Shiba Inu: From Historic Gains to Significant Challenges Ahead

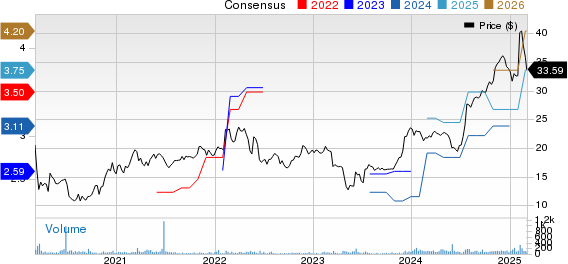

The Shiba Inu (CRYPTO: SHIB) cryptocurrency provided an astonishing return for early investors, turning a $1 investment into over $1 million from January 1, 2021, to October 28, 2021. Beginning the year at a price of $0.00000000008 per token, it skyrocketed by over 100,000,000% to reach a record high of $0.000086 in under 10 months.

Unfortunately, by mid-2022, Shiba Inu had plummeted, losing more than 90% of its peak value. The speculative nature of these market trends cannot be sustained, and Shiba Inu lacks a clear, real-world application. Although 2024 has seen some positive activity, the token remains 85% below its all-time high.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Despite its struggles, the cryptocurrency market is currently benefiting from supportive regulatory attitudes that may create substantial value by 2025. This raises the question: could Shiba Inu stage another remarkable rally and potentially reach $1? The implications may surprise you.

The Role of Pro-Crypto Policies in Market Sentiment

President Donald Trump’s campaign included pro-crypto initiatives before the election on November 5 last year, such as creating a strategic Bitcoin (CRYPTO: BTC) reserve and advocating for reduced regulations. Following his victory, the cryptocurrency market surged, with the total value of all coins reaching an all-time high of $3.9 trillion.

After the election, Trump nominated Paul Atkins to lead the Securities and Exchange Commission (SEC). Atkins, a supporter of the crypto industry, co-chairs the Token Alliance. Although his confirmation is pending, interim SEC chairman Mark Uyeda has already paused several legal actions against crypto firms like Binance.

Although Bitcoin continues to flourish and reach new heights, it is the only major cryptocurrency to do so post-election. Tokens like XRP (CRYPTO: XRP) are positioned to benefit from a more favorable SEC, but investors ultimately gravitate toward cryptocurrencies backed by solid fundamentals. Bitcoin’s decentralized nature, limited supply, and the availability of exchange-traded funds (ETFs) significantly enhance its appeal.

Shiba Inu, however, struggles to gain traction among investors and consumers alike. Major firms such as Ark Investment Management and BlackRock are unlikely to develop Shiba Inu ETFs due to its volatility and reputation as a meme coin. Additionally, only around 960 businesses worldwide accept Shiba Inu as payment, mostly limited to niche internet services. Without widespread consumer adoption, the market demand for Shiba Inu remains weak.

Shiba Inu’s Supply Challenge

The main obstacle preventing Shiba Inu from hitting $1 isn’t merely lack of adoption—it’s the massive token supply. Currently, there are 589.2 trillion tokens in circulation, resulting in around an $8 billion market capitalization based on the current price of $0.000014 per token.

If Shiba Inu were to reach $1 per token, its market cap would soar to $589.2 trillion, which exceeds the total annual output of the U.S. economy ($29.7 trillion) by a factor of 20. It would also mean Shiba Inu would be valued at 163 times Apple’s market cap, currently at $3.6 trillion.

Therefore, achieving a price of $1 under the existing conditions seems unattainable. However, the Shiba Inu community is attempting to address this issue through “token burning,” which involves permanently removing tokens from circulation. This strategy can theoretically increase the price per token in line with the reduced supply.

Image source: Getty Images.

How Could Shiba Inu Reach $1?

It’s important to note that burning tokens does not inherently create value. Currently, Shiba Inu’s market cap is $8 billion, so theoretically burning 99.99998% of tokens would mean leaving around 8 billion in circulation for a price of $1 per token. Yet, all participants’ financial positions would remain unchanged.

Despite this lack of tangible gains, a focused burning initiative may be Shiba Inu’s only pathway to reach $1. The community recently burned 293.6 million tokens in a month, translating to an annualized rate of about 3.5 billion tokens. To reduce the supply to 8 billion tokens, nearly all of the existing 589.2 trillion would need to be burned—at the current pace, this would take around 168,342 years. Thus, a price of $1 seems improbable in 2025 and likely will remain out of reach for the foreseeable future.

Ultimately, for Shiba Inu to deliver real returns, it must establish a legitimate use case that adds actual value. Absent such developments—even with a crypto-friendly administration—investors should exercise caution when considering this speculative token.

Is Now the Right Time to Invest in Shiba Inu?

Before investing in Shiba Inu, consider this:

The Motley Fool Stock Advisor analyst team has identified 10 best stocks for investors currently, and Shiba Inu is not included in that list. Those selected stocks possess the potential for significant returns in the coming years.

For example, if you had invested $1,000 in Nvidia when it was recommended on April 15, 2005, you’d be looking at a colossal $710,848 now!

Stock Advisor offers investors a straightforward strategy for achieving success through ongoing portfolio guidance, regular updates from analysts, and two new Stock picks each month. Since 2002, the service has quadrupled the return of the S&P 500. Don’t miss the latest top 10 list when you join Stock Advisor.

*Stock Advisor returns as of March 3, 2025

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Bitcoin, and XRP. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.