Exploring Put Options: A Strategy for Scholar Rock Investors

Investors eyeing Scholar Rock Holding Corp (Symbol: SRRK) who hesitate at the current market price of $37.22 per share might find selling puts to be a viable strategy. One particular put contract worth noting is the December put option at the $30 strike, currently showing a bid of $4.30. By selling this put, an investor could earn a premium that reflects a 14.3% return on the $30 commitment or an annualized rate of return of 18.1%. This concept is referred to as YieldBoost on Stock Options Channel.

It is important to note that selling a put does not grant access to SRRK’s upside potential in the same way owning shares does. In fact, the put seller will only own shares if the contract is exercised. The buyer of the put option would only choose to exercise it at the $30 strike if that choice offers a better outcome than selling shares at the current market price. For instance, unless Scholar Rock’s stock price drops by 20% and results in the contract being exercised, the only benefit to the put seller comes from collecting that premium, thus securing the 18.1% annualized rate of return.

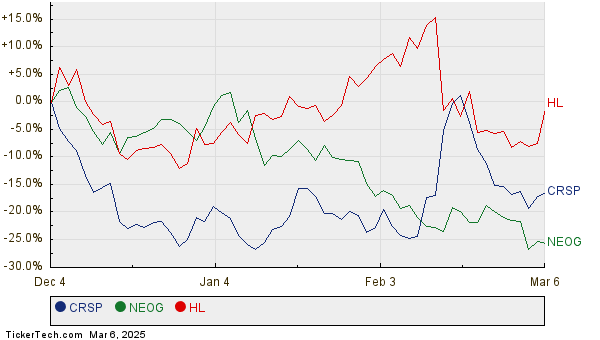

Below is a chart depicting the trailing twelve-month trading history for Scholar Rock Holding Corp, with the $30 strike clearly marked in green against this historical backdrop:

The above chart, combined with Scholar Rock’s historical volatility, assists in evaluating whether selling the December put at the $30 strike for an 18.1% annualized return offers an adequate reward for potential risks. We estimate Scholar Rock Holding Corp’s trailing twelve-month volatility at 169%, calculated from the last 250 trading day closing values as well as the current share price of $37.22. For additional put options ideas with different expiration dates, visit the SRRK Stock Options page on StockOptionsChannel.com.

![]() Top YieldBoost Puts of the S&P 500 »

Top YieldBoost Puts of the S&P 500 »

Also See:

- GAMB Options Chain

- TMX Historical Stock Prices

- Top 10 Hedge Funds Holding SYF

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.