“My Metric for everything I look at is the 200-day moving average of closing prices. I’ve seen too many things go to zero, stocks and commodities. The whole trick in investing is: ‘How do I keep from losing everything?’ If you use the 200-day moving average rule, then you get out. You play defense, and you get out.” ~ Paul Tudor Jones

Understanding the 200-Day Moving Average in Investing

The Role of the 200-Day Moving Average

Over my more than two decades of investing experience, I have learned the significance of simplicity. In today’s world of smartphones, instant news updates, and commission-free trading through platforms like Robinhood (HOOD), investors often face the risk of over-trading and noise overload. A reliable strategy for navigating these challenges is to focus on the charts rather than getting distracted. The 200-day moving average serves as an essential tool for identifying long-term trends, pinpointing high-probability buying opportunities, and effectively managing risk.

The Impact of the 200-Day Moving Average in Recent Markets

Although the 200-day moving average is just a trend identifier, its influence is substantial. For instance, in January 2022, the Nasdaq 100 Index ETF (QQQ) dropped below the 200-day moving average and remained below this threshold for a year, severely impacting its performance. However, by early 2023, the bear market concluded, allowing QQQ to reclaim the 200-day moving average, and since that time, the index’s value has nearly doubled.

Image Source: TradingView

Buying Opportunities Using the 200-Day Moving Average

The 200-day moving average allows investors to strategically buy during price dips. If the investment thesis holds, these investors can benefit from upcoming upward price movements. Conversely, if the market proves otherwise, investors can minimize their losses as prices dip below this key indicator.

Three Recommended Stocks with Strong 200-Day Moving Average Trends

1. On Holding (ONON)

Zacks Rank #2 (Buy) Stock On Holding is a rising player in the running shoe market, boasting double-digit revenue growth. This success stems from its premium brand appeal, a focus on direct-to-consumer sales, and global market expansion. Recently, ONON surpassed Zacks Consensus Estimates by an impressive 90%.

Image Source: Zacks Investment Research

2. Amazon (AMZN)

As a long-standing leader in the U.S. e-commerce market, Amazon’s logistics network remains unmatched. The company’s reach extends well beyond e-commerce, positioning it as a front-runner in the cloud market with its AWS services alongside its ventures into content and generative AI.

Image Source: TradingView

3. MicroStrategy (MSTR)

MicroStrategy is notable as the first public company to add Bitcoin to its balance sheet. As a leveraged Bitcoin proxy, MSTR exhibits notable volatility while providing substantial returns, especially when purchased at the 200-day moving average. In October 2023, MSTR tested the 200-day moving average around $30, later surging to $200 by March 2024. The stock revisited the 200-day MA in August 2024, reaching over $500 by November.

Image Source: TradingView

Emerging Catalysts for MicroStrategy

Anticipation for the upcoming US Bitcoin Strategic Reserve announcement adds to MSTR’s potential bullish momentum.

Conclusion

The 200-day moving average serves as a valuable tool for investors aiming to navigate market volatility and control risk exposure. By concentrating on this trend indicator, investors can uncover potential buying opportunities during market dips.

Zacks Identifies Top Semiconductor Stock

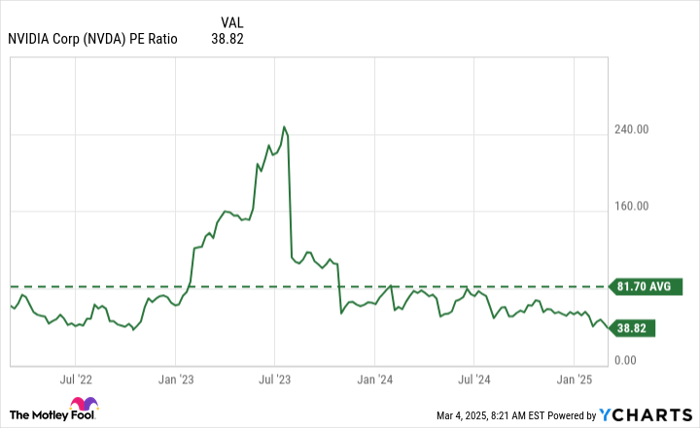

This new semiconductor stock is significantly smaller than NVIDIA, which has soared over 800% since our recommendation. While NVIDIA remains strong, our latest pick has substantial growth potential.

With robust earnings growth and an expanding customer base, this stock is poised to meet the surging demand in Artificial Intelligence, Machine Learning, and the Internet of Things. Global semiconductor manufacturing is expected to rise from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

To receive the latest recommendations from Zacks Investment Research, download the report on the 7 Best Stocks for the Next 30 Days here.

Company Analysis:

- Amazon.com, Inc. (AMZN): Free Stock Analysis report

- Invesco QQQ (QQQ): ETF Research Reports

- MicroStrategy Incorporated (MSTR): Free Stock Analysis report

- Robinhood Markets, Inc. (HOOD): Free Stock Analysis report

- On Holding AG (ONON): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.