Analysts Predict Strong Upside Potential for AVLV ETF and Holdings

At ETF Channel, we evaluated the underlying holdings of various ETFs to determine their potential based on analyst predictions. We compared each holding’s trading price against the average 12-month forward target price set by analysts. For the Avantis U.S. Large Cap Value ETF (Symbol: AVLV), we found the implied analyst target price to be $78.49 per unit.

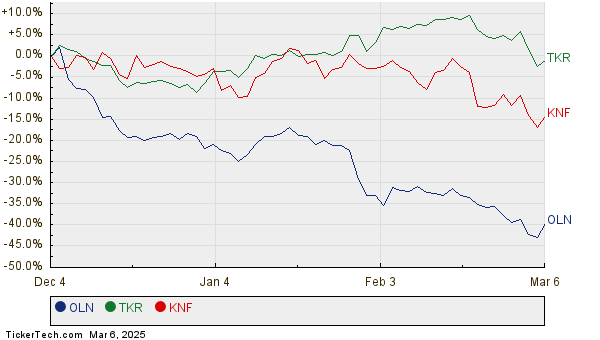

Currently, AVLV is trading at about $66.69 per unit. This indicates that analysts expect a noteworthy 17.70% upside for this ETF based on the average targets of its underlying holdings. Among these holdings, Olin Corp. (Symbol: OLN), Timken Co. (Symbol: TKR), and Knife River Corp (Symbol: KNF) stand out with significant upside potential compared to their target prices. Olin Corp. is trading at $25.19 per share, while the average analyst target is 35.20% higher at $34.06. Timken Co. has a recent share price of $75.87, with analysts projecting a target price of $91.67—representing a potential upside of 20.82%. Likewise, Knife River Corp. trades at $90.99, with analysts anticipating growth to a target price of $109.33, reflecting a 20.16% upside. Below, you can see a chart detailing the 12-month price history of OLN, TKR, and KNF:

Here’s a summary table highlighting the current analyst target prices for the mentioned stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Avantis U.S. Large Cap Value ETF | AVLV | $66.69 | $78.49 | 17.70% |

| Olin Corp. | OLN | $25.19 | $34.06 | 35.20% |

| Timken Co. | TKR | $75.87 | $91.67 | 20.82% |

| Knife River Corp | KNF | $90.99 | $109.33 | 20.16% |

This raises some pertinent questions: Are analysts being realistic with these target prices, or are they too optimistic about future stock performance? Do they have a solid justification for these targets, or are they merely responding to past company developments? A high target relative to a stock’s trading price can reflect optimism, but it may also foreshadow potential downgrades if the targets are outdated. Investors should consider these questions as they conduct further research.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

• Historical EPS

• Funds Holding SEAL

• Seagate Technology Holdings market cap history

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.