First Watch Restaurant Group Set to Release Q4 Fiscal Results

First Watch Restaurant Group, Inc. (FWRG) will announce its fourth-quarter fiscal 2024 financial results on March 11, prior to market opening.

Stay updated with quarterly releases: view the Zacks earnings Calendar.

In the previous quarter, First Watch’s earnings fell short of the Zacks Consensus Estimate by 40%.

Current Earnings Estimates for FWRG

The Zacks Consensus Estimate for earnings per share (EPS) in the fourth quarter is 2 cents, down 50% from the 4 cents reported in the same quarter last year. Over the past 60 days, earnings estimates for the company have remained stable.

The revenue consensus for the quarter stands at $262.2 million, suggesting a growth of 7.2% compared to the previous year’s figure.

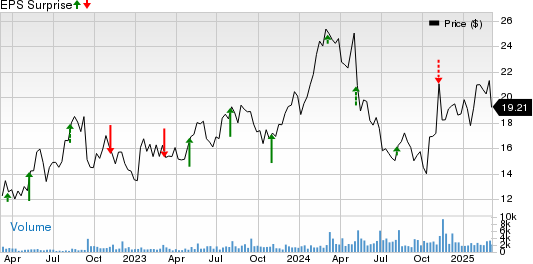

First Watch Restaurant Group, Inc. Price and EPS Surprise

First Watch Restaurant Group, Inc. price-eps-surprise | First Watch Restaurant Group, Inc. Quote

Factors Influencing FWRG’s Q4 Performance

First Watch’s fiscal fourth-quarter revenue is expected to rise year-over-year, bolstered by new restaurant openings and strategic franchise acquisitions. The company anticipates the addition of 23 new restaurants during this quarter, with plans for annual system expansion of over 10%.

Additionally, a focus on a modest pricing strategy, targeted marketing, and technology investments are expected to positively impact the firm’s performance. The Zacks Consensus Estimate for restaurant sales in the fourth quarter is $259 million, compared to $241 million reported during the prior-year period.

Nevertheless, a decline in same-restaurant sales and lower customer traffic are projected to adversely affect overall performance. Preliminary results indicate a 0.3% decrease in same-restaurant sales year-over-year, alongside a 3% decline in traffic during this quarter.

The consensus estimate for franchise revenues in the fiscal fourth quarter is set at $2.8 million, down from $3.6 million reported last year.

On the expense side, increased general and administrative costs alongside labor cost inflation are anticipated to weigh on the bottom line. However, the company’s commitment to operational execution and cost management may help to mitigate some financial pressures.

Earnings Outlook for FWRG

Our proven model currently does not indicate an earnings beat for First Watch this quarter. A favorable earnings ESP combined with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) typically increase the chances of an earnings surprise, but this is not applicable in this case.

Earnings ESP of FWRG: Currently, First Watch has an earnings ESP of 0.00%. Utilize our earnings ESP Filter to discover top stocks on the verge of a surprise.

FWRG’s Zacks Rank: First Watch holds a Zacks Rank of #3.

Other Stocks That May Beat Earnings Estimates

Several companies within the Zacks Retail-Wholesale sector appear poised to exceed earnings expectations, per our model.

CAVA Group, Inc. (CAVA) features an earnings ESP of +0.17% and holds a Zacks Rank of 3. It is projected to see a 16.7% year-over-year increase in earnings for the upcoming quarter, having outperformed expectations in three of the last four quarters with an average surprise of 62.6%.

Domino’s Pizza, Inc. (DPZ) presents an earnings ESP of +0.04% with a Zacks Rank of 3. The company has delivered earnings beats in three out of the last four quarters, with an average surprise of 6.8%. DPZ’s earnings for the next quarter are anticipated to rise by 11.5% compared to last year.

Yum! Brands, Inc. (YUM) has an earnings ESP of +0.73% and also carries a Zacks Rank of 3. Expected earnings growth for YUM this quarter is 10.4%, having topped expectations in two of the last four quarters while recording a negative average surprise of 0.7%.

Only $1 to see All Zacks Buys and Sells

Believe it or not.

Years ago, we surprised our members by offering them 30-day access to our entire portfolio for just $1—no further spending required.

Thousands took advantage of this offer, while some remained skeptical, assuming there must be a catch. Our aim is straightforward: we want you to explore our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, which yielded 256 positions with double- and triple-digit gains in 2024 alone.

See Stocks Now >>

Want the latest from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days for free. Click to access this report.

Yum! Brands, Inc. (YUM): Free Stock Analysis report

Domino’s Pizza Inc (DPZ): Free Stock Analysis report

First Watch Restaurant Group, Inc. (FWRG): Free Stock Analysis report

CAVA Group, Inc. (CAVA): Free Stock Analysis report

This article was originally published by Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.