Analysts Forecast Significant Upside for iShares ESG ETF Holdings

At ETF Channel, we’ve analyzed the underlying assets of the iShares ESG Advanced MSCI USA ETF (Symbol: USXF). By comparing each holding’s trading price against the average 12-month target price from analysts, we’ve calculated the ETF’s weighted average implied target price. The finding indicates that the target price for USXF is $59.74 per unit.

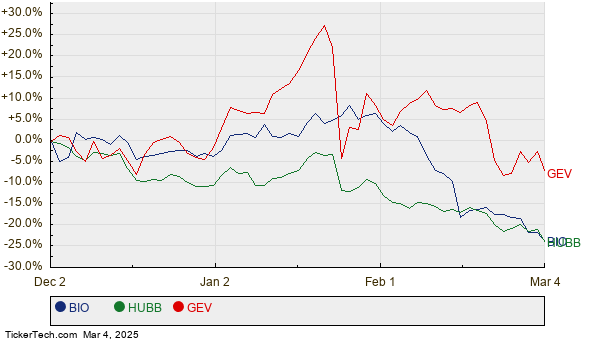

Currently, USXF is trading at approximately $48.68 per unit. This suggests analysts anticipate a 22.72% upside based on the average targets for its underlying holdings. Notable holdings with promising upside potential include Bio-Rad Laboratories Inc (Symbol: BIO), Hubbell Inc. (Symbol: HUBB), and GE Vernova Inc (Symbol: GEV). For instance, Bio-Rad, with a recent trading price of $256.45 per share, has an average target price of $382.40 per share—a 49.11% increase. Similarly, HUBB shows a 33.13% upside from its recent price of $354.95, with a target of $472.56. GEV has a target price of $419.92 per share, representing a 32.89% upside from its recent price of $315.98. Below is a twelve-month price history comparison chart for BIO, HUBB, and GEV:

To summarize, here are the current analyst target prices for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares ESG Advanced MSCI USA ETF | USXF | $48.68 | $59.74 | 22.72% |

| Bio-Rad Laboratories Inc | BIO | $256.45 | $382.40 | 49.11% |

| Hubbell Inc. | HUBB | $354.95 | $472.56 | 33.13% |

| GE Vernova Inc | GEV | $315.98 | $419.92 | 32.89% |

These targets raise important questions for investors. Are analysts justified in their projections, or are they overly optimistic about these stocks’ future? Investors should consider whether analyst estimates reflect recent company developments and market trends. A high target relative to a stock’s current trading price may signal optimism, but it also risks being revised downward if the targets no longer align with market realities. Further research will be essential for investors weighing these factors.

![]() 10 ETFs With Most Upside to Analyst Targets »

10 ETFs With Most Upside to Analyst Targets »

also see:

BBWI Videos

Funds Holding LDRH

CTB Split History

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.