Beazer Homes Faces Market Pressure with Falling Earnings in 2025

Beazer Homes USA, Inc. (BZH) is navigating a challenging housing market in 2025. With a Zacks Rank of #5 (Strong Sell), the homebuilder is projected to experience declining earnings this year.

Beazer Homes is a national homebuilder with a market capitalization of $674.9 million, operating in states including Arizona, California, Delaware, Florida, Georgia, Indiana, Maryland, Nevada, North and South Carolina, Tennessee, Texas, and Virginia.

Beazer Homes Accelerates Share Repurchases Amid Share Price Decline

On February 6, 2025, Beazer Homes announced an acceleration in its share repurchase program due to what it called “share price dislocation.” As of that date, the program had approximately $24.8 million remaining for repurchases.

Following the fiscal first quarter 2025 earnings report released on January 30, 2025, the stock saw a sell-off. In response, Beazer Homes repurchased about $4.1 million of its shares at an average price of $21.86.

“Accelerating our share repurchase makes considerable sense at this time,” said Allan P. Merrill, Chairman and CEO. “Buying back shares at a significant discount to book value presents a compelling investment opportunity, and we plan to act on it.”

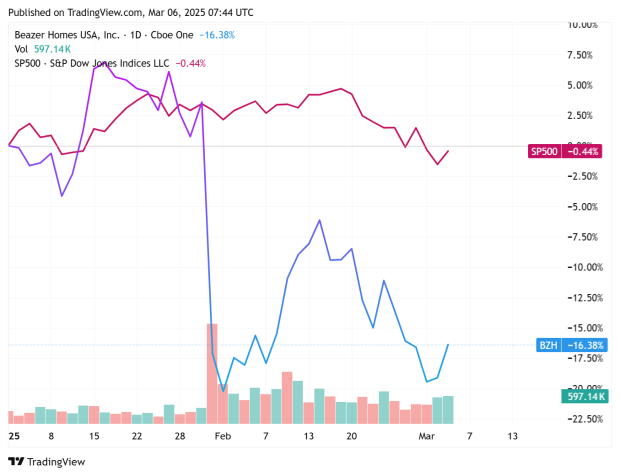

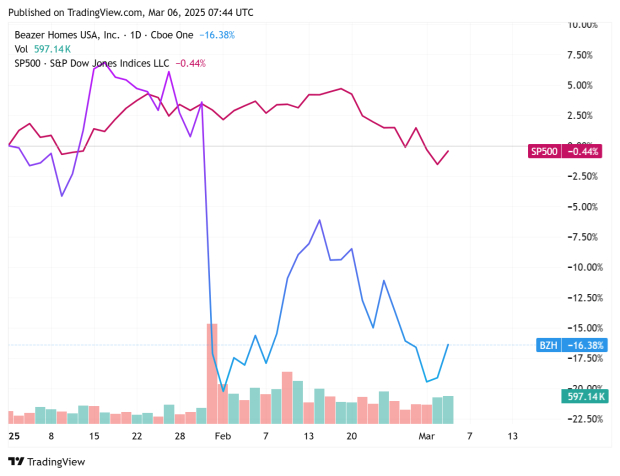

Here is the stock performance chart compared to the S&P 500 year-to-date.

Image Source: Zacks Investment Research

Due to the increased share repurchases, Beazer stated that it would moderate its debt reduction commitments in the near term.

First Quarter Earnings Miss Signals Concerns

On January 30, 2025, Beazer Homes reported its fiscal first quarter earnings, missing the Zacks Consensus Estimate by $0.21. The reported earnings of $0.10 fell short of the anticipated $0.31, representing a miss of 67.7%. This miss is notable, as it marks only the second earnings miss for Beazer in the past five years.

Year-over-year, revenue rose 20.9% to $460.4 million, driven by a 22.1% increase in closed home sales to 907 homes. However, this was partially offset by a 1% drop in average sales price to $507,600. The uptick in closings stemmed from a higher volume of spec homes being sold and an improvement in construction cycles.

For homebuilders, gross margins are a critical metric. Beazer’s adjusted gross margin for the quarter was 18.2%, down from 22.9% a year prior. This decline was primarily due to price concessions, closing cost incentives, a higher mix of spec home closings—typically with lower margins—and shifts in products and communities.

Beazer characterized the market as a “challenging new home sales environment.”

Analysts Hold Bearish Outlook for Beazer Homes

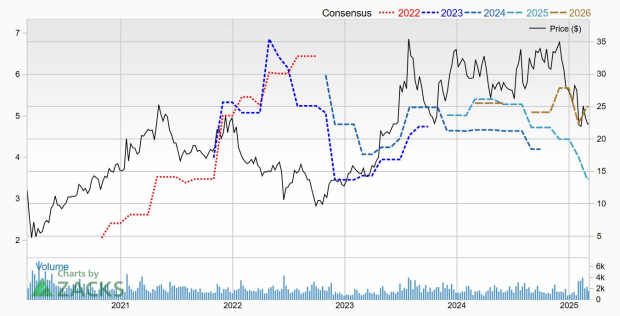

The challenging new home market has led analysts to adopt a bearish stance for fiscal 2025. In the past 30 days, one earnings estimate has been cut, and two in the last 60 days, bringing the Zacks Consensus Estimate down to $3.49 from $4.44. This represents a 23% decline compared to Beazer’s earnings of $4.53 in fiscal 2024.

Here is the 5-year price and consensus chart.

Image Source: Zacks Investment Research

Value Proposition: Beazer Homes Shares Are Inexpensive

In 2025, Beazer Homes shares have weakened due to concerns over the housing market and the implications of tariffs, falling 27.6% over the last six months. Currently, Beazer shares are valued at a forward price-to-earnings (P/E) ratio of 6.2, a figure under 10 typically suggests that a stock is undervalued.

The company has a PEG ratio of 0.3, indicating its potential for growth and value. While Beazer took steps to buy back shares recently, investors may prefer to wait for an improvement in earnings estimates before making new investments.

Access Zacks’ Recommendations for Only $1

We’re not kidding.

In a surprising offer, several years ago, we provided members with 30-day access to all our investment picks for just $1, without any obligation to spend more.

Thousands have taken advantage of this opportunity, while others hesitated, thinking there must be a catch. The reason behind this offer is simple: we want you to experience our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and many others that closed 256 positions with double- and triple-digit gains in 2024 alone.

Interested in the latest recommendations from Zacks Investment Research? You can download “7 Best Stocks for the Next 30 Days” for free by clicking here.

Beazer Homes USA, Inc. (BZH): Free Stock Analysis report.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.