reached $11 billion, exceeding expectations.

In summary, Nvidia remains at the forefront of the AI boom. While market trends can shift, the notion that Nvidia’s advantage is waning appears premature.

IonQ’s Vision for the Quantum Computing Future

Although quantum computing and AI differ, they often intersect. IonQ’s quantum systems are being utilized by industry giants like Microsoft and Amazon to enhance the capabilities of AI researchers.

Investors are drawn to IonQ for several reasons:

- The company employs a distinctive method for trapping ions, enhancing quantum computing processes.

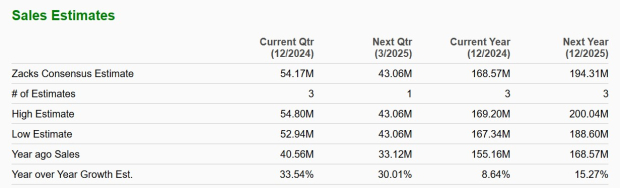

- IonQ experienced a remarkable 92% revenue increase, reaching $11.7 million in the fourth quarter.

- According to McKinsey, the quantum computing market could be worth $2 trillion by 2035.

IonQ claims its systems can achieve linear chains of ions capable of over 100 qubits, potentially resulting in fewer errors compared to other models.

IonQ’s long-term prospects are rooted in the belief that quantum computing could transform fields like drug discovery and AI model creation. While still speculative, major players, including Alphabet and Microsoft, are investing in quantum tech, highlighting its potential.

However, the practical applications of quantum computing remain limited. Recently, Nvidia CEO Jensen Huang pointed out that such applications may still be decades away.

Nvidia Emerges as the Superior AI Stock

IonQ presents a less favorable scenario in this comparison due to its speculative opportunities and high stock price. IonQ’s price-to-sales ratio stands at 167, which is high by any standard. Despite witnessing revenue growth, the company remains unprofitable, reporting a net loss of $202 million in the fourth quarter.

Though quantum computing might be a significant future trend, uncertainty remains regarding whether IonQ’s business can capitalize on it and how soon. At the same time, its stock price seems overpriced.

In contrast, Nvidia’s shares are attractively priced, with a forward price-to-earnings ratio of 30. The company demonstrates profitability with GAAP earnings per share of $0.89 for the latest quarter—an 82% increase from the prior period.

For these reasons, Nvidia stands out as the superior AI stock at this time.

Is Nvidia a Smart $1,000 Investment Today?

Before buying Nvidia stock, consider this:

The Motley Fool Stock Advisor team recently identified their view of the 10 best stocks to invest in now, and Nvidia was not included. The stocks on this list have the potential for remarkable returns.

For perspective, if you had invested $1,000 based on a recommendation made by Nvidia on April 15, 2005, that investment would now be valued at $765,576!*

Stock Advisor provides an insightful path for investors, complete with portfolio-building guidance, timely updates, and two new stock choices each month. Since 2002, Stock Advisor has outperformed the S&P 500 more than fourfold.* Join Stock Advisor to access the latest top ten recommendations.

*Stock Advisor returns as of March 3, 2025

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is also a member of The Motley Fool’s board of directors. Chris Neiger does not hold any positions in the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.