AMD Hits 52-Week Low: Is This a Buying Opportunity?

Over recent years, semiconductor stocks generally have performed well, primarily driven by surging interest in artificial intelligence (AI). One significant component of this trend is the rise of data centers that utilize chipsets known as graphics processing units (GPUs). These GPUs are crucial for the development of generative AI. Companies such as Nvidia (NASDAQ: NVDA), Taiwan Semiconductor Manufacturing, and Broadcom have seen their market values climb substantially due to their involvement in the GPU market.

Where to invest $1,000 right now? Our analyst team recently revealed their top 10 stocks to buy currently. Learn More »

However, one notable exception in the chip industry is Advanced Micro Devices (NASDAQ: AMD). Over the past year, AMD’s shares have plummeted by 44%, and as of February 28, the stock is trading at a 52-week low.

Could this be the right moment to buy AMD Stock? Continue reading to discover more.

AMD Stock Dropping, but Key Factors Remain

Currently, AMD has a market capitalization of $162 billion. For perspective, Broadcom and TSMC are nearing trillion-dollar valuations, while Nvidia’s market cap stands at an impressive $2.9 trillion, placing it among the world’s most valuable companies.

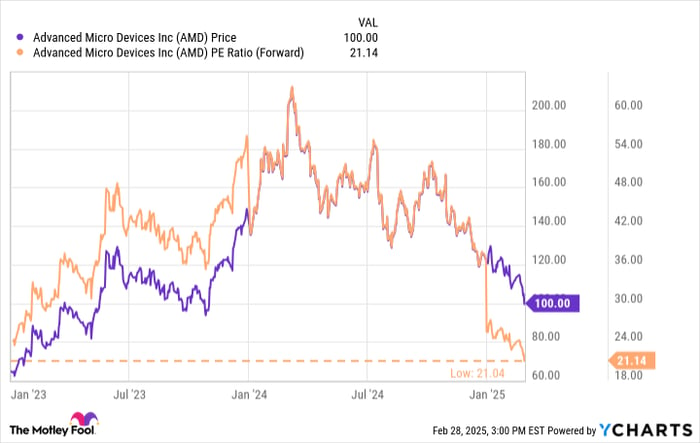

Data by YCharts.

As shown in the chart above, AMD’s share price currently sits around $100, marking its lowest point in a year. Furthermore, the company’s forward price-to-earnings (P/E) ratio of 21.1 is the lowest it has been in two years.

This lackluster performance may lead some investors to consider exiting their positions. However, astute investors recognize that market sell-offs often stem from emotional reactions rather than the actual fundamentals of the company.

…But the Business Has Strengths

Examining AMD’s business can be complex. While its revenue and profitability trail behind Nvidia’s, it might suggest that AMD lacks a foothold in the data center GPU market—a sector dominated by Nvidia.

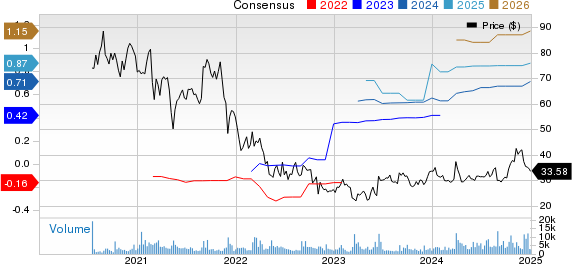

Data by YCharts.

Despite the numbers, I believe they can be misleading. In 2024, AMD experienced declines in its gaming and embedded operating segments, but simultaneously, its client and data center businesses reported meaningful growth. This indicates that while AMD’s gaming and embedded revenues might falter, its data center GPU segment is thriving.

Patience is Essential

Several factors contribute to AMD’s recent sell-off. One key issue is the prevailing assumption among investors that AMD may never catch up to Nvidia. Given Nvidia’s anticipated growth stemming from its new Blackwell architecture, it’s understandable why some investors may be hesitant.

Nevertheless, AMD’s innovation pace is noteworthy. The company’s data center GPU business reported year-over-year growth of 94% in 2024, with operating profits soaring 175%. These healthy unit economics are enabling AMD to reinvest in next-generation GPU technology aimed at competing against Blackwell.

Furthermore, AMD’s guidance during its fourth-quarter and full-year 2024 earnings call was not particularly strong, likely leading investors to assume the company is losing traction. However, the new architecture that follows Blackwell could attract customers seeking alternatives to Nvidia, especially for cost reasons. Notably, AMD has already garnered interest from existing Nvidia clients like Meta Platforms and Microsoft.

I anticipate that AMD will reach an inflection point, where revenue and profit growth becomes increasingly noticeable as the data center sector expands. Until then, I expect continued skepticism from investors regarding the Stock.

In my view, these price dips present attractive opportunities for long-term investors to acquire AMD Stock at historically low valuations.

Should You Invest $1,000 in Advanced Micro Devices Now?

Before purchasing Stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team has recently highlighted what they believe are the 10 best stocks for investors today—Advanced Micro Devices was not included. The selected stocks are positioned for potentially significant returns in the coming years.

For example, if you had invested $1,000 in Nvidia on April 15, 2005, when it made this list, you would have approximately $699,020 now!

Stock Advisor offers an easy-to-follow blueprint for investment success, complete with portfolio management guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor service has outperformed the S&P 500 by over four times since 2002*. Don’t miss the latest top 10 list available with your join of Stock Advisor.

*Stock Advisor returns as of March 3, 2025

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, serves on The Motley Fool’s board of directors. Adam Spatacco has positions in Meta Platforms, Microsoft, and Nvidia. The Motley Fool holds positions in and recommends Advanced Micro Devices, Meta Platforms, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool also recommends Broadcom and has options positions in Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.