Market Turbulence: S&P 500 Sees $1.5 Trillion Loss Amid Trade Fears

The stock market experienced significant volatility recently, leading traders to prepare for ongoing fluctuations. On Monday, the S&P 500 index lost an astonishing $1.5 trillion in market value as concerns about a trade war flared up again.

Exchange-traded funds (ETFs) related to the index ended the day in the red: the SPDR S&P 500 ETF SPY fell by 1.75%. Similarly, both the Vanguard S&P 500 ETF VOO and the iShares Core S&P 500 ETF IVV recorded declines of 1.72% at the close of trading on Monday.

Related: Markets Tank After Trump Confirms More Tariffs: here’s What Wall Street Is Saying

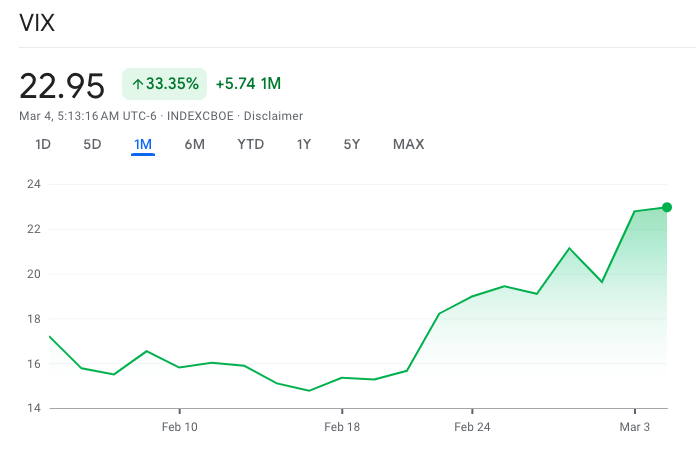

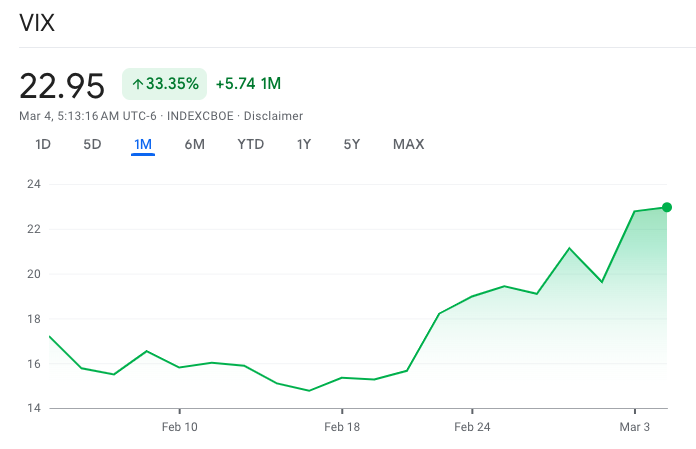

As tariffs targeting Canada, Mexico, and China escalate, volatility is clearly returning to the market. Over the past month, the VIX, known as the market’s fear index, surged more than 33%:

Chart source: Google Finance

Despite the chaos, experienced investors recognize that such volatility often presents opportunities—if they know how to capitalize on it.

1. Utilize the VIX for Potential Gains

The Cboe Volatility Index ($VIX) serves as a barometer of market fear and traders remain alert when it rises. As uncertainty increases, options-based strategies can yield attractive returns.

To safeguard against further market shifts, investors might explore the ProShares Ultra VIX Short-Term Futures ETF UVXY or the iPath Series B S&P 500 VIX Short-Term Futures ETN VXX.

However, these instruments are intended for short-term trading, not long-term investments.

2. Defensive Strategies with Broad Market ETFs

During turbulent market conditions, investors often shift their focus to low-volatility and defensive stocks.

The Invesco S&P 500 Low Volatility ETF SPLV provides access to more stable stocks, while the iShares MSCI USA Minimum Volatility ETF USMV can help mitigate potential losses.

For those anticipating continued market uncertainty yet preferring to stay invested in equities, the SPY remains a reliable option to weather the storm.

3. Follow Market Trends – Don’t Fight Them

As uncertainty looms, employing trend-following strategies can be beneficial. Investors seeking short-term profit might consider the ProShares Short S&P 500 ETF SH for bearish market positions or the ProShares UltraPro Short S&P 500 ETF SPXU for heightened downside exposure.

In addition, gold, recognized as a safe-haven asset, is drawing renewed interest, notably through ETFs like SPDR Gold Shares GLD.

With President Trump hinting at more significant announcements by Wednesday night, the market may experience continued volatility. The key question is not if markets will fluctuate, but rather, are you prepared to navigate through these turbulent times?

Read Next:

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs