Johnson & Johnson: A Key Player Amid Market Unrest

Markets have experienced continued sell-offs this week as investors assess the implications of new tariffs and rising geopolitical tensions. In this context, Johnson & Johnson JNJ is emerging as a notable stock.

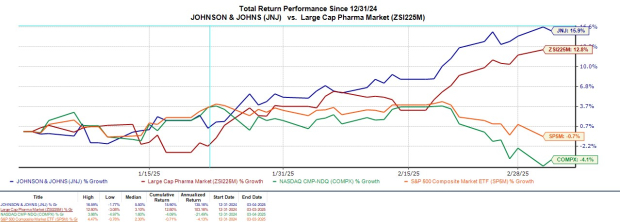

The pharmaceutical leader reached 52-week highs of nearly $170 on Tuesday, marking a +16% increase year to date. With its defensive positioning, JNJ may be a promising opportunity for investors looking for growth.

Image Source: Zacks Investment Research

Diversification Strengthens J&J’s Position

During periods of economic uncertainty, medical stocks often draw investor interest due to the consistent demand for healthcare services.

Johnson & Johnson’s diversified product lines across various therapeutic areas—including oncology, immunology, and neuroscience—enhance its resilience against market fluctuations. Additionally, its medical device division specializes in operational equipment for orthopedics, advanced surgical procedures, and vision care.

Expectations for 2024 indicate JNJ will generate $88.82 billion in revenue, with a projected 1% growth this year, followed by a further 3% increase to $92.8 billion by 2026.

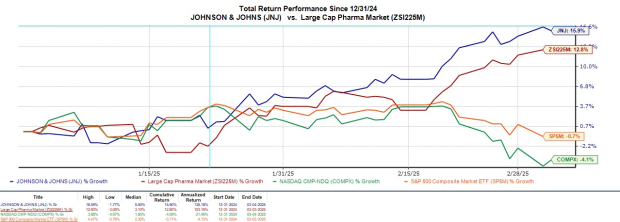

Image Source: Zacks Investment Research

Positive Earnings Growth

Johnson & Johnson is projected to see a 6% increase in annual earnings this year, reaching $10.58 per share, up from $9.98 in 2024. Furthermore, FY26 EPS is anticipated to rise by another 4%.

Image Source: Zacks Investment Research

Evaluating J&J’s Valuation

Currently, JNJ trades at a forward earnings multiple of 15.8X, which is lower than the S&P 500’s average of 22X and the Zacks Large Cap Pharmaceuticals Industry average of 18.1X. Competing firms include AbbVie ABBV, Eli Lilly LLY, and Pfizer PFE.

Image Source: Zacks Investment Research

JNJ also remains below its decade-long median of 16.4X for forward earnings, with a peak of 20.1X in the past ten years. Notably, the stock’s beta ratio stands at 0.47, indicating less volatility compared to broader market fluctuations.

Image Source: Zacks Investment Research

Bottom Line

After significant gains this year, Johnson & Johnson holds a Zacks Rank #3 (Hold). The stock is near 52-week highs, which may indicate it’s prudent to wait for better buying opportunities, though further highs are also possible.

Investors may consider holding JNJ as a diversification strategy amid recent market volatility, particularly due to Johnson & Johnson’s consistent growth and appealing valuation.

Only $1 to Access All Zacks’ Buys and Sells

We mean it.

In an unprecedented move, we gave our members 30 days of access to all our stock picks for just $1, with no obligation for further spending.

Thousands of members have embraced this offer, while others hesitated, thinking there was a catch. Our motivation is simple: we want you to experience our investment services, including Surprise Trader, Stocks Under $10, Technology Innovators, and others that have closed 256 positions with double- and triple-digit gains in 2024 alone.

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

This article was originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.