Rigetti Computing’s Stock Takes a Nosedive Amid Market Concerns

Rigetti Computing(NASDAQ: RGTI), part of a volatile set of quantum computing stocks, experienced a significant decline last month. This downturn was influenced by various macroeconomic factors and negative news affecting investor perceptions of the Stock.

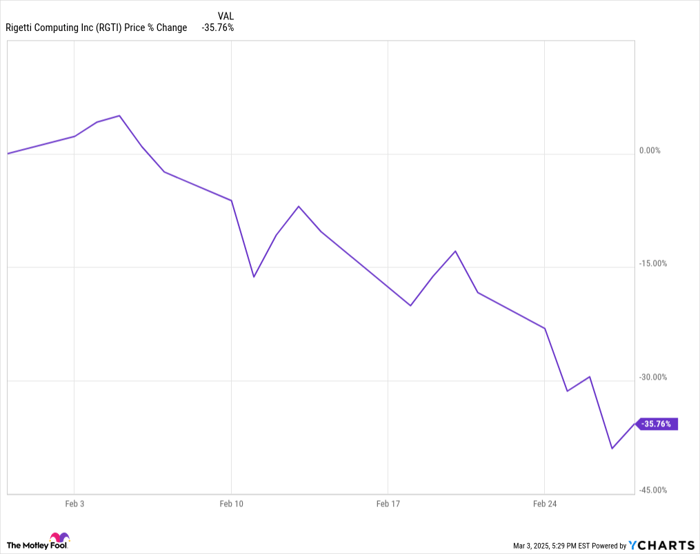

Despite negligible revenue, shares of Rigetti had been buoyed by optimistic investor enthusiasm surrounding quantum computing. Still, it remains a speculative investment. The Stock plummeted by 36% last month, as reported by S&P Global Market Intelligence, a drop that wasn’t entirely unexpected given its inherent volatility.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

The chart below illustrates the steady decline of the Stock throughout the month, reflecting diminishing investor hopes for Rigetti and its startup counterparts in the quantum computing space.

RGTI data by YCharts.

Analysts’ Perspectives on Rigetti

While the month lacked any groundbreaking announcements for Rigetti specifically, some supportive opinions emerged from Wall Street analysts. On February 10, Alliance Global Partners raised its price target for the Stock from $5.50 to $15, maintaining a buy rating. They suggested that the company might be awarded a DARPA Quantum Benchmarking contract, which could strengthen its positioning in the market.

Meanwhile, significant movement in the quantum computing sector occurred on February 19 when Microsoft introduced its Majorana 1, a quantum chip promising to enable faster solutions to industrial-scale problems. This announcement briefly boosted quantum stocks, including Rigetti, although it also signified the entry of another major competitor into the space.

Despite this initial rally in quantum stocks, Rigetti’s share price faltered at the end of the month. Investor sentiment dipped, influenced by factors such as poor consumer confidence, persistent inflation, and upcoming tariffs on goods from Canada and Mexico set to take effect soon.

Image source: Getty Images.

Looking Ahead for Rigetti Computing

Rigetti is scheduled to report its fourth-quarter earnings on March 5 after the market closes. Analysts predict the company will report revenue of approximately $2.5 million, a decline of 26% compared to last year. This indicates that Rigetti remains in the early stages of development, with quantum computing yet to make a significant commercial impact.

The company is advancing its technology and has potential for meaningful business growth in the future, yet high expectations are already reflected in the Stock, which carries a market cap exceeding $2 billion even after last month’s decline. Furthermore, Rigetti’s stock could continue facing challenges from broader economic headwinds if the economy shifts negatively.

Watch for the upcoming Q4 earnings, but it may require more than this report to revitalize the Stock in the current economic climate.

Seize the Opportunity Before It’s Gone

Have you ever felt like you missed the chance to invest in the top-performing stocks? If so, now is the moment to reconsider.

Our team of analysts occasionally issues a “Double Down” Stock recommendation for companies poised for significant growth. If you’re concerned about missing your opportunity to invest, act now before it’s too late. Consider these returns:

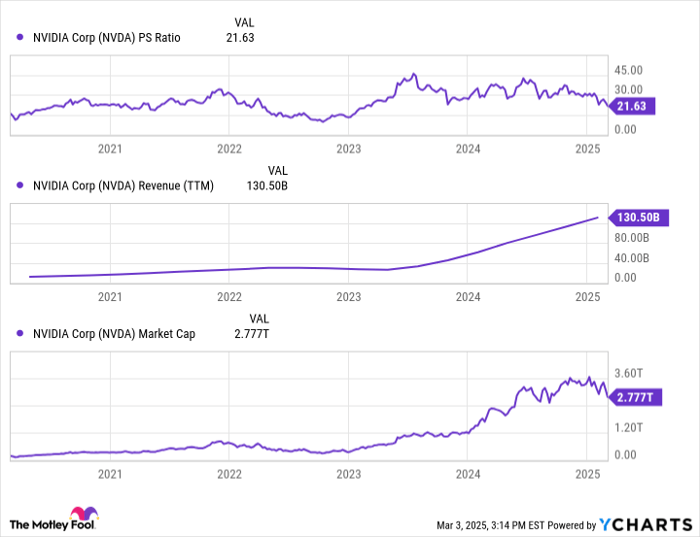

- Nvidia: An investment of $1,000 in 2009 would be worth $323,920!*

- Apple: A $1,000 investment in 2008 would have grown to $45,851!*

- Netflix: A $1,000 investment in 2004 could now be valued at $528,808!*

Currently, we are issuing “Double Down” alerts for three exceptional companies, and such opportunities may not present themselves again soon.

Continue »

*Stock Advisor returns as of March 3, 2025

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.